Bitcoin faces resistance enroute to its $100,000 target, with a likelihood of consolidation. This has sparked a fresh interest in the altcoin market. In 2021, altcoins delivered massive gains to traders when Bitcoin paused its rally, and a similar scenario may be unfolding this cycle.

With traders anticipating another potential breakout, we analyse key altcoins that could rally once more if Bitcoin takes a breather. This deep dive explores five altcoins from the 2021 bull run that are showing signs of gearing up for an explosive move this cycle.

Bitcoin dominance dwindles, altcoin gains likely

Bitcoin’s dominance peaked at 61.53%, the highest level since 2021, on November 18. Since then, dominance has dwindled, down to 58.97% on Tuesday, November 26, 2024.

A decline in Bitcoin dominance typically paves the way for capital rotation into altcoins and a likely comeback in the altcoin season, where at least 75% of the tokens outperform Bitcoin in a 90-day timeframe.

During the 2021 bull run, Bitcoin dominance dropped to 40%, and altcoins started rallying, yielding nearly double-digit gains for traders during the cycle. A similar occurrence could push altcoin prices higher during this bull run.

Is it altcoin season?

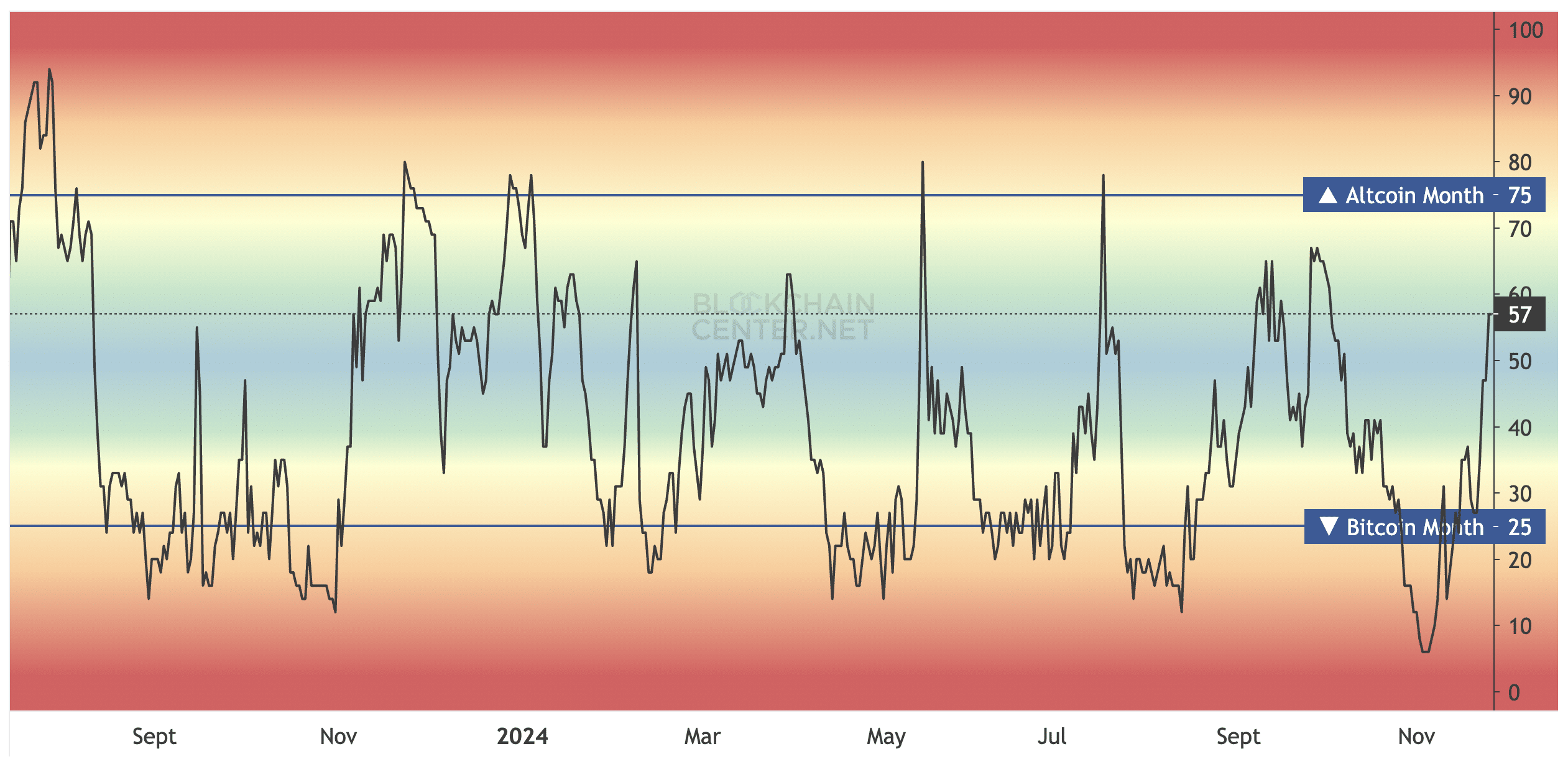

The altcoin season index on Blockchaincenter.net shows a steady climb in the scale that measures whether it is “alt season.” When 75% of the top 50 altcoins outperform Bitcoin in a 90-day timeframe, it confirms an alt season, excluding stablecoins like Tether, DAI, and asset-backed tokens like WBTC, stETH, and cLINK.

The chart shows an increase in the index, up from 6 on November 5 to 57 at the time of writing. Once the metric touches 75, it marks an “altcoin month.” When this occurs in the 90-day timeframe, it is altcoin season.

While it isn’t altcoin season yet, this shows steady progress towards the same, and traders can begin preparing by adding relevant altcoin tokens to their portfolio to take profits in the coming weeks.

Altcoins from the 2021 bull run eye massive gains

During the 2021 bull run, altcoins like Avalanche (AVAX), Polkadot (DOT), Fantom (FTM), Internet Computer Protocol (ICP) and the Sui Protocol (SUI) could make a return in this cycle. Technical and on-chain indicators support the comeback of these assets.

