Ethereum’s price continues to advance towards $4,000 despite market-wide liquidations and the U.S. SEC postponing a decision on Blackrock and Fidelity ETH ETF filings.

Ethereum traders have doubled bullish positions despite a major setback to institutional participation on the pioneer smart contract network and intense market volatility recorded on Mar. 6.

Market analysis explores how this show of conviction among speculative traders could impact the ongoing ETH price rally in the near-term.

Ethereum price reclaims $3,900 despite bearish headwinds

Ethereum’s price rose 9%, soaring from $3,500 to a peak of $3,900 within the daily timeframe on Mar. 6. The latest wave of ETH price rally is remarkable, as ETH defied downward pressure from two major bearish events.

The crypto markets suffered intense volatility as investors who booked profits when BTC claimed a new all-time high on Mar. 5 inadvertently triggered over $1 billion in liquidations.

Previously, crypto.news also reported that the U.S. SEC had postponed its decision on Blackrock and Fidelity’s filings to launch an Ethereum ETF product.

Despite two crucial events, ETH added another $48 billion to its market cap within the daily timeframe on Mar. 6, breaking past $3,900 for the first time in three years.

It was previously anticipated that the SEC would provide a verdict as early as April 2024. Still, the latest development means that the May 7 deadline on Vanguard’s application is now the most significant date for a possible ETH ETF approval verdict.

The launch of the Ethereum ETF is expected to open the floodgates of institutional demand, as observed in the Bitcoin markets over the past month.

Typically, news of such a verdict delay from the SEC, could put instant downward pressure on the price of the underlying asset. Remarkably, ETH defied the bears’ soaring 9% within 24 hours of the postponement hitting the newsreels.

Bullish traders keep ETH funding rates elevated

The dominant bullish expectations and positive buzz surrounding the Ethereum ecosystem ahead of the upcoming Dencun upgrade were vital catalysts for ETH’s resilient price performance on Mar. 6.

Market data shows that ETH speculative traders have maintained their bullish conviction, even as BTC and other mega-cap altcoins experienced major liquidations.

