DeFi platform Inverse Finance succumbed to a flash loan exploit on Thursday. Around 2 hours back, at 8:47 AM UTC, the hacker executed the hack using 27,000 WBTC. Per Etherscan’s data, the exploited funds included 53 BTC and 100,000 USDT and summed up to $1.2 million.

Flash loans allow traders to borrow unsecured loans from lenders without intermediaries. Essentially, the borrowed sum ought to be returned in the same transaction, and is usually executed by arbitrage traders. More often than not, attackers end up gaslighting DeFi price data feeds, or oracles, to carry out exploits.

Inverse Finance brought to light via a Tweet that its stablecoin DOLA was removed from its money market, Frontier. As a result, it had temporarily paused borrowings and begun investigating the incident. The protocol, however, claimed that no user funds were taken or risked.

Chalking out what could have possibly gone wrong, Curve Finance asserted that “the problem was them rolling a vulnerable LP token price oracle.” LP tokens, as such, allow market makers to be non-custodial, as in, they do not hold on to users’ tokens, but instead operate via automated functions.

Despite the broader market being in the midst of a relief rally, the protocol’s token INVERSE was trading in red at $0.53, evidently reacting to the attack. DOLA had also lost its $1 peg and was trading at $0.9957 at press time, after depreciating by 1.54% in the last 24 hours.

DeFi stolen fund numbers continue to rise

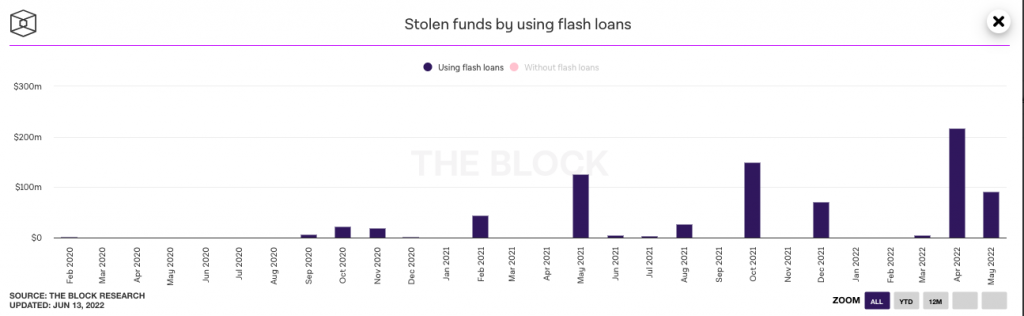

The reliance of hackers on flash loan attacks has not necessarily been on the rise. Per data from The Block, in April, $216.2 million was drained out of the DeFi ecosystem, while in May, the number had dropped down to $90 million.

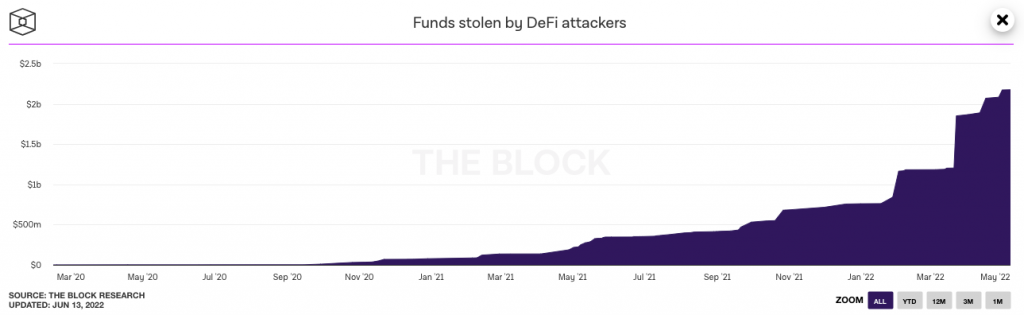

However, with some of the other vulnerabilities being exploited every other day, the cumulative lost funds have been rising, despite briefly becoming flat for a while in April. At this point, the total funds stolen by DeFi attackers mount up to $2.18 billion.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Toncoin

Toncoin  Sui

Sui  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Pepe

Pepe  Polkadot

Polkadot  LEO Token

LEO Token  Stellar

Stellar  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  POL (ex-MATIC)

POL (ex-MATIC)  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  MANTRA

MANTRA  Arbitrum

Arbitrum  dogwifhat

dogwifhat  Monero

Monero  Stacks

Stacks  OKB

OKB  Filecoin

Filecoin