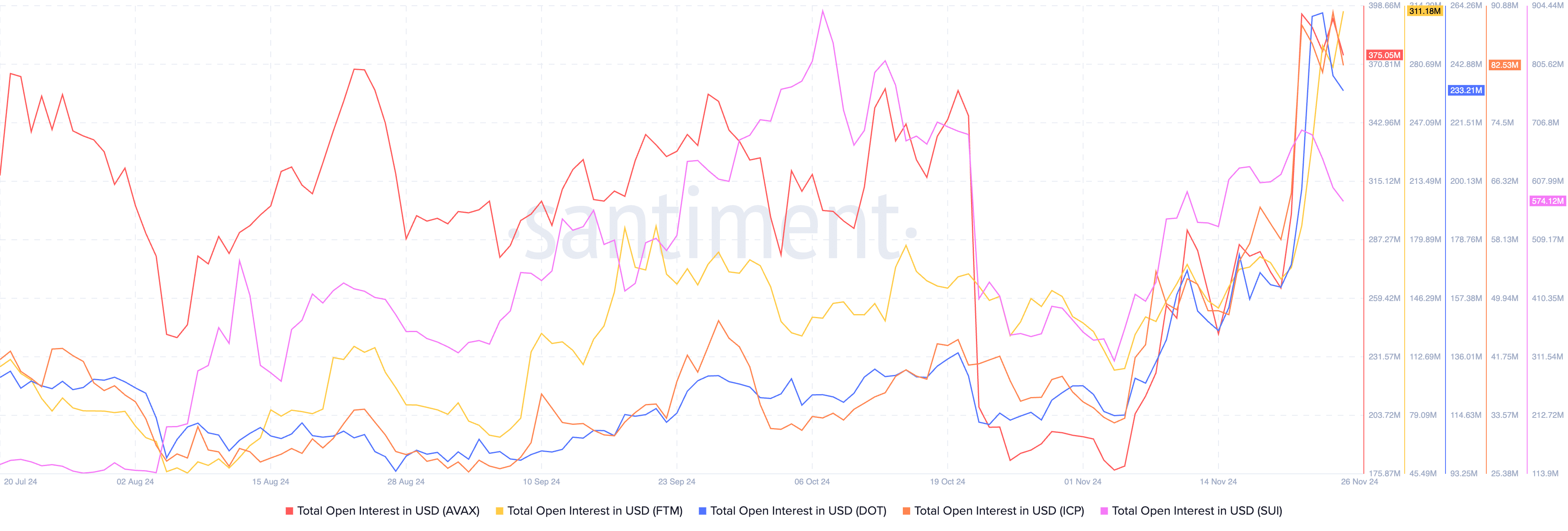

Total open interest in the US dollar is a metric used to identify the value of all open contracts across derivatives exchanges in a given token. For AVAX, DOT, FTM, ICP and SUI, open interest recorded a spike on November 22, and since then, it holds steady above average, per Santiment data.

Volume traded in these assets and address activity remains close to average and above average levels in some cases, meaning there is an increase in interest in these tokens from crypto traders.

AVAX gained nearly 20% in the past week; DOT added 33% to its value, FTM rallied 44%, ICP observed an 18% increase, while SUI erased 8% of its value. In the 2021 cycle, these tokens were relevant for their utility, partnerships and ecosystem value addition for traders.

Alongside the meme coin narrative, utility and real-world asset tokenization, Ethereum-alternative chains have gained traction this cycle, making Avalanche, Polkadot, Fantom, and Sui Protocol relevant for traders.

