Donald Trump now reportedly holds over 90% of his net worth in cryptocurrency. This revelation has sparked intense debate across social media, with prominent tech entrepreneur and former Coinbase CTO Balaji Srinivasan weighing in on the potential global implications.

Writing on January 19 via X, Srinivasan called this development a “FIRST CRYPTO PRESIDENT.” In his words, “Overnight, the vast majority of the net worth ($59B) of the next President of the United States is now held in cryptocurrency. This will hold true even with a 90% drop.” He further pointed out that Trump’s stake in crypto soared from possibly 1% of his holdings to well over 90%, which Srinivasan likened to the early days of Bitcoin, Ethereum, and Solana adopters who saw similar meteoric changes to their personal wealth.

What The TRUMP Memecoin Means For Crypto

Srinivasan expressed a view that this phenomenon, where non-crypto assets are overshadowed by crypto almost overnight, might soon happen on a wider scale, saying, “This phenomenon — the overnight relative devaluation of all non-crypto holdings — will be experienced by billions globally within our lifetime as fiat dies.” According to him, Trump’s vast existing audience and his significant influence over political discourse could place him in a uniquely advantageous position. He observed that “every politician, influencer, and celebrity worldwide is watching mouth agog at the phenomenon. They’ll wait to see how it shakes out politically and financially, and if the memecoin shows staying power — big if! — they may do their own.”

Srinivasan argued that if thousands of personal memecoins emerge, investors would know they are primarily betting on a personal brand, saying, “every buyer knows what they’re buying: the potential future brand value of the meme.” In scrutinizing whether a Trump-branded token could withstand the volatility that causes many celebrity tokens to plummet, Srinivasan singled out the Trump’s massive following, “daily non-stop coverage,” and what he called “presidential immunity” as factors that might buoy a token’s value. “Trump is Trump,” he wrote, underscoring the uniqueness of someone with more than one hundred million global followers and “unprecedented control over the government.”

Because of these advantages, Srinivasan suggested that any backlash from Washington might lead the incoming US president to “debate across social media in the most aggressive way possible,” as the incentives for him to protect his own digital wealth would align with pro-crypto regulatory frameworks. He noted that critics would most likely assail this scenario as a direct conflict of interest.

Yet, he also alleged that it would be no different from how other high-level public figures have profited over time, remarking that “Biden took 10% for the big guy, and Pelosi traded her stocks, and Hillary monetized her speeches, and Podesta had his $300B climate slush fund, and Obama got his Netflix deal. All became millionaires via various deniable forms of payola for Democrats.” By contrast, Srinivasan said, “Trump’s rebuttal may be that he’s just doing everything in public. His claim may be that disclosure solves the conflict of interest problem.”

Nevertheless, public disclosure alone would not put to rest concerns about whether the interests of Trump’s office could be decoupled from the performance of the digital assets he owns. Srinivasan drew a parallel between a corporate chief executive and a head of state, suggesting that alignment is the key issue: “The CEO of a company is typically one of the largest shareholders, but he is aligned with all his employees because they hold the same shares. All holders rise and fall as one, ideally.”

By analogy, he speculated that in a purely aligned system, a president’s holdings and those of ordinary citizens might converge in something like a national cryptocurrency. “You would ideally want the President to be aligned with his citizens, such that they all held (say) USA coin, which gave some dividend from the profits of the USA. Kind of like the Alaska Permanent Fund.”

Srinivasan then raised the possibility of Trump distributing tokens to the public, proposing that “one way of solving the alignment problem would be for Trump to airdrop some TRUMP to every US citizen” or at least to every supporter in his database. Such an unprecedented move would test legal boundaries, since “to my knowledge no politician has attempted a personal airdrop before, to give away money — and certainly not at this scale.”

He suggested that if the current valuations hold, Trump could distribute the equivalent of one hundred dollars’ worth of TRUMP to all seventy-seven million of his voters at a cost of roughly 7.7 billion dollars in an asset “that was worth zero two days ago.” Srinivasan reasoned that the cost to Trump might be offset by an immense expansion of his political brand, especially if the only requirement for the airdrop was signing up for his personal email list. “It would ‘pay for itself’ by turning his base into even more rabid supporters.”

He speculated that this could undermine longstanding patronage structures within American politics, especially “the Democrat patronage machine,” by incentivizing individuals to back pro-crypto policies in exchange for an effective universal basic income. “If 77M Americans are also benefiting from TRUMP, charges of conflict of interest go away. It’d be a new kind of social contract, a personal relationship between President & citizen.”

At press time, TRUMP traded at $58.00.

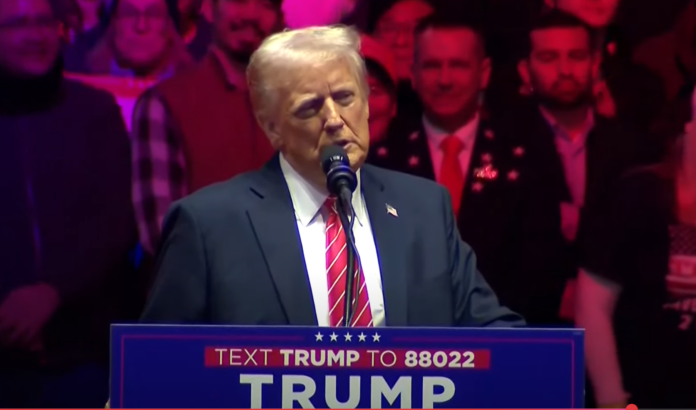

Featured image from YouTube, chart from TradingView.com

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Hedera

Hedera  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Official Trump

Official Trump  WETH

WETH  Polkadot

Polkadot  Parkcoin

Parkcoin  Litecoin

Litecoin  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Uniswap

Uniswap  Hyperliquid

Hyperliquid  Pepe

Pepe  Wrapped eETH

Wrapped eETH  USDS

USDS  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Ondo

Ondo  Ethereum Classic

Ethereum Classic  Monero

Monero  POL (ex-MATIC)

POL (ex-MATIC)  Algorand

Algorand  MANTRA

MANTRA  Cronos

Cronos  Render

Render  OKB

OKB  Bittensor

Bittensor