Altcoins have been collectively rallying over the last couple of days. On the weekly, most of the top alts have managed to pose double-digit return figures. However, one particular alt that had been living under the shadow of the alt king Ethereum, has been stealing the limelight of late.

While the likes of Cardano, XRP, Solana, and Dogecoin had their 7-day RoI capped under 20%, the #22nd ranked Ethereum Classic, has climbed up by 77%. The token has managed to pull off a 180-degree flip over the past 9-odd weeks and is currently trading around the same price as it was during the end of May.

Ethereum Classic, at the moment, stands at a critical juncture. As illustrated below, it has broken past its strong resistance at $25.5 [yellow], which is an optimistic sign. So, if the bullish thrust persists in the market, traders can consider $28.5 and $30.75 as short-term ETC targets.

Ethereum Classic’s yearly low twins

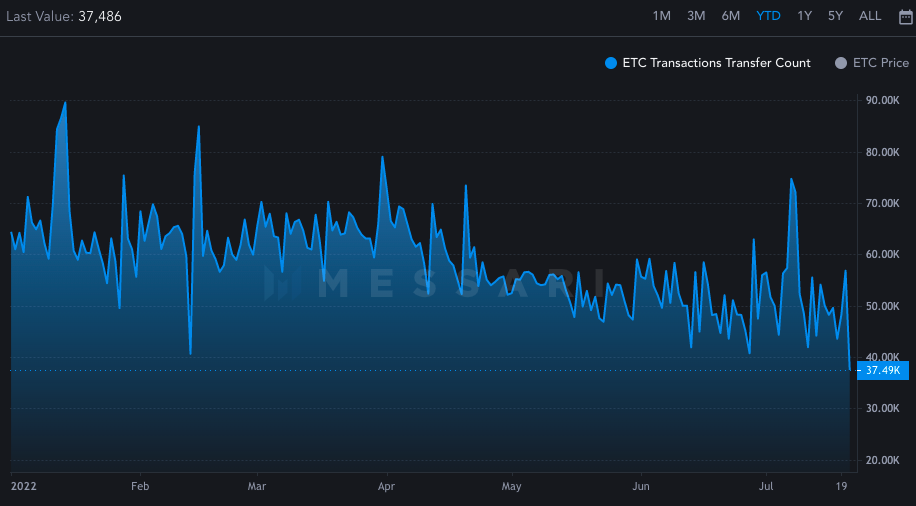

The state of Ethereum Classic’s metrics, however, remains to be quite gloomy. Let’s consider the case of the transaction transfer count first. The reading of this metric currently stands at 37.49k, and as illustrated below, the same is at its lowest point this year. This essentially means that Ethereum Classic is currently not fostering transactions on its network like before.

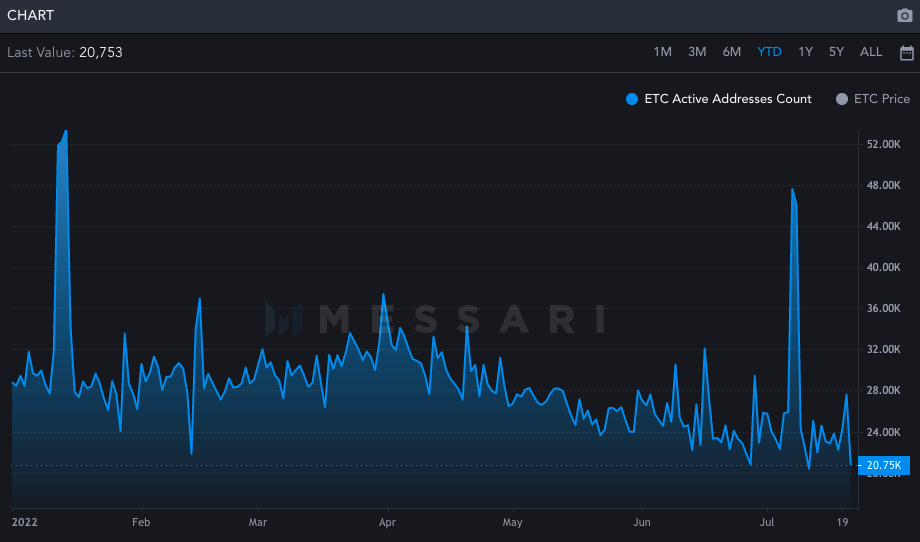

Alongside, the state of the address activity also painted a similar picture. Per Messari’s data, only around 20.75k addresses were active on Friday as opposed to 7 July’s 47.5k. The current figure is, again, quite close to its yearly low at 20.4k, making it another red flag.

Self-sustainability at stake?

Now, it’s a known fact that during past bullish/bearish phases, Ethereum Classic has always tagged along with Ethereum. But now, their correlation is not that high. Per data from Cryptowatch, the weekly correlation of the two forked tokens stands only around 0.56. This basically means that if ETC has to continue rallying, it will have to remain self-sustainable.

Keeping the current state of the on-chain metrics in mind, it likely won’t be a cakewalk for ETC to continue its rally. Also, its market is currently overheated and is primed for a correction. So, if the bearishness indeed intensifies, then the alt might end up falling below its afore-highlighted resistance. In such a case, it would likely find solace at either of its EMAs around $22.04 and $19.06.

Credit: Source link

Troll

Troll  MSTR2100

MSTR2100  Galeon

Galeon  Gui Inu

Gui Inu  Spectre AI

Spectre AI  Hegic

Hegic  sETH2

sETH2  Nuvola Digital

Nuvola Digital  Artrade

Artrade  Baby Wen

Baby Wen  Synternet

Synternet  WigoSwap

WigoSwap  Gamer Arena

Gamer Arena  SelfieDogCoin

SelfieDogCoin  Kava Lend

Kava Lend  KYVE Network

KYVE Network  Diamond

Diamond  Aventus

Aventus  Index Cooperative

Index Cooperative  nomnom

nomnom  Diamond Launch

Diamond Launch  Klever

Klever  RARI

RARI  Rake.com

Rake.com  OG Fan Token

OG Fan Token  UFO Gaming

UFO Gaming  PIVX

PIVX  Iron Fish

Iron Fish  AUKI

AUKI  MakerDAO Optimism Bridged DAI (Optimism)

MakerDAO Optimism Bridged DAI (Optimism)  Mistery

Mistery  Tensorplex Staked TAO

Tensorplex Staked TAO  GameSwift

GameSwift  Counterparty

Counterparty  SelfKey

SelfKey  Uni

Uni  APX

APX  Apollo

Apollo  MOOxMOO

MOOxMOO  SolanaHub staked SOL

SolanaHub staked SOL  Dog Wif Nunchucks

Dog Wif Nunchucks  MEMENTO•MORI (Runes)

MEMENTO•MORI (Runes)  sUSD (Optimism)

sUSD (Optimism)  Index Coop - ETH 2x Flexible Leverage Index

Index Coop - ETH 2x Flexible Leverage Index  Boop

Boop  Nuklai

Nuklai  Kyros Restaked SOL

Kyros Restaked SOL  NPC On Solana

NPC On Solana