Top 5 altcoin targets this cycle

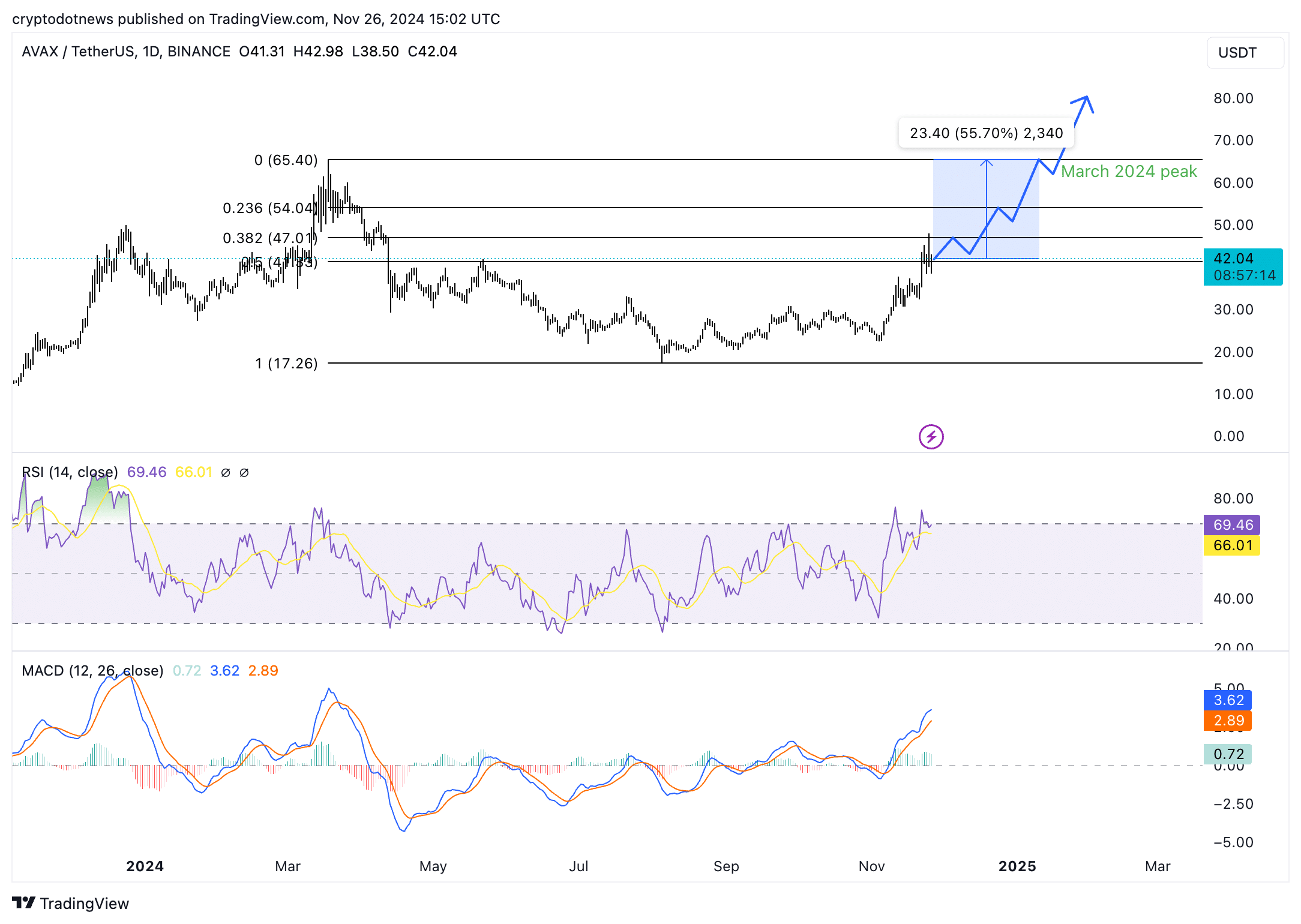

Avalanche’s daily price chart shows that the altcoin could extend its gains by 55% to revisit its March 2024 peak, and the target is at the $80 level. This is a psychologically important price level for AVAX.

The relative strength index reads 69, close to but under the “overvalued” zone above 70. Moving average convergence divergence, a momentum indicator shows green histogram bars above the neutral line. This supports a thesis of further gains in AVAX.

