Quantitative easing (QE) has become synonymous with the COVID-19 pandemic as the blowout from the lockdowns stalled the growth of the global economy and threatened to turn into a financial crisis.

To artificially create economic growth, central banks began buying up government bonds and other securities, while governments began expanding the money supply by printing more money.

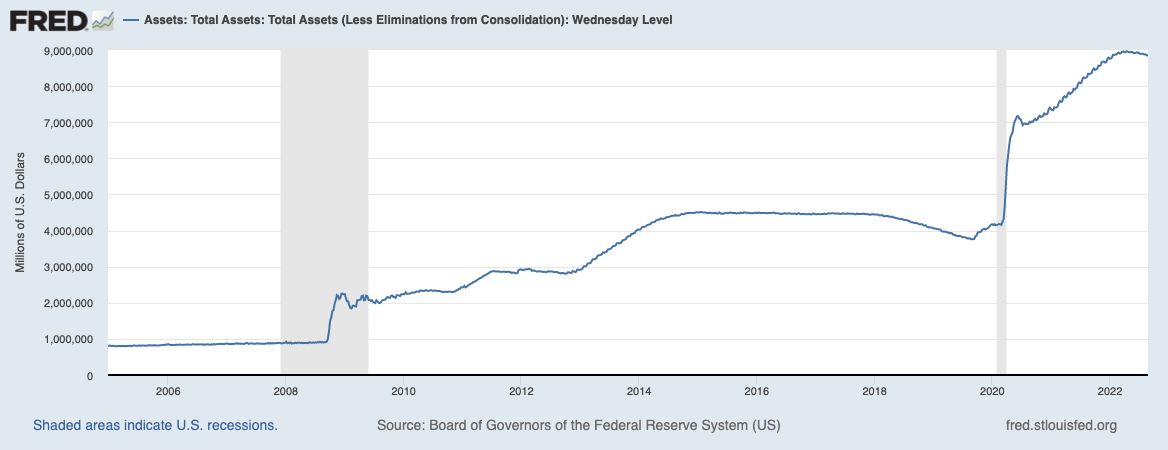

This was felt the most in the U.S., where the Federal Reserve increased the rate of dollars in circulation by a record 27% between 2020 and 2021. The Fed’s balance sheet reached around $8.89 trillion at the end of August 2022, an increase of over 106% from its $4.31 trillion size in March 2020.

None of this, however, managed to deter a financial crisis. Fueled by the ongoing war in Ukraine, the current crisis is slowly gearing up to become a full-blown recession.

To mitigate the consequences of its ineffective QE policies, the Federal Reserve has embarked on a quantitative tightening (QT) spree. Also called balance sheet normalization, QT is a monetary policy that reduces the Fed’s monetary reserves by selling government bonds. Removing Treasurys from its cash balances removes liquidity from the financial market and, in theory, curbs inflation.

In May this year, the Fed announced that it would begin QT and raise the federal funds rate. Between June 2022 and June 2023, the Fed plans on letting around $1 trillion worth of securities mature without reinvestment. Jerome Powell, the Chairman of the Federal Reserve, estimated this would equal one 25-basis-point rate hike in how it would affect the economy. At the time, the cap was set at $30 billion per month for Treasurys and $17.5 billion for mortgage-backed securities (MBS) for the first three months.

However, increasingly worrying inflation has pushed the Fed to double its shrinking pace for September, increasing it from $47.5 billion to $95 billion. This means that we can expect $35 billion in mortgage-based securities to be offloaded in a month. And while the market seems more worried about Treasurys, offloading the mortgage-backed securities could be what actually triggers a recession.

The dangers of the Fed unloading mortgage-backed securities

While mortgage-backed securities (MBS) have been a significant part of the financial market in the U.S. for decades, it wasn’t until the 2007 financial crisis that the general public became aware of this financial instrument.

A mortgage-backed security is an asset-backed security that’s backed by a collection of mortgages. They’re created by aggregating a similar group of mortgages from a single bank and then sold to groups that package them together into a security that investors can buy. These securities were considered a sound investment before the 2007 financial crisis, as unlike bonds which paid out quarterly or semi-annual coupons, mortgage-backed securities paid out monthly.

Following the collapse of the housing market in 2007 and the subsequent financial crisis, MBS became too tainted for private sector investors. To keep interest rates stable and prevent further collapse, the Federal Reserve stepped in as a buyer of last resort and added $1 trillion in MBS to its balance sheet. This continued until 2017 when it started letting some of its mortgage bonds expire.

