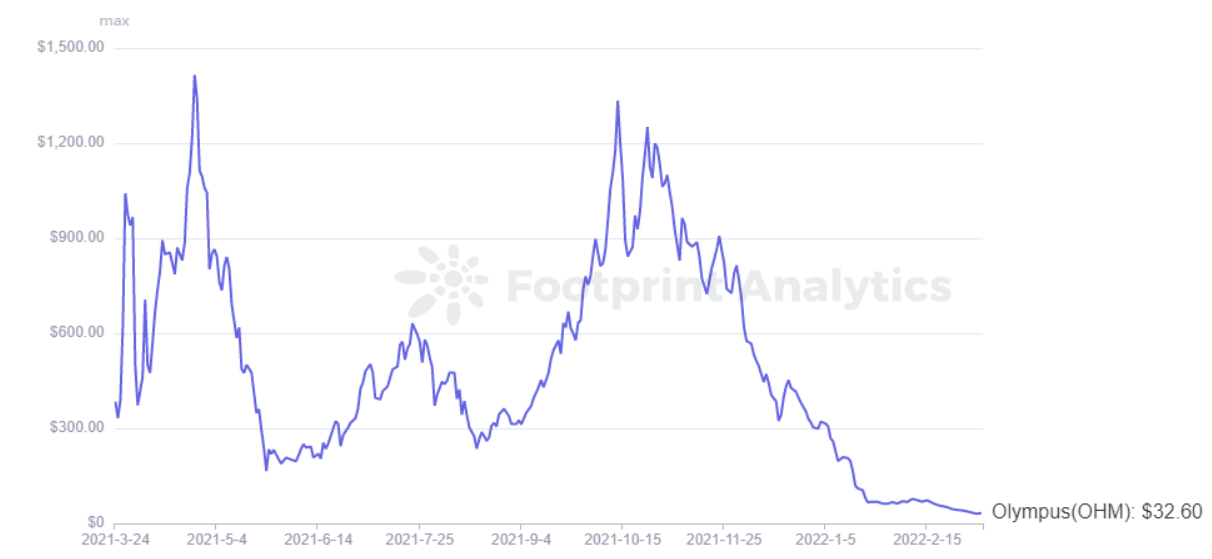

Olympus DAO was hit hard by the recent market sell-off, with OHM trading as low as $32 on March 9, down 97.7% from its all-time high of $1,415 set last April.

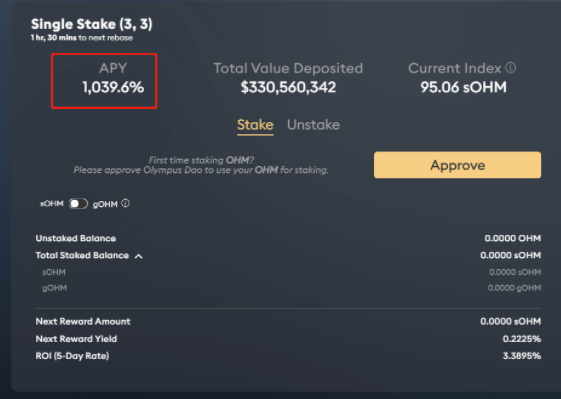

Olympus DAO is a decentralized reserve currency protocol, which will automatically issue OHM based on the value of the cryptocurrency. As of the end of October, staking OHM was over 8,000% APY, and is currently at 1,039%. However, both its TVL and token prices have plummeted in the face of such high APY.

What stopped OHM from continuing to grow?

