The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

This week’s topics

- Monumental SEC failure

- Bitcoin ETF multiple

- German economic update

- Taiwan elections and China response

SEC’s 2FA Failure

Bitcoin is a great teacher. Many of us have learned so much, from studying and following Bitcoin over the years, not just about money but about life. Once again, Bitcoin provides us with a teachable moment in the hack of the SEC’s X/Twitter account. First, even if you are a normie in favor of heavily regulated markets, this event should open your eyes to the fact that the regulators have grown into a systemic risk themselves. They are a risk to the investors they are supposed to protect. The SEC is even in a battle at the Supreme Court battle over their in-house semi-judicial system.

Secondly, this scandal happened because the SEC didn’t use 2FA, months after warning everyone about the use of 2FA. This shocking incompetence might wake many out there and spread the use of 2FA — something long overdue.

The total damage based on the SEC’s failure was $30 billion wiped from the market cap with $90 million worth of open positions liquidated. Of course, the SEC did not apologize for their failure and will likely be facing legal consequences. Spicy take, this bitcoin-inspired scandal might result not only in us getting the ETFs approved, but also the SEC getting taken down a peg.

Bitcoin Market Cap Multiple of Inflows

Estimates of inflows on the bitcoin ETF’s first days of trading are expected to be massive. Issuers have publicly stated they are seeding their funds with $312.9 million so far. These are commitments by private players to immediately create shares to seed liquidity. This does not include other money from regular trading.

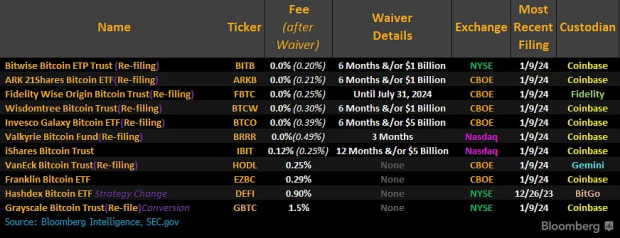

The fee structures submitted this week by issuers have clauses for introductory periods based on the inflow of assets under management. For example, ARK is offering a 0.0% management fee for the first 6 months or until $1 billion in AUM. Invesco is offering 0.0% for 6 months or $5 billion AUM. This means they expect those time periods and AUM to be a practical expectation. If we add up all these special fees discounts, we arrive at $13 billion of expected AUM growth in the first 6-12 months from 5 issuers alone. That does not mean inflows exactly because bitcoin bought earlier will appreciate adding to AUM.

Source: @JSeyff

The seeding funds are small potatoes compared to the total $25 trillion AUM of the issuers. If 1% were to come into the bitcoin ETFs over the first 12 months, that is $250 billion.

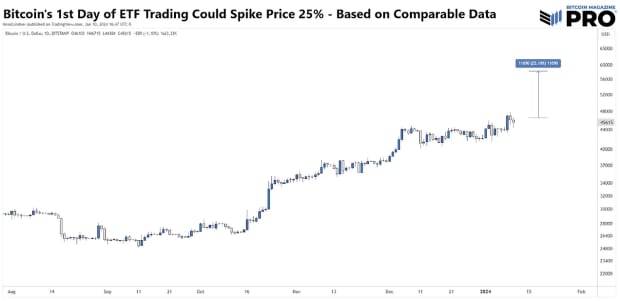

Back in 2021, near the ATH, Bank of America put out a study that bitcoin had a 118x multiplier on inflow to market cap appreciation. So, for every $1 million in fresh buying, the market cap would increase by $118 million. That multiplier relies on many different factors, like speed of inflow, number of available bitcoin on exchanges, and block reward. Bank of America made their estimate when there were 2.7 million BTC on exchanges, today there are only 1.8 million — or 607,000 when considering the major US exchanges Coinbase, Gemini and Kraken only. In other words, the multiplier could be greater than 118x this time.

The largest single ETF launch in history saw $2 billion of inflows. The bitcoin ETF event promises to be bigger than that because it is a group of 11 ETFs and is a new asset class. $2 billion is therefore conservative, but we’ll use it for our purposes here. $2 billion times 118 means $236 billion market appreciation on day one. The market cap at time of writing is $900 billion, meaning the first day move could be ~25%, taking us to $58,000.