The 2020 pandemic forced the Fed to go on another buying spree, adding billions in MBS to its portfolio to inject cash into an economy struggling with lockdowns. With inflation now soaring, the Fed is embarking on another offloading spree to keep rising prices at bay.

In addition to allowing them to expire, the Fed is also selling the mortgage-backed securities in its portfolio to private investors. When private investors buy these mortgage bonds, it pulls cash out of the overall economy — and should (at least in theory) help the Fed achieve exactly what it set out to do.

However, the chances of the Fed’s plan actually working are decreasing every day.

While offloading $35 billion in MBS every month might look like it’s curbing inflation in the short term, it could have a detrimental effect on the already struggling housing market.

Since the beginning of the year, mortgage rates have increased from 3% to 5.25%. The jump to 3% from a 2.75% fixed interest rate was enough to raise red flags for many. A jump to 5.25% and the potential to increase even higher means that hundreds of thousands of people could be pushed out of the housing market. The gravity of this problem becomes clearer when looking at it as a percentage increase, and not as an absolute number — interest rates have gone up 75% since the beginning of the year.

With mortgage payments 75% higher, the market could see many people defaulting on their payments and their homes in danger of foreclosure. If mass foreclosures like the ones we’ve seen in 2007 do happen, the U.S. housing market could be flooded with a fresh supply of houses.

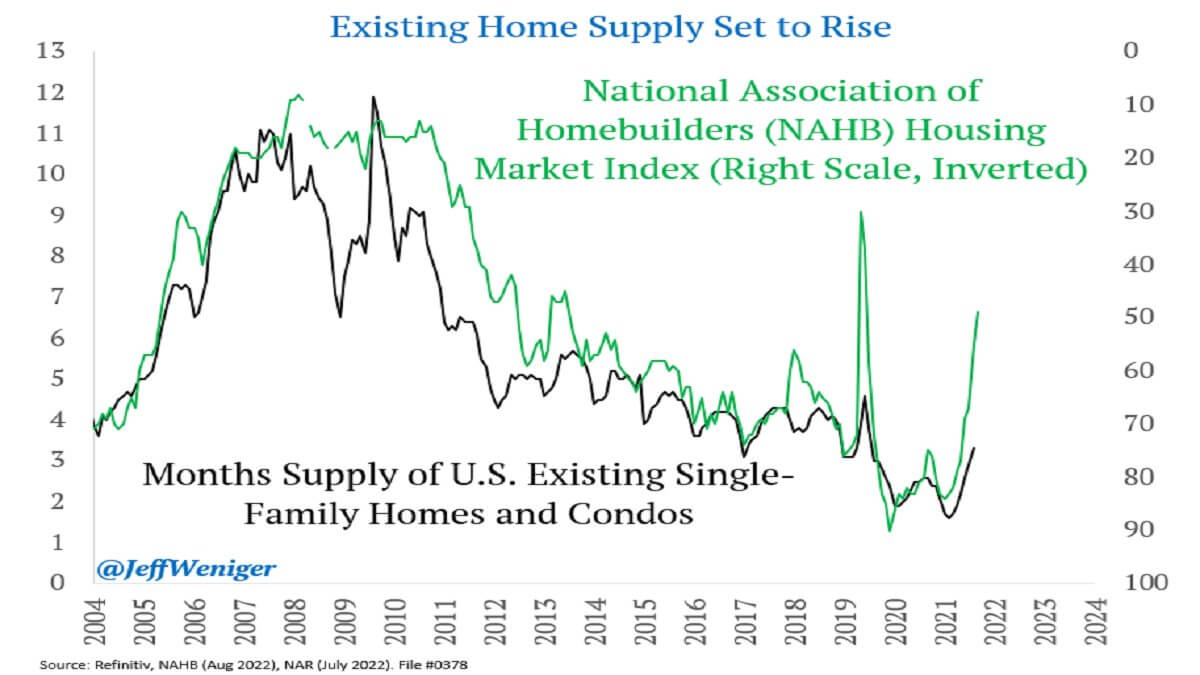

Data from the National Association of Homebuilders (NAHB) shows that the monthly supply of single-family homes and condos in the U.S. has been on the rise since 2021. The NAHB Housing Market Index, which rates the relative level of single-family home sales, has been decreasing significantly since the beginning of the year, entering its eighth straight month of decline.