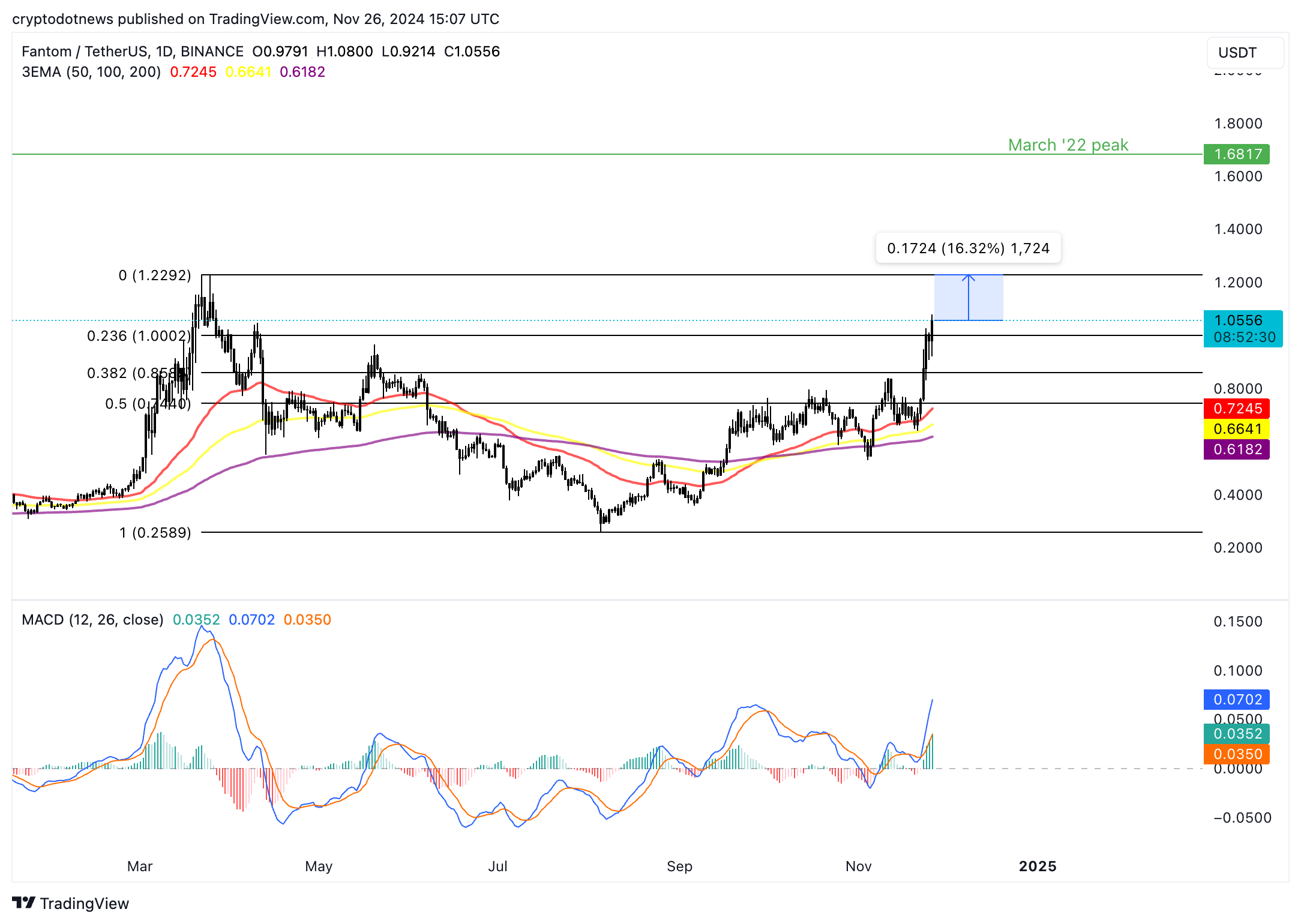

Fantom could rally 16% in the coming weeks and revisit its March 2024 peak of $1.2292, per the daily price chart. The March 2022 peak of $1.6817 is the target for Fantom.

MACD shows that further gains in Fantom are likely and the three exponential moving averages are the key support levels for FTM.

