In the volatile world of cryptocurrencies, Binance Coin (BNB) has emerged as a strong contender, decoupling from the market’s recent downturn. While other digital assets fell, BNB showcased resilience, demonstrating a price surge towards a critical level that could dictate its future trajectory in the days to come.

At the time of writing, BNB was trading at $318, reflecting a solid 10% increase over the past seven days. With a market capitalization exceeding $47 billion, BNB’s performance overshadowed its counterparts, capturing the attention of both investors and analysts alike.

Binance Coin On A Strong Ascent

Prominent crypto analyst Crypto Tony recently underscored BNB’s ascent, emphasizing the coin’s trajectory toward a key resistance zone. If BNB manages to breach the $355 level, there is a high likelihood that it could establish this zone as a new support level, bolstering its prospects for further upward movement.

Flip into support at $355.00 and i am into a position. Just holding tight for now pic.twitter.com/ZFhhbIZRWK

— Crypto Tony (@CryptoTony__) January 20, 2024

However, the path to higher levels is not without its challenges. A closer examination of BNB’s liquidation heat map reveals a substantial increase in liquidations near $320.

Moreover, several additional resistance zones loom in the near term, acting as potential hurdles on BNB’s journey to $355. These resistance levels include $320, $325, and $340, necessitating careful monitoring to gauge BNB’s ability to surmount them.

To gain further insights into BNB’s potential, a comprehensive analysis of the coin’s daily chart was conducted. The Chaikin Money Flow (CMF), which experienced a slight downtick following a sharp uptick, offers a mixed signal.

BNB market cap currently at $47.56 billion. Chart: TradingView.com

Simultaneously, BNB’s Bollinger Bands indicate a shift towards a less volatile zone, suggesting a potential slowdown in price growth. However, the MACD presents a more optimistic outlook, with the possibility of a bullish crossover on the horizon.

Binance Coin RSI Shows Strength

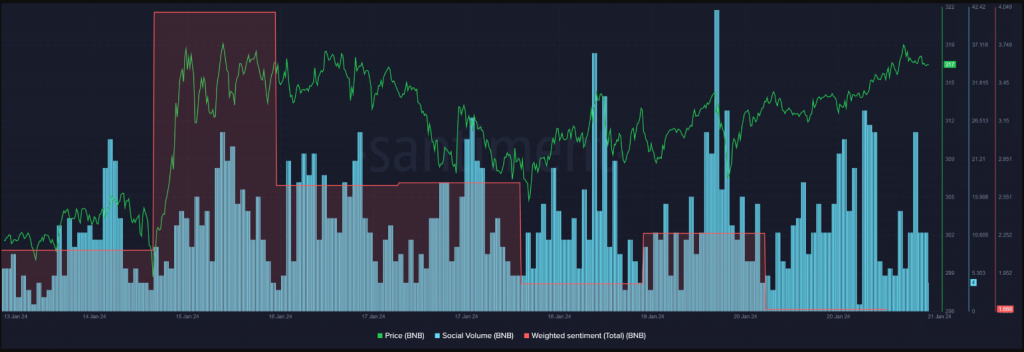

The Relative Strength Index (RSI) for BNB remains high, indicating a continued uptrend in its price. Notably, despite these positive market indicators, bearish sentiment remains dominant in the market, as evidenced by a significant drop in BNB’s weighted sentiment over the past seven days.

This dichotomy between market indicators and sentiment highlights the uncertainty and cautiousness surrounding BNB’s future prospects.

Source: Santiment

Nevertheless, BNB continues to maintain its popularity within the crypto space, boasting a high social volume. This sustained interest further underscores the coin’s potential and the attention it garners from enthusiasts and investors alike.

As cryptocurrency markets remain highly unpredictable, it is crucial for investors to exercise caution and conduct thorough research before making any investment decisions.

While BNB’s recent performance and positive indicators suggest potential upward movements, the presence of resistance zones and prevailing bearish sentiment warrant careful observation in the days ahead.

Featured image from Shutterstock

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Toncoin

Toncoin  Sui

Sui  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Pepe

Pepe  Polkadot

Polkadot  LEO Token

LEO Token  Stellar

Stellar  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  MANTRA

MANTRA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  dogwifhat

dogwifhat  Monero

Monero  Stacks

Stacks  Filecoin

Filecoin  OKB

OKB