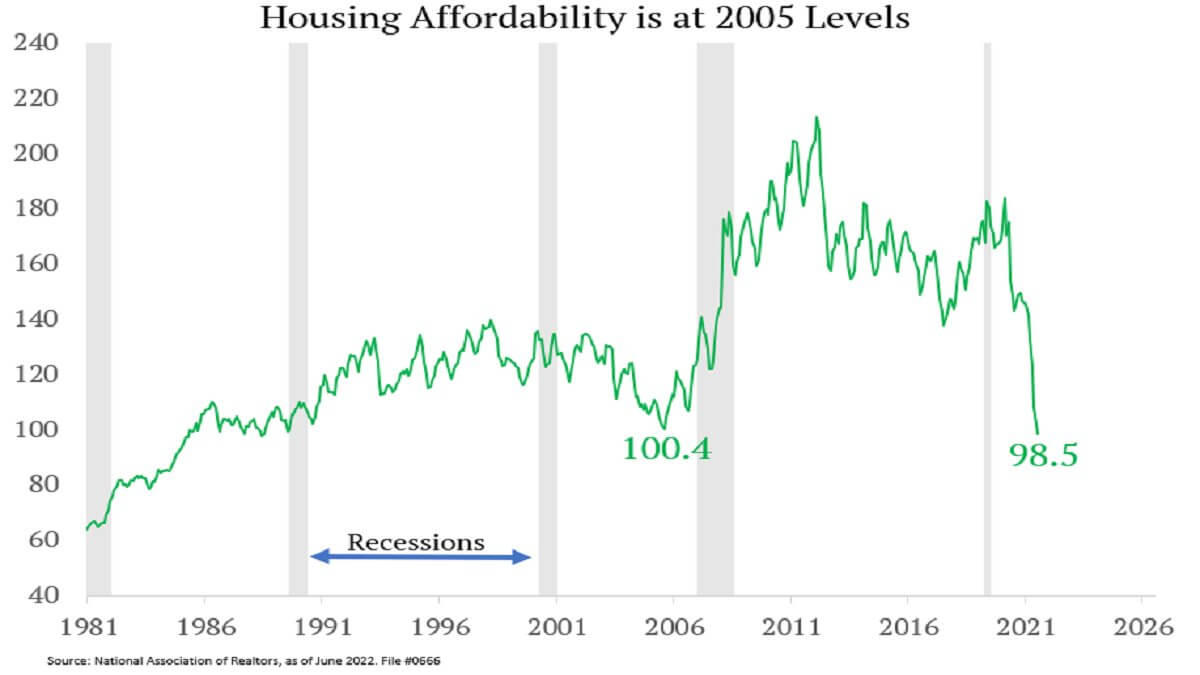

According to data from the National Association of Realtors, housing affordability in the U.S. has reached its 2005 levels, suggesting that housing prices could peak just as they did in 2006.

Redfin and Zillow, the two largest real estate brokerages in the U.S., saw their share price drop 79% and 46% since the beginning of the year. The trouble that’s been brewing in the housing market since last summer shows that the “soft landing” the Fed is trying to achieve with QT will be anything but soft. With more and more market conditions lining up almost perfectly with the conditions seen in 2006, a new housing crisis could be waiting around the corner. In its attempt to stabilize the financial market, the Fed could inadvertently destabilize the housing one.

The effects a housing crisis and a recession could have on the crypto market are hard to predict. Previous market downturns have dragged cryptocurrencies down with them, but the digital asset market managed to recover more quickly than its traditional counterparts.

We could see the crypto market taking another hit in the event of a full-blown recession. However, currency devaluation could push more people to look for alternative “hard assets” — and find what they’re looking for in crypto.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Shiba Inu

Shiba Inu  Avalanche

Avalanche  Toncoin

Toncoin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Pepe

Pepe  LEO Token

LEO Token  Stellar

Stellar  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Render

Render  Bonk

Bonk  Ethereum Classic

Ethereum Classic  MANTRA

MANTRA  Bittensor

Bittensor  POL (ex-MATIC)

POL (ex-MATIC)  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  dogwifhat

dogwifhat  Monero

Monero  Arbitrum

Arbitrum  Stacks

Stacks  Filecoin

Filecoin  OKB

OKB