Senator Cynthia Lummis (R-WY) has announced plans to introduce legislation directing the U.S. government to accumulate 1 million Bitcoin, which would be worth over $68 billion at current prices.

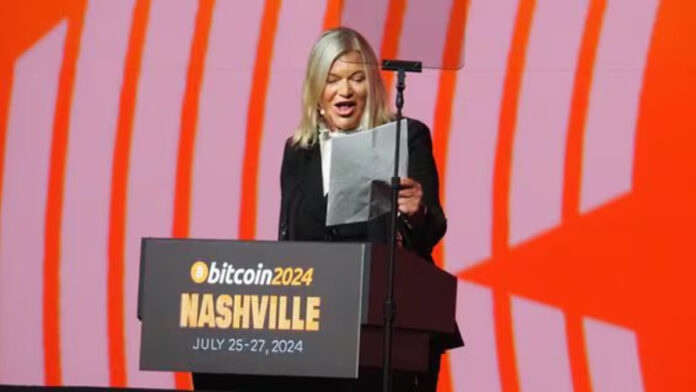

Speaking at the Bitcoin 2024 conference in Nashville, Lummis said the bill would have the U.S. Treasury purchase Bitcoin over a 5-year period as a strategic reserve asset to fortify the dollar. She likened it to the government’s strategic petroleum reserve.

“We know from modelling the numbers and past experience with Bitcoin that it is capable of being an absolute game changer for the mess the United States has gotten itself into with its debt and its deficits,” says Lummis.

The senator said the government would self-custody the Bitcoin across various geographic locations. The assets could only be used to pay down the national debt and would need to be held for at least 20 years.

Lummis has been one of the leading Bitcoin advocates in Congress. She believes acquiring Bitcoin will help stabilize the dollar’s value and counter inflation. The national debt recently surpassed $35 trillion.

Her proposal follows former President Donald Trump’s endorsing the idea of a U.S. Bitcoin reserve at the Nashville conference. Trump said he would never sell any of the government’s 210,000 bitcoin holdings.

Independent presidential candidate Robert F. Kennedy Jr. also called for purchasing 500 bitcoins daily until accumulating a 4 million Bitcoin reserve.

While Lummis admits her legislation is unlikely to pass before the 2024 elections, she believes the growing political interest in Bitcoin reserves reflects a paradigm shift. Bitcoin has become a major campaign issue, with both parties courting the burgeoning industry.

Lummis bill represents the most aggressive government adoption of Bitcoin proposed yet. Though its prospects remain uncertain, the move would legitimize Bitcoin as an economic asset.

Lummis said she is “optimistic” that other Bitcoin-focused bills could still pass this year as Bitcoin moves closer to the political mainstream.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Pepe

Pepe  Polkadot

Polkadot  Stellar

Stellar  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  MANTRA

MANTRA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  dogwifhat

dogwifhat  Arbitrum

Arbitrum  Monero

Monero  Stacks

Stacks  OKB

OKB  Filecoin

Filecoin