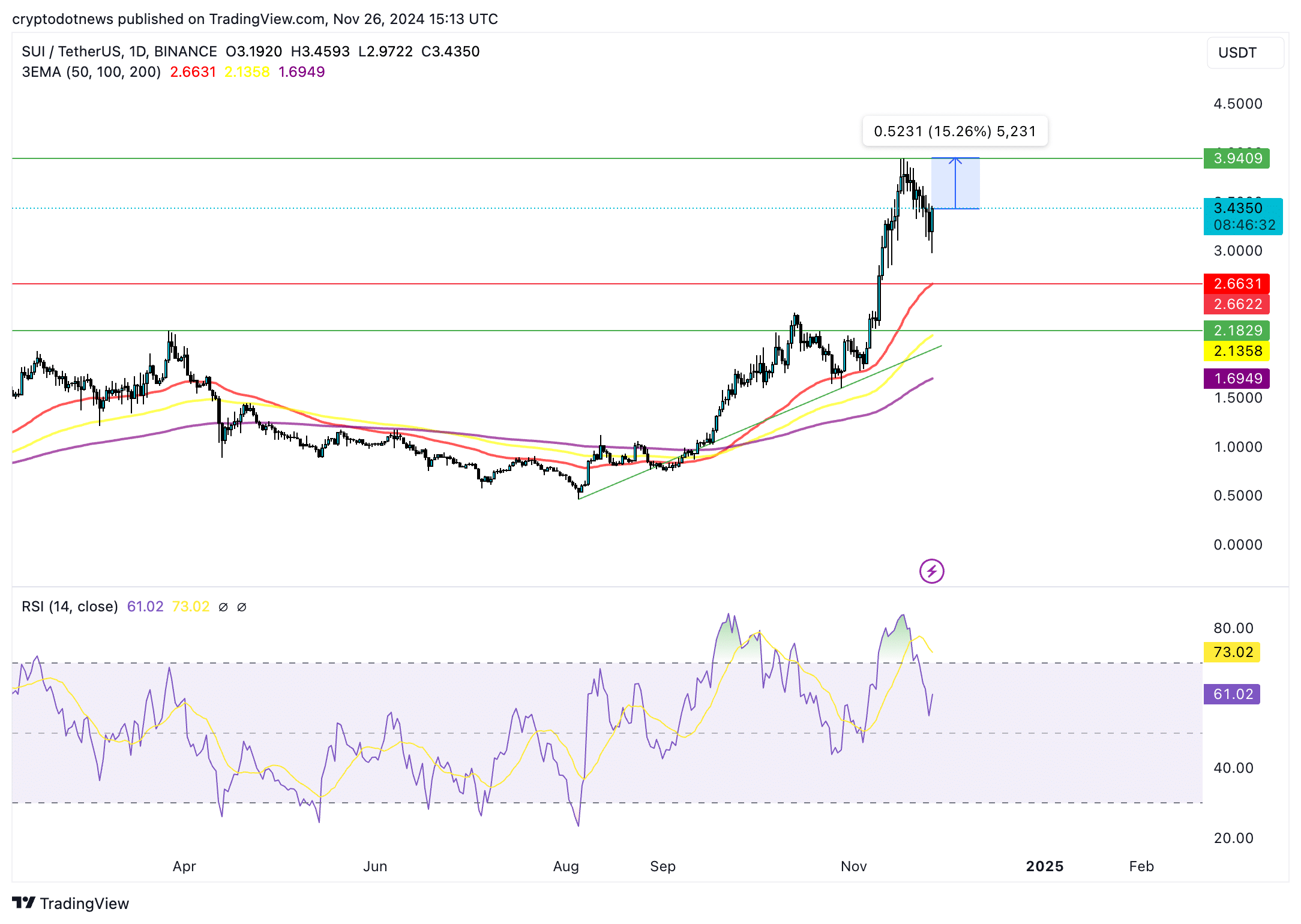

Sui Protocol’s token trades at $3.4350 at the time of writing. SUI could revisit its 2024 peak at $3.9409. The token trades above its three EMAs, with 50-day EMA at $2.6631 acting as a key support level.

SUI could rally 15.26%, upward sloping RSI supports the bullish thesis for the token.