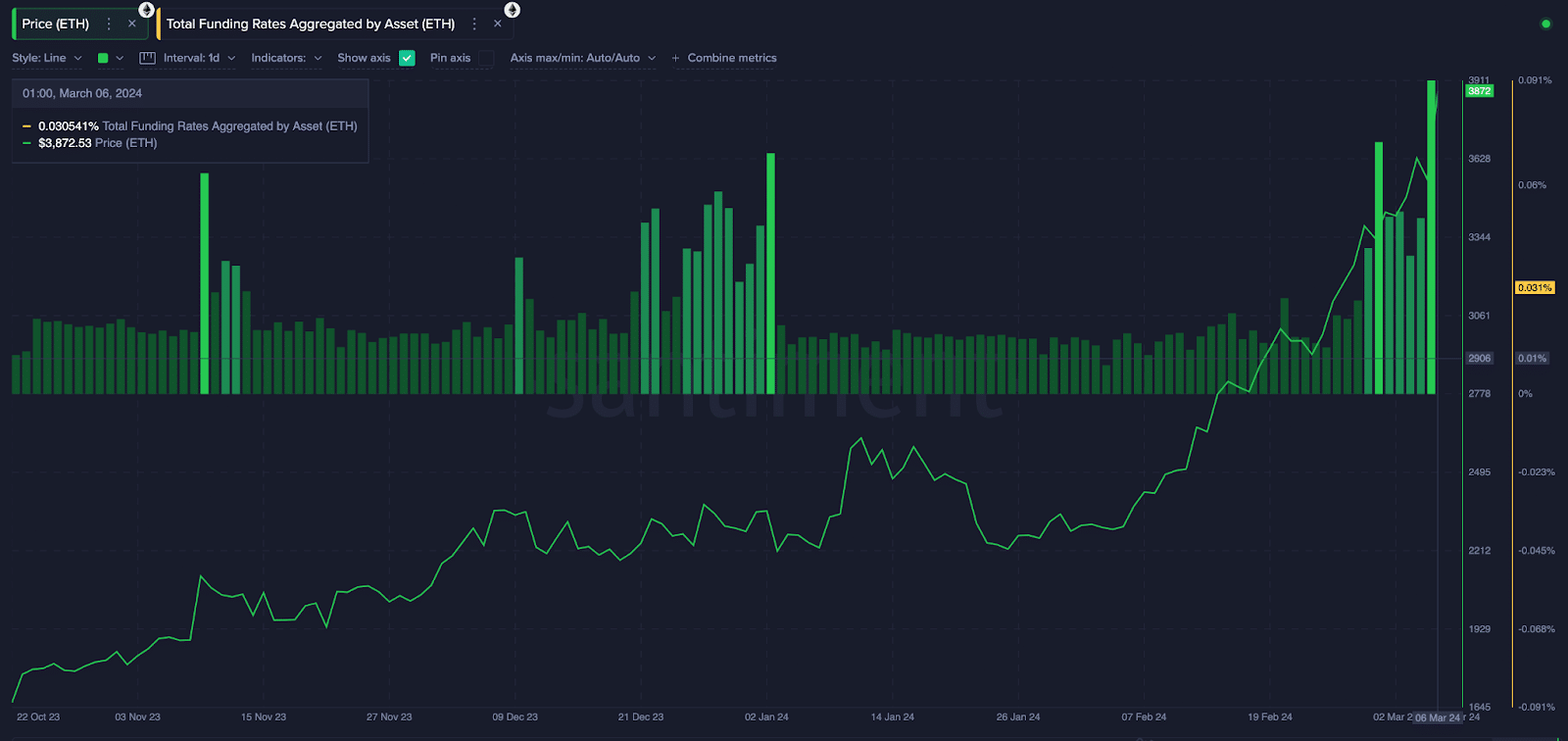

Santiment’s Funding Rates metric presents a daily aggregate of fees paid between holders of perpetual futures contracts for a specific crypto asset. Fluctuations in funding rate trends offer insights into speculative traders’ inclinations regarding short-term price movements.

The chart below shows that the ETH funding rate remained at elevated positive values above 0.05% since Feb. 27, when ETH prices first broke above the $3,500 milestone price.

Despite the bearish headwinds on Mar. 6, ETH bulls did not exit their positions. Instead, they doubled down on bullish positions, driving the funding rate to a 2024 peak of 0.09%.

Elevated levels in funding rates suggest that traders are overwhelmingly confident of further short-term price upswings and, as a result, offer higher fees to keep contracts open.

Unsurprisingly, ETH’s price quickly soared above $3,900 within the subsequent 24 hours following the spike in funding rate. If this rare market trend persists, according to historical trends, it’s only a matter of time before ETH’s price breaks above the $4,000 mark.

Ethereum price prediction: $4,500 retest only a matter of time?

Ethereum’s journey to having a listed ETF in the U.S. may have suffered a setback. However, its path toward reclaiming the $4,000 price level still appears unhindered, considering the growing bullish conviction observed in the ETH derivatives markets.

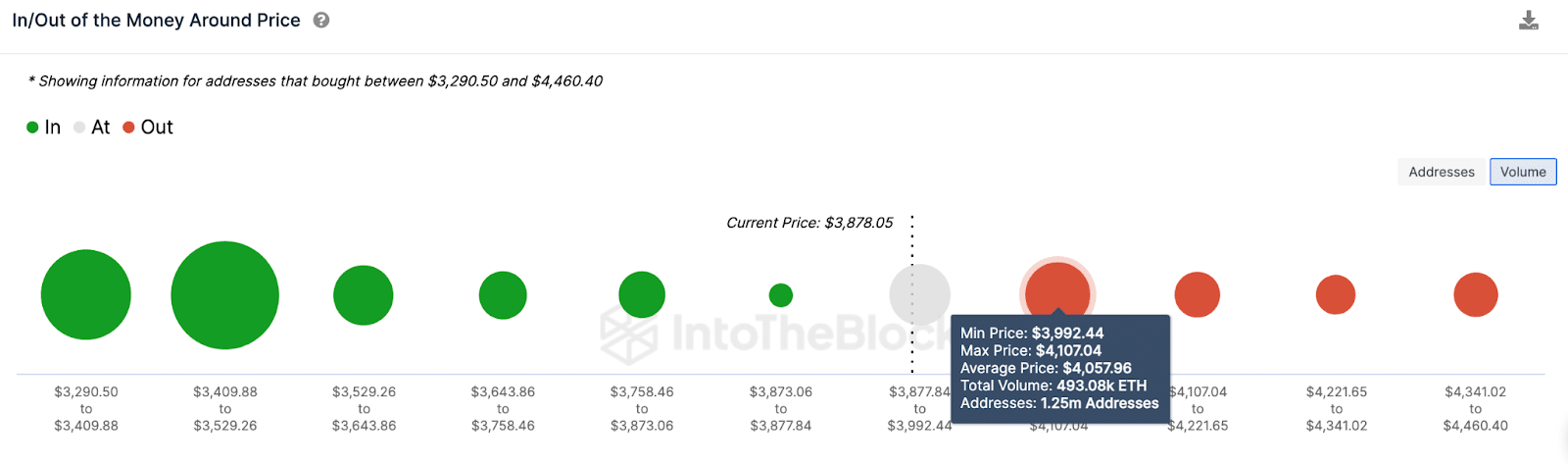

IntoTheBlock’s global in/out of money chart further affirms this stance: The latest price upswing on Mar. 6 effectively sent the percentage of profitable ETH holders above 97%.

Profitable holders are often reluctant to sell during a bullish market phase, hence, ETH is likely to maintain a relatively high support level above $3,500 as it consolidates before its next leg-up.

However, in the event of another bullish upswing, the bulls now have only the $3,992 resistance level to beat on its way to new peaks above $4,000.

As seen above, 1.3 million addresses had acquired 493,080 ETH at the minimum price of $3,992. Hence, if Ethereum’s price can establish a steady support level above that range, a move towards new peaks above $4,500 could be on the horizon as predicted.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Toncoin

Toncoin  Sui

Sui  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Pepe

Pepe  Polkadot

Polkadot  LEO Token

LEO Token  Stellar

Stellar  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  MANTRA

MANTRA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  dogwifhat

dogwifhat  Monero

Monero  Stacks

Stacks  Filecoin

Filecoin  OKB

OKB