Gemini Payments, an affiliate entity of crypto exchange Gemini led by billionaire investor twins Cameron and Tyler Winklevoss, has been granted an electronic money (e-money) operator license by the Central bank of Ireland.

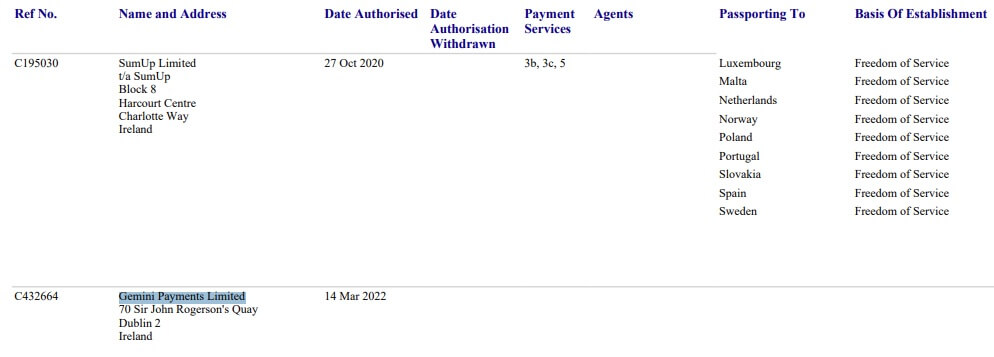

According to the regulator’s records, the corresponding application was approved on March 14, allowing Gemini Payments Limited “to issue e-money in accordance with the European Communities (Electronic Money) Regulations 2011, as amended (EMR).”

In total, there are now 18 institutions with such a license in Ireland. Other well-known major companies, including Stripe, Facebook, and Google, have also obtained similar permits in the past.

Per the The Irish Times’ report, Gemini first applied for the e-money license in early 2020. Last year, the company opened an office in Dublin and hired Gillian Lynch, a former chief strategy officer at financial services provider Leveris, to lead it.

“Gemini doesn’t provide services in Ireland [yet] but residents in other member states can open accounts,” Peter Oakes, a former Central bank enforcement director and founder of Fintech Ireland, told the outlet.

“An interesting play for Gemini”

Further, the combination of an e-money license and a virtual asset services provider [VASP] registration “should provide Irish consumers and corporates a fuller range of Gemini’s digital assets and non-fungible tokens service such as buying and selling, interest on accounts, payments, credit cards and e-wallets,” he added.

Notably, there are no officially registered VASPs in Ireland at the moment, according to the Central bank’s registry.

“An interesting play for Gemini in Ireland could be institutional wealth management and custody. Many large financial institutions, especially U.S. banks operating in Ireland, have a strong interest in digital assets for both themselves and their clients,” Oakes inferred. “They generally segregate their trading and investment activities from the very specialized but fairly lucrative pricing and custodial responsibilities of digital assets.”

As CryptoSlate reported, countries across the globe continue to embrace cryptocurrencies. Just yesterday, the Government of Malaysia proposed to adopt Bitcoin and other digital assets as legal tender.

Get your daily recap of Bitcoin, DeFi, NFT and Web3 news from CryptoSlate

Get an Edge on the Crypto Market 👇

Become a member of CryptoSlate Edge and access our exclusive Discord community, more exclusive content and analysis.

On-chain analysis

Price snapshots

More context

Join now for $19/month Explore all benefits

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Toncoin

Toncoin  Sui

Sui  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Pepe

Pepe  Polkadot

Polkadot  LEO Token

LEO Token  Stellar

Stellar  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  MANTRA

MANTRA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  dogwifhat

dogwifhat  Monero

Monero  Stacks

Stacks  OKB

OKB  Filecoin

Filecoin