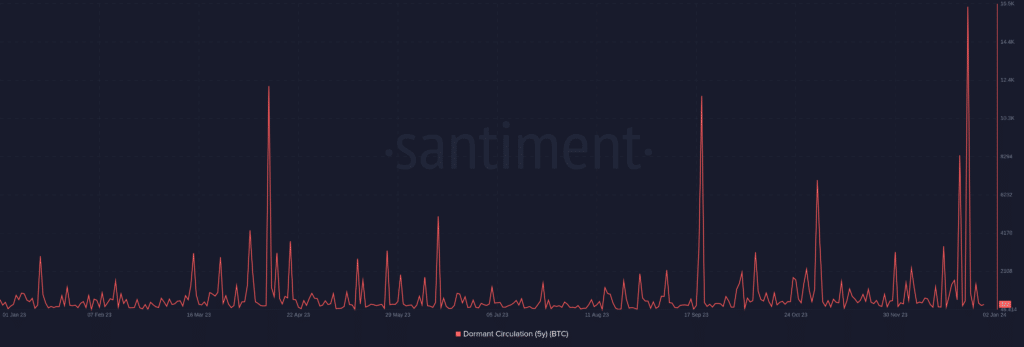

Despite market enthusiasm, the amount of Bitcoin lying dormant in digital wallets is hovering at low levels.

Low dormant Bitcoin (BTC) levels are a potential warning sign for the cryptocurrency. The reason is that spikes in dormant Bitcoin usually preceded rallies, given that dormant Bitcoin is not being sold, effectively resulting in a lower circulating supply. Long-term investors have likely decided to take profit amid ongoing market enthusiasm.

Only 1,832 BTC have gone without spending over the past two years, down sharply from over 30,000 in late December, according to data from the blockchain analytics firm Glassnode. Such low dormancy levels for the world’s largest cryptocurrency frequently precede major price swings.

When dormancy runs high, it suggests Bitcoin holders believe they’re better off doing nothing with their stash. Low dormancy levels indicate more holders are on the move, possibly to sell or trade. The number of Bitcoins lying untouched for five years has also declined, from almost 16,400 in December to around 300.

Bitcoin is also currently trending on social media, with Santiment indicating that it has topped its social dominance chart, responsible for 3.5% of all the detected crypto-related social media posts. The summary of the trend suggests that it is mostly discussed in anticipation of the approval of a spot Bitcoin exchange-traded fund by the United States Securities and Exchange Commission (SEC) — which apparently many long-term holders have seen as an occasion to sell high.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Sui

Sui  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Litecoin

Litecoin  Aptos

Aptos  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Internet Computer

Internet Computer  Cronos

Cronos  USDS

USDS  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Render

Render  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Bittensor

Bittensor  Ethena USDe

Ethena USDe  Arbitrum

Arbitrum  Cosmos Hub

Cosmos Hub  WhiteBIT Coin

WhiteBIT Coin  Bonk

Bonk  Filecoin

Filecoin  Dai

Dai  MANTRA

MANTRA  dogwifhat

dogwifhat  OKB

OKB