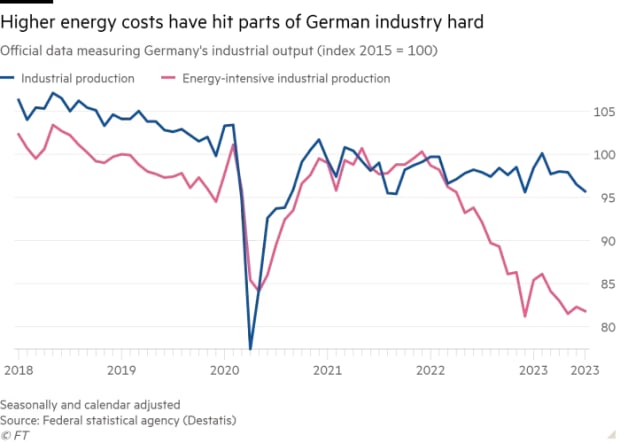

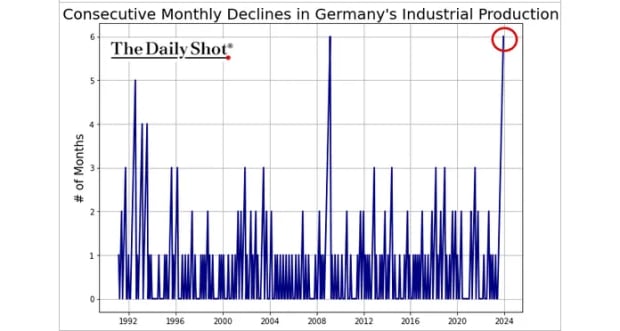

German De-industrialization

People think it can’t happen, that’s why it is happening. Some Germans are beginning to understand the effect of deglobalization on their economic model, and the effect that communist climate policies will have on heavy industry. Large companies like BASF, Linde, and Volkswagen all have plans to move out of Germany. Energy-intensive industrial production is being hit the worst. 2024 is going to be a massive recessionary year around the world.

Source: Financial Times

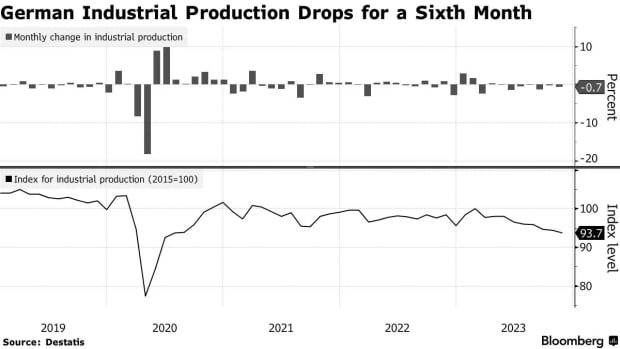

The latest number for November showed the sixth straight month of industrial production, the worst stretch since the Great Financial Crisis.

Source: Bloomberg

Source: @SoberLook

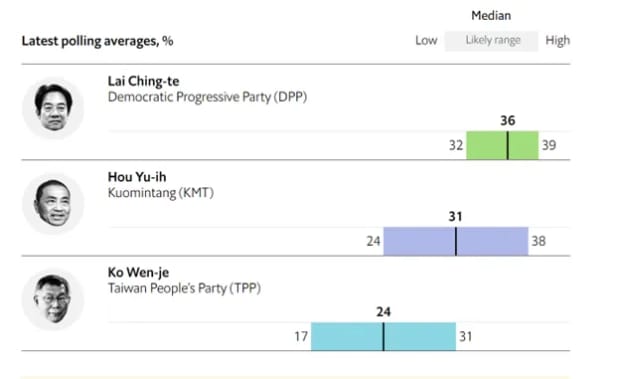

Taiwan Elections and China’s Economic Disaster

One of the most consequential elections this year is happening Saturday in Taiwan. As it stands, it is a three-way race for president with the more anti-China Democratic Progressive Party, Lai Ching-te, as the front-runner. He is friendly to the US and will be a thorn in the side of the CCP. Certainly, China has invested heavily in stopping him and spreading propaganda within Taiwan. Despite this, the anti-China candidate is still favored.

Source: NHK Japan Broadcasting Corporation

Source: Fulcrum Asset Management

This election has global consequences as you can imagine. In an article yesterday on Bloomberg, they highlighted the possibility that the election of Lai could lead directly to conflict with China and potentially cost the global economy $10 trillion.

This is also happening as the Chinese economy is falling apart. Their blue-chip stock market CSI 300, recently hit 5-year lows, standing in stark contrast to the US stock markets rallying to near ATHs.

Source: Yahoo Finance

Last but not least, the foreign direct investment (FDI) numbers for 2023 have come out and they are a total disaster. Money is fleeing China at the fastest pace in modern history. All this is to say that the election in Taiwan and the economic pressures in China could move the world closer to conflict over Taiwan.

Source: @Geo_papic

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Pepe

Pepe  Polkadot

Polkadot  Stellar

Stellar  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  MANTRA

MANTRA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  dogwifhat

dogwifhat  Arbitrum

Arbitrum  Monero

Monero  Stacks

Stacks  OKB

OKB  Filecoin

Filecoin