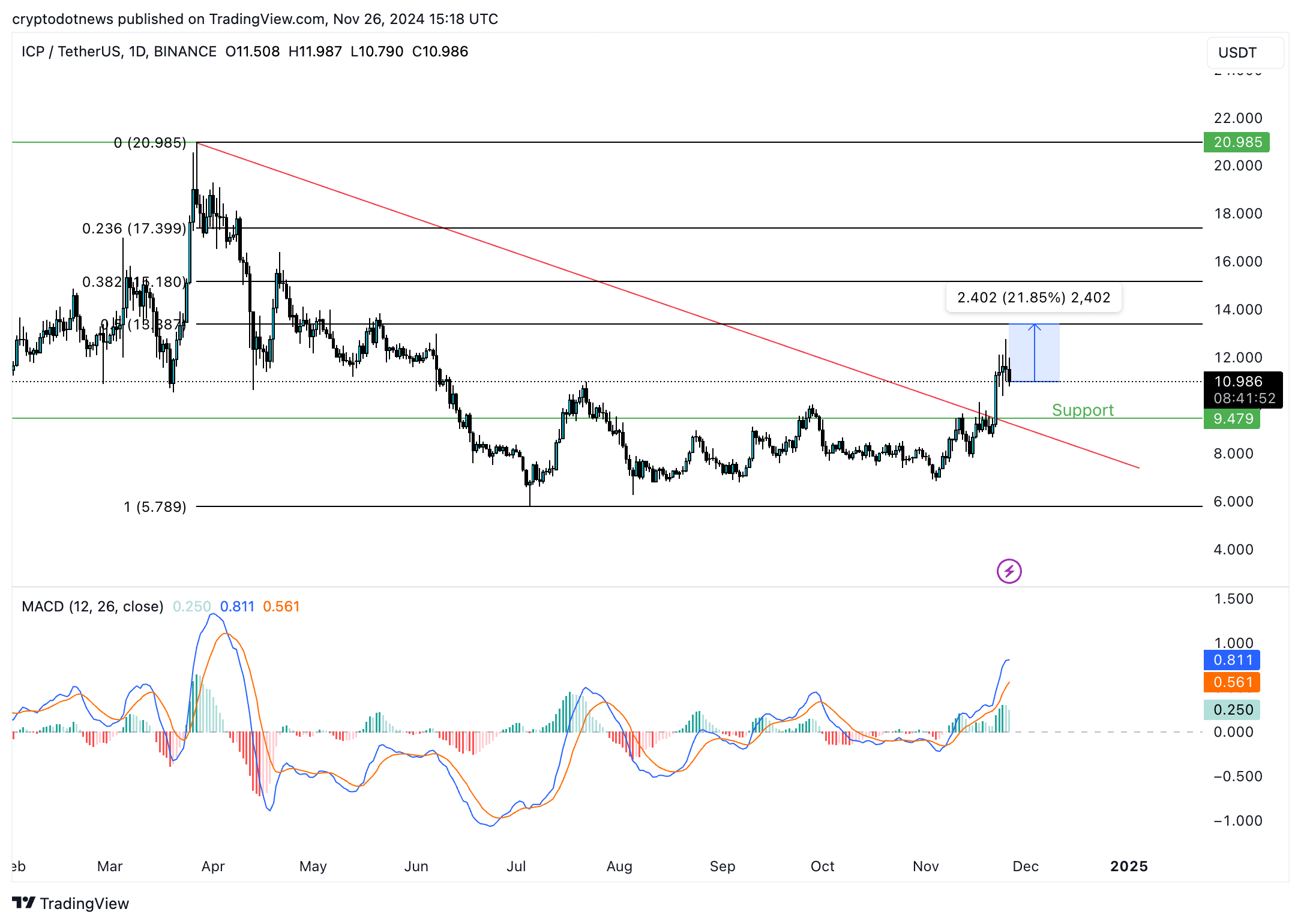

ICP ended its multi-month downtrend on November 22. The token could retest its 2024 peak at $20.9850. On its path to the target, ICP faces resistance at the 50%, 38.2% and 23.6% Fibonacci retracement levels at $13.3870, $15.1800, and $17.3990 respectively.

The momentum indicator MACD supports ICP’s bullish thesis on the daily timeframe.

$9.4790 is a key support level for ICP, in the event of a correction in the token.

