The hope of an Ethereum upsurge is fading as the number one altcoin price dropped significantly within the last four days. Between 20 and 23 October the ETH price fell by 9.6% after facing a rejection on the $2,700 resistance level. That price dip erased Ethereum gains accrued within the last 10 days. At this point, the price of ETH has stabilized around the $2,500 level.

At the time of writing, ETH is trading at $2,519 ETH/USDT at Gate.io exchange. However, its value dropped by 2.2% within the last 24 hours. The yearly chart, though, shows that it has gained by around 37.2%. Within the last previous week its value decreased by 3.82% despite a rise in its trading volume. The following graph shows ETH’s price movement within the last 7 days.

Ethereum Price Action – CoinMarketCap

As seen on the image, the current ETH price downtrend started on 10 October and is set to continue. It is still showing much bearish pressure.

Reasons for ETH Price Decline

The possibility of an ETH rebound above $2,800 is diminishing as there is low optimism in its market. There could be a number of reasons for the poor performance of the number one altcoin. However, the greatest contributor to the Ethereum poor market performance is likely to be its high transaction fees. The exorbitant transaction fees are forcing crypto investors to invest in other altcoins such as Solana, BNB and Cardano (ADA). Of course, the list of attractive cryptocurrencies is growing by day. For instance, FET, SEI, TON, NOT and WLD are performing relatively better than ETH.

Ethereum’s past price performance is affecting its current market activity as well. As an example, the recent drop in Ethereum market capitalization is another contributing factor to its price drop. This is because a decrease in its market cap has generated pessimism among the investors. For example, between 22 and 23 October ETH market capitalization fell by 5%. And in the last 24 hours, it fell by 2.32% , exacerbating the already dire situation.

Congestion on the Ethereum network is also contributing to its poor market performance. What is making the situation worse is that the developers are taking much time to resolve the challenges that the users have been experiencing for a long time. Thus, the investors are relocating their funds to more user-friendly blockchains such as Solana, Polygon, Avalanche and Arbitrum. Although the cited challenges do not affect smart investors in a significant way they have a great effect on those using it on a day-to-day basis such as traders.

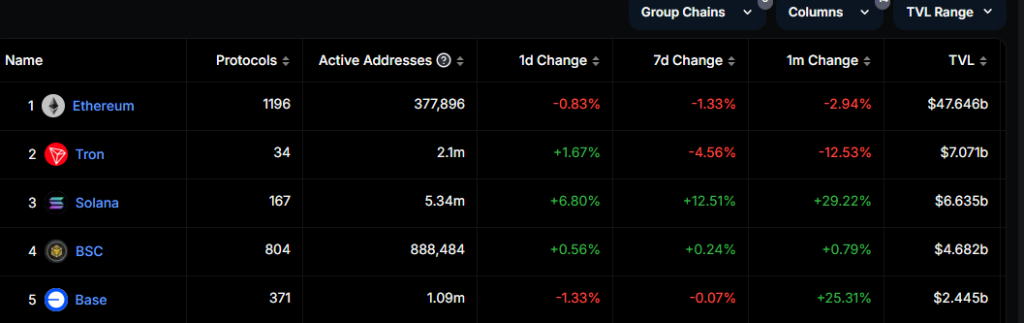

To illustrate the decline in network activity on Ethereum, we can compare it to what is happening on other blockchains such as Solana and Binance Chain. Data on Defilama shows that Solana recorded $13.4 billion in volume during the last 7 days. That was a whopping 67% higher than Ethereum trading volume during that period. Also, Solana’s total value locked is rising as the next picture shows.

Solana Total Value Locked – Defilama

Whereas, the total value locked on Solana is increasing Ethereum’s TVL is decreasing. This clearly shows the challenges that the Ethereum blockchain is facing. The next graph shows the current trend of the Ethereum total value locked.

Ethereum Total Value Locked – Defilama

By comparison the Ethereum TVL increased by a smaller percentage than the Solana’s. And that is not all. Other blockchains like Binance Chain and Avalanche have been performing better than ETH in various ways. More significantly, the trading volume of decentralized exchanges that exist on the Ethereum blockchain has been decreasing as well. For example, during the 7-day period ending on 23 October the trading volume of these DEXes decreased by 13%. That followed a significant drop of trading volumes on Curve Finance and Uniswap, both operating on the Ethereum network.

The decrease in a network’s total value locked may create much negative sentiment among its users. Specifically, a reduction in the number of depositors shows a negative development in its supply and demand dynamics. This becomes direr if the validators are unstaking their ETH. There are other metrics that show Ethereum’s poor performance. For instance, Ethereum has experienced a decline in the number of active addresses.

Changes in Active Addresses – Defilama

We have discussed several metrics that show that Ethereum is not performing as expected. That might be contributing to its current bearish pressure.

Ethereum Price Analysis

ETH has been facing much resistance around its descending channel. This has forced its price to continuously decline within the last few days. As of 24 october, the ETH price dropped below its 50-day Exponential Moving Average (EMA) at $2,564. That might have confirmed the rise in selling activity. The current fear is that if the seller’s activity remains high its price may fall further to $2,461. On the other hand, if it rebounds above the 50-day EMA it may head towards $2,820, its 24 August high.

As of now, ETH has broken the ceiling of the falling channel. That may indicate a slow down of the downward trend. However, the probability of a continued price fall is high.

Ethereum Price Action – Investtech

As observed on the graph, the ETH price has gained slightly to break above the trendline. The short term bullishness it has shown is supported by its Relative Strength Index which is rising. The RSI has a current reading of 58. Considering ETH’s performance within the past 7 days, its price rise above the trendline may turn out to be a false break out .

Gate.io P2P: Empowering Accessibility for Ethereum

One of the significant ways Gate.io has enhanced Ethereum’s accessibility is through its Peer-to-Peer (P2P) trading platform. The Gate.io P2P service enables users to trade Ethereum and other cryptocurrencies directly with one another using their local currency, eliminating the need for intermediaries. This feature provides a seamless and cost-effective solution for users across different regions, especially in countries with limited access to traditional financial systems.

Gate.io P2P’s integration into the Ethereum ecosystem is particularly beneficial during periods of market volatility. By offering competitive rates and secure transactions, it allows investors to enter or exit Ethereum positions quickly. Additionally, the platform’s escrow mechanism ensures that transactions are safe and transparent, building trust among users.

As Ethereum faces challenges like high transaction fees and congestion, Gate.io P2P provides an alternative pathway for users to acquire ETH without incurring hefty network fees. This ease of access could play a crucial role in maintaining user engagement and supporting Ethereum’s broader adoption despite its ongoing struggles.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Toncoin

Toncoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Hedera

Hedera  Stellar

Stellar  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Litecoin

Litecoin  Uniswap

Uniswap  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  USDS

USDS  Aave

Aave  Internet Computer

Internet Computer  Aptos

Aptos  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Monero

Monero  MANTRA

MANTRA  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Filecoin

Filecoin