Olympus DAO Controls Its Own Liquidity

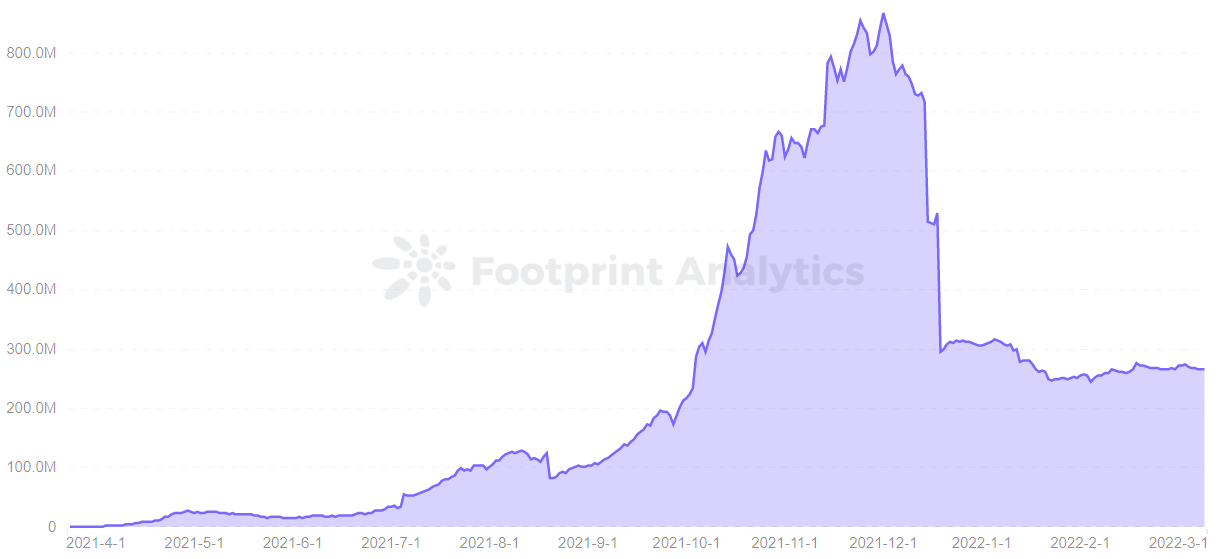

According to Footprint Analytics data, Olympus DAO reached a peak TVL of $860 million by attracting users to stake and create LP tokens at over 1,000% APY. However, due to the market sell-off, TVL has fallen straight down to an equilibrium state and currently stands at $260 million, a 70% drop.

Olympus DAO is the first protocol to use a bond mechanism to create an alternative to the “liquidity mining” model, providing liquidity by issuing OHM at a discount and creating LP tokens, creating the concept of “protocol-owned liquidity”.

Olympus DAO supports three types of user actions: staking, bond buying, and selling.

Bond purchases are a unique mechanism of the Olympus DAO that allows users to purchase discounted OHM from the treasury by backing assets such as wETH and DAI. However, getting the discounted OHM requires paying the corresponding value of treasury assets such as wETH and DAI, and requires a waiting period of 2 to 5 days to fully obtain the purchased OHM.

In addition to treasury-backed assets, users can also pay LP tokens in exchange for discounted OHM, typically liquidity pair tokens associated with OHM, such as OHM-DAI LP. With stablecoins forming the LP token, this ensures that the treasury can control most of the liquidity and earn a fee by way of the LP token.

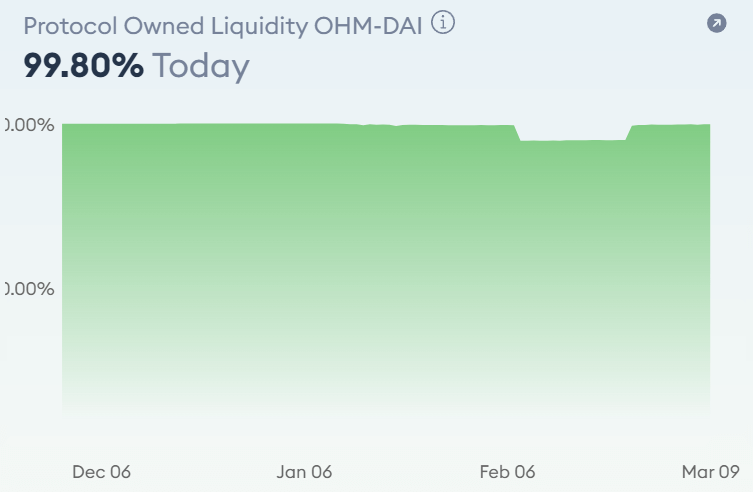

As a result, the capture of LP tokens and the stake function of OHM allow Olympus DAO to capture 99.8% of OHM liquidity.