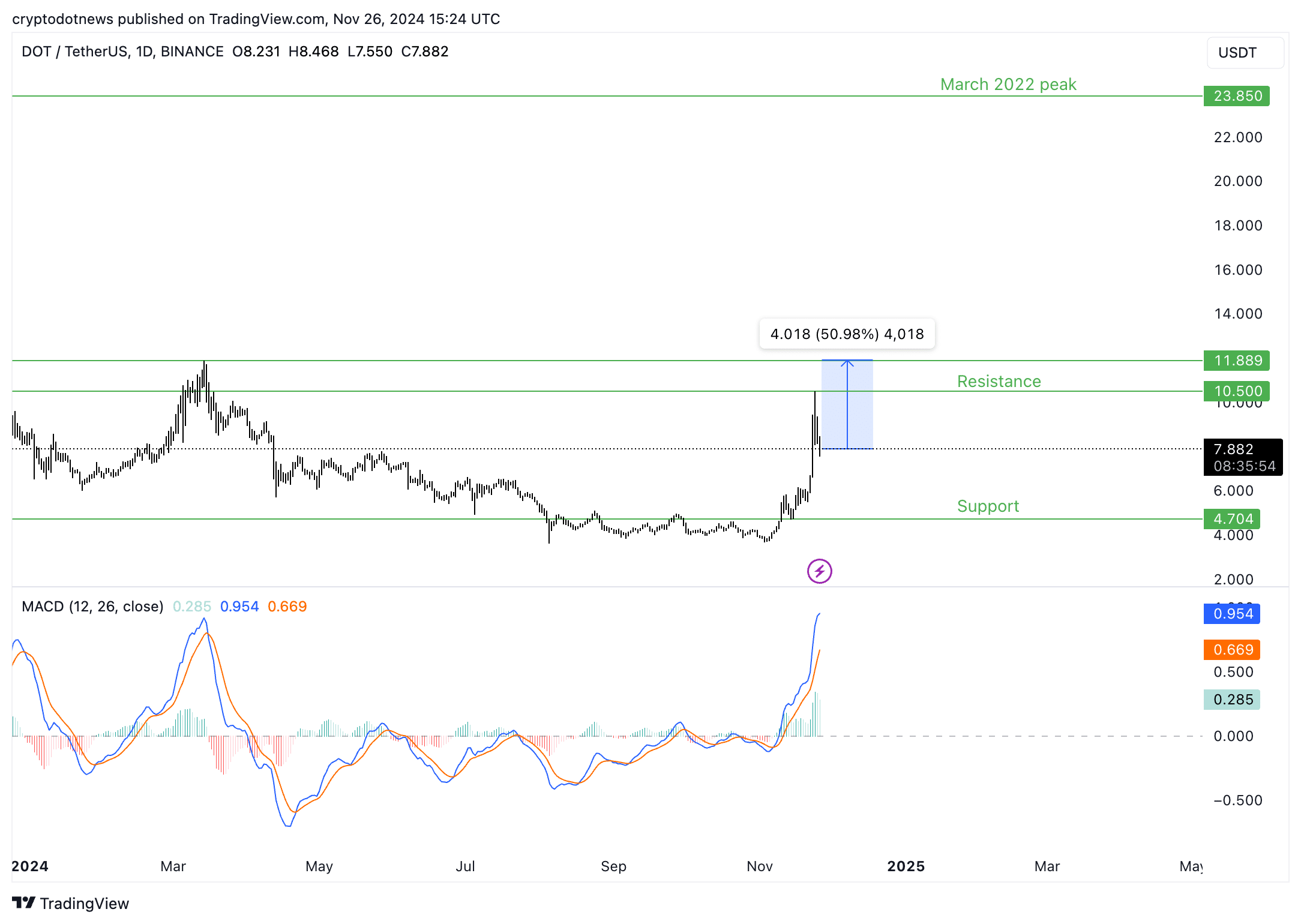

Polkadot could extend its gains by 50% if the token makes a resurgence in the upcoming altcoin seasons. DOT could face resistance at $10.50 and break past this level to target $11.8890. This marks nearly 51% gain from the current price level.

The March 2022 peak of $23.850 is the target for DOT, the token could find support at $4.7040.

MACD supports a bullish thesis for Polkadot. DOT has currently suffered a decline in the 7-day timeframe; however, recovery is likely in the short term.

It is important for traders to consider that a resurgence in altcoin prices is dependent on Bitcoin’s dwindling dominance and capital rotation out of BTC and into alts. If Bitcoin closes above $100,000 on the daily timeframe and climbs higher, the altcoin season could be delayed or pushed to early 2025.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  WETH

WETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Litecoin

Litecoin  Uniswap

Uniswap  Aptos

Aptos  Wrapped eETH

Wrapped eETH  USDS

USDS  Internet Computer

Internet Computer  Hedera

Hedera  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Ethena USDe

Ethena USDe  Bittensor

Bittensor  Render

Render  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Dai

Dai  WhiteBIT Coin

WhiteBIT Coin  Celestia

Celestia  MANTRA

MANTRA  Filecoin

Filecoin  OKB

OKB  Bonk

Bonk  Stacks

Stacks