The derivatives market for Bitcoin (BTC) and Ethereum (ETH) experienced significant fluctuations following the incident on Jan. 9, where the U.S. Securities and Exchange Commission’s (SEC) Twitter account was compromised. This false announcement of a spot Bitcoin ETF approval led to a series of market reactions that wiped out over $50 billion in Bitcoin’s market capitalization.

The derivatives market saw unprecedented volatility. CryptoSlate’s analysis of CoinGlass data showed an increase in overall trading volume by 8.52% to $79.02 billion. This rise in trading activity likely reflects the market’s rapid response to the fake news, as traders either sought to capitalize on the volatility or mitigate their risks.

However, this was contrasted by a 2.78% decrease in open interest, bringing it down to $19.69 billion. The decrease in open interest, representing the total number of outstanding derivative contracts, suggests that many traders were closing their positions amid the uncertainty, preferring to reduce exposure rather than engage in a highly volatile market.

While Bitcoin options volume saw a considerable drop of 39.73% to $625.97 million, the options open interest slightly increased by 2.18% to $10.24 billion. This indicates that while there was a reduction in the trading of options contracts, a number of traders held onto their positions. This could be due to a strategy to wait out the market’s fluctuations or a belief in longer-term trends unaffected by short-term volatility.

The market witnessed $95.41 million in liquidations, with long positions accounting for $59.39 million and shorts for $36.02 million. The higher liquidation of long positions suggests a bearish market reaction, where traders betting on a price increase were caught off-guard by the drop in prices following the clarification of the ETF news.

Looking into Binance and Bybit, the two largest exchanges by open interest, we see both platforms experiencing an increase in trading volume, indicating heightened activity. The decrease in open interest on these platforms further corroborates the trend of traders choosing to close positions in a volatile environment.

| Symbol | Price | Price (24h%) | Volume (24h) | Volume (24h%) | Market Cap | Open Interest | Open Interest (24h%) | Liquidation (24h) |

|---|---|---|---|---|---|---|---|---|

| BTC | $44911.2 | -4.01% | $77.66B | +5.23% | $884.97B | $19.66B | -3.59% | $94.36M |

| ETH | $2375.65 | +4.47% | $41.18B | +77.57% | $285.82B | $7.78B | +10.67% | $49.30M |

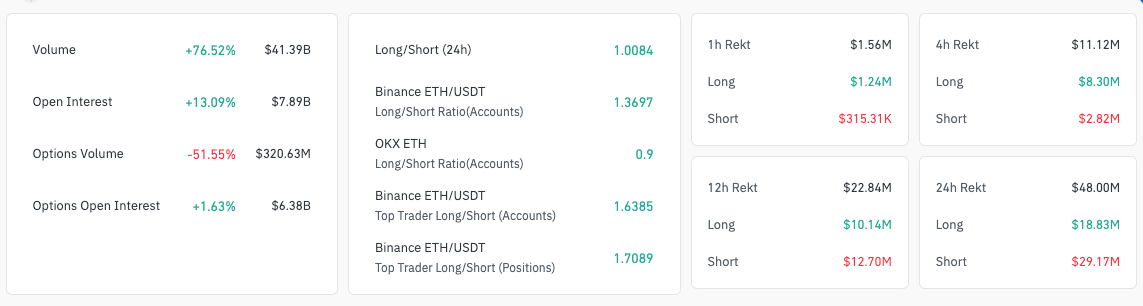

Turning to the Ethereum derivatives market, the situation presents a different picture. The total trading volume for Ethereum derivatives surged dramatically by 79.85% to $41.30 billion. This substantial increase in volume could be attributed to traders pivoting towards Ethereum amid the Bitcoin turbulence or perceiving Ethereum as a safer or more lucrative option during this period of heightened market sensitivity.

Interestingly, despite this surge in overall trading volume, the options volume for Ethereum derivatives decreased significantly by 51.55% to $320.63 million. This disparity suggests that while there was a general increase in trading activity, the options market saw a withdrawal.

Traders might have been more inclined to engage in futures contracts, viewing these as more direct ways to capitalize on or hedge against the market volatility rather than dealing with the complexities of options trading in such uncertain conditions.

Open interest in Ethereum also increased by 11.52% to $7.81 billion, contrasting with the pattern observed in Bitcoin. This indicates new positions being opened, which, combined with the increase in trading volume, suggests a more bullish sentiment in the Ethereum market, or at least a perception of Ethereum as a more stable asset in the face of market shocks.

The post Ethereum takes the lead over Bitcoin in derivatives trading volume appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Toncoin

Toncoin  Stellar

Stellar  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Sui

Sui  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Litecoin

Litecoin  Uniswap

Uniswap  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Render

Render  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Bittensor

Bittensor  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  Stacks

Stacks  Dai

Dai  Arbitrum

Arbitrum  Bonk

Bonk  Filecoin

Filecoin  Cosmos Hub

Cosmos Hub  OKB

OKB  Celestia

Celestia