Adopting the Prisoner’s Dilemma Model of Game Theory

The Olympus DAO attracts a large number of users because of its (3,3) economic model, which comes from the famous “Prisoner’s Dilemma” model of game theory.

The three behaviors of stake, bond, and sell design a (3,3) economic model. When all users participate in the stake, it can achieve a win-win effect for users and the protocol, that is the state of (3,3). However, the reason why users are willing to buy and stake OHM is due to its high staking income.

When obtaining OHM by purchasing bonds, users will pay assets such as wETH, DAI, and FRAX to increase Olympus’ treasury funds to support the value of OHM. The growth of the Olympus DAO treasury combined with the agreement to control 99.8% of OHM, then the OHM of the inherent 1 DAI can have a market price that is hundreds or even thousands of times higher.

A higher APY would also mean a higher premium, which would lead to a large amount of OHM as an incentive for inflationary output. At the same time, there will be a lot of OHM mining and selling operations in the market, and the price of OHM and the pledged APY of the agreement will also decrease. In the worst case, it may fall to a (-3,-3) phase. This means a corresponding loss for both Olympus DAO and users.

In this model, users who enter at the right time can earn high short-term returns, but the greedy tokenomics created with the APY can also be driven by human nature. Therefore, high returns are not maintained for a long time.

OHM Prices Are Free Floating and Determined by the Market

The price of OHM is backed by DAO’s treasury assets (such as wETH, DAI, and FRAX). Underlying logic:

- When the price of OHM rises, the protocol pushes down the price by issuing additional OHM.

- When the OHM price drops, the agreement will buy back and destroy the OHM, pulling the price back up.

As clear from the Footprint Analytics chart, OHM is highly volatile. Two peaks of over $1,100 were recorded, but as of March 9, the price was at an all-time low of $32.60.

An analysis of the main upside and downside factors through OHM’s coin price movements.

OHM price increases:

- Olympus has introduced a bond feature that allows users to buy discounted OHM to form LP tokens and earn between super 1000% and 8000% APY.

- The rewards earned by users are compounded 3 times a day, accelerating the growth of the asset pool.

OHM prices fall:

- More users staking OHM will also cause OHM prices to fall.

- OHM’s prices are largely maintained by new purchasers.

- There is currently no practical use for OHM—the demand for OHM comes from users who want to use OHM to obtain high APY and provide liquidity for OHM trading pairs, pegging their LP tokens to discounted OHM.

- On January 17, a whale sold off 82,526 OHM coins (worth $13.3 million at the time), triggering a drop to a new low.

In contrast to the Lido stake protocol, where users do not need to lock in tokens such as ETH or LUNA to receive a stake reward at a 1:1 price for stETH or stLUNA, the reward for staking wETH or DAI at Olympus is OHM, which is still very risky as the price of OHM is highly dependent on market factors.

Summary

Still, in its early stages, Olympus DAO leads the project with a (3,3) model that requires users to participate together in placing bets, and it only makes sense if there are no rebels among all OHM stakers.

It is, therefore, more difficult to create a dynamic and balanced trend in an ever-changing cryptocurrency market. And users who want a high APY need to take a higher risk.

Date and Author: Mar. 2022, Vincy,

Data Source: Footprint Analytics – Olympus DAO Dashboard

This piece is contributed by the Footprint Analytics community.

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.

What is Footprint Analytics?

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Get your daily recap of Bitcoin, DeFi, NFT and Web3 news from CryptoSlate

It’s free and you can unsubscribe anytime.

Get an Edge on the Crypto Market 👇

Become a member of CryptoSlate Edge and access our exclusive Discord community, more exclusive content and analysis.

On-chain analysis

Price snapshots

More context

Join now for $19/month Explore all benefits

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Chainlink

Chainlink  Polkadot

Polkadot  Pepe

Pepe  Stellar

Stellar  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  MANTRA

MANTRA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  dogwifhat

dogwifhat  Arbitrum

Arbitrum  Monero

Monero  Stacks

Stacks  OKB

OKB  Filecoin

Filecoin