- Bitcoin and Ethereum decouple, “painting a blurred picture” of the much-anticipated altseason this bull cycle.

- An analyst has advised that investors create an early position in Bitcoin as the periods of altseason appear over.

The Bitcoin price recently witnessed a huge scare after macroeconomic indicators caused the asset to take a significant nosedive to $91k. However, the asset has since appreciated as the price bounced back to $100k before marginally declining to $98.6k.

According to our market data, Bitcoin has declined by 0.69% in the last 24 hours and increased its market dominance to 60%. Also, its recent fall marks the second time the asset trended below the $93k area this year, as outlined in a recent blog post.

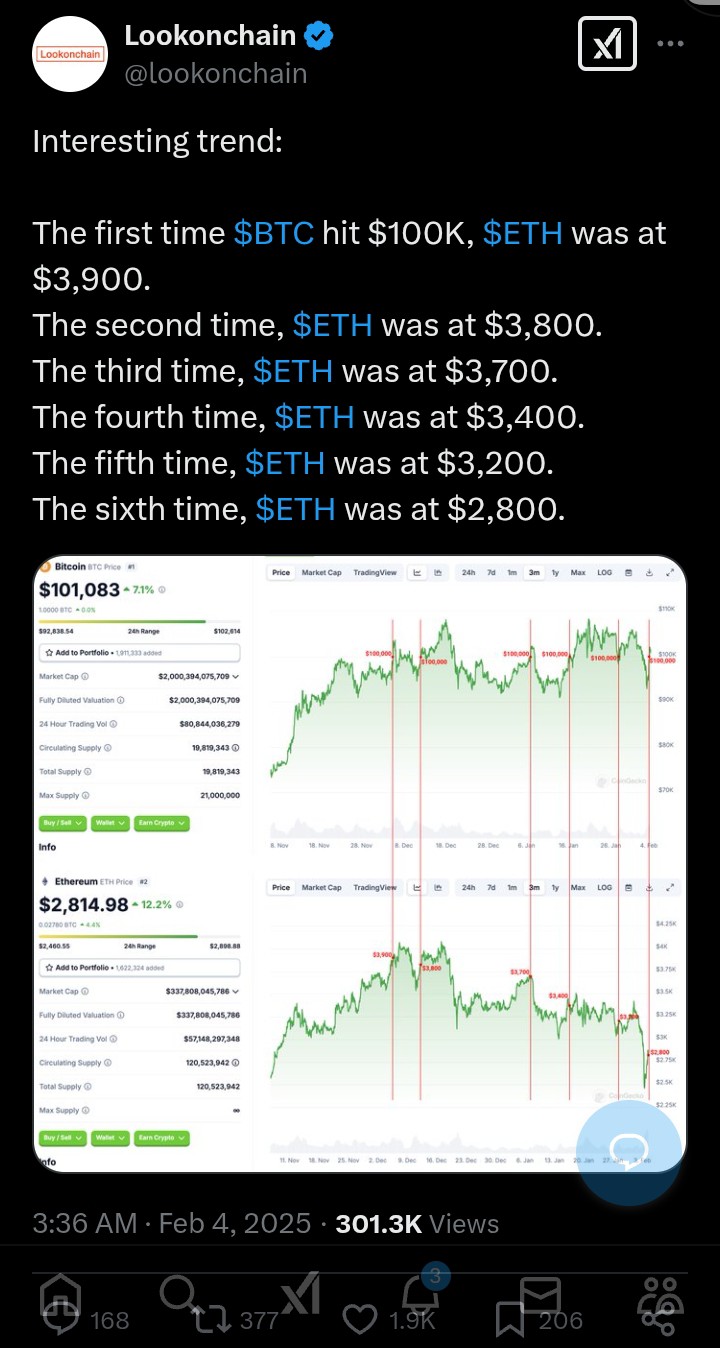

Just like Bitcoin, Ethereum (ETH) has also declined by 0.97% in the last 24 hours to trade at $2.7k. Fascinatingly, the asset earlier declined below a crucial support level of $2,400. Regardless of the quick bounce back, analysts have observed an unexpected decoupling between Bitcoin and Ethereum. Confirming this is Lookonchain data, which discloses that ETH trends lower than the subsequent event whenever Bitcoin reclaims the $100k level.

More About the Bitcoin and Ethereum Decoupling

Looking at the historical trend, we found that ETH was trading at $3.9k on December 5 when Bitcoin was hovering within the $100k zone. On December 11, ETH declined slightly to $3,800 after Bitcoin had gone past the $100k level.

In the last four scenarios, ETH had declined to $3,700, $3,400, $3,200, and $2,800 whenever Bitcoin retouched $100k. Meanwhile, the ETH/BTC chart confirms this development as ETH falls to 0.0281 BTC. According to data, this is the lowest recorded in the last 4 years. Interestingly, similar weakness could be witnessed in the price behavior of Dogecoin, Cardano, and Binance Coin.

Bitcoin’s dominance could also be seen in the significant surge of institutional interest as inflows surge to more than $460 million. As we noted in our earlier post, this amount surpasses the entire crypto market, including Ethereum and XRP. Meanwhile, a larger part of this amount comes from the US spot Bitcoin Exchange-Traded Funds (ETFs), which has produced a cumulative flow of $1.1 billion in the past five days.

What the Decoupling Means to the Altseason

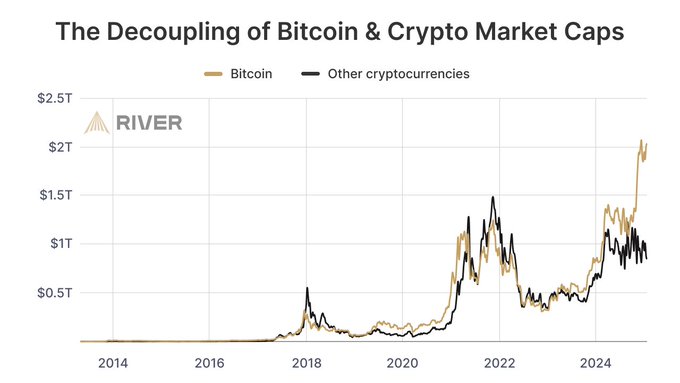

According to a River Financial executive, Sam Wouters, there may be no altseason this cycle. This conclusion was drawn from the decoupling of the altcoins from Bitcoin.

Meanwhile, he advises crypto investors to start building a meaningful Bitcoin position now.

6 months ago, I called out the decoupling of Bitcoin and crypto market caps. People came out in droves to tell me I was wrong and altseason was upon us. The truth is, there is no more altseason. The sooner you accept that, the sooner you can still build up a meaningful Bitcoin position. You’re not too late. You’re among the first 1-2% of people to get into bitcoin. It’s time to leave this chapter of false narratives behind and get on board with something real and meaningful.

According to our recent analysis, Bitcoin could record an impressive surge this year to hit $250k.

Recommended for you:

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Bitget Token

Bitget Token  WETH

WETH  USDS

USDS  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  MANTRA

MANTRA  Uniswap

Uniswap  Ondo

Ondo  Pepe

Pepe  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  NEAR Protocol

NEAR Protocol  Mantle

Mantle  Official Trump

Official Trump  Dai

Dai  Aptos

Aptos  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bittensor

Bittensor  OKB

OKB  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Gate

Gate