Join Our Telegram channel to stay up to date on breaking news coverage

Insidebitcoins provides investors with a curated list of the best digital tokens to explore. With these tokens, investors can capitalize on the market’s upward trend.

The recent data update shows that the global cryptocurrency market capitalization is $1.16 trillion. Thus reflecting a 2.67% increase over the past 24 hours. During the same period, the total trading volume in the crypto market amounted to $35.88 billion, marking a 14.15% decrease.

Notably, the decentralized finance (DeFi) sector contributed $4.01 billion to this trading volume, comprising 11.17% of the total crypto market 24-hour volume. Stablecoins also played a significant role, with a combined trading volume of $32.26 billion, representing 89.91% of the total crypto market 24-hour volume.

7 Best Altcoins to Invest in Right Now

Bitcoin’s market dominance currently stands at 51.47%, reflecting a modest increase of 0.12% over the day. These figures provide a snapshot of the recent developments in the cryptocurrency market, indicating both overall growth and the specific contributions of DeFi and stablecoins to the trading landscape.

1. Maker (MKR)

The Maker Protocol has recently reported a significant milestone, achieving an annualized revenue of $203 million. This success can be attributed to the influence of rising U.S. treasury yields throughout the year.

Furthermore, Maker’s stablecoin, DAI, has witnessed a surge in its supply, reaching a yearly high of $5.6 billion. Another contributing factor to this accomplishment is the growing deposits of real-world assets (RWA), which have reached a substantial $3 billion.

Moreover, yield opportunities have played a crucial role in driving the growth of Maker’s stablecoin, DAI. This growth is mainly due to the DAI Savings Rate (DSR) mechanism, operated by the Spark Protocol. Hence offering DAI holders an annual yield rate of 5%.

⚡️ @sparkdotfi has launched its brand-new website.

Explore Spark’s purpose and solutions as a community-built DeFi infrastructure, sustained by the Spark SubDAO.

Check it out → https://t.co/yzR9qjm823 pic.twitter.com/p6fcJNIsvE

— Maker (@MakerDAO) October 18, 2023

This mechanism has significantly increased the demand for DAI, resulting in a fivefold expansion of the sDAI supply since August. As such, SDAI now constitutes 31.3% of DAI’s total supply, equivalent to $1.7 billion.

2. Avalanche (AVAX)

Avalanche’s price performance has breached the $10.15 resistance level, propelled by a consistent accumulation of buyers. AVAX has undergone a somewhat turbulent price journey, ultimately falling below $10.15. However, the sustained influx of buyers during trading helped breach the resistance level. In addition, increased buying was essential in AVAX experiencing this upward trajectory.

In recent data, Avalanche’s price was $10.30, registering a 2.93% increase in its market capitalization during the intraday trading session. Trading volume also surged within the same session, indicating active buyer participation. Likewise, the volume-to-market cap ratio is 3.11%, reflecting the cryptocurrency’s liquidity.

According to the AVAX price prediction, the maximum expected price for AVAX by the end of 2023 is approximately $21.83. This projection assumes a scenario without major bearish market events and anticipates an average price of around $17.64 for AVAX in 2023.

SK Planet subsidiary and Korean entertainment giant Dreamus is launching a ticketing platform powered by Avalanche and SK Planet’s UPTN Subnet.

Let’s take a look at why this is a big win for blockchain ticketing and real world use cases 🎟️🔺 pic.twitter.com/f9JVKsxoaT

— Avalanche 🔺 (@avax) September 21, 2023

Furthermore, if the cryptocurrency market witnesses a downtrend, the minimum price for Avalanche Coin in 2023 could decline to $15.49. However, the analysis suggests a potential for a bullish rally in the crypto market, leading to a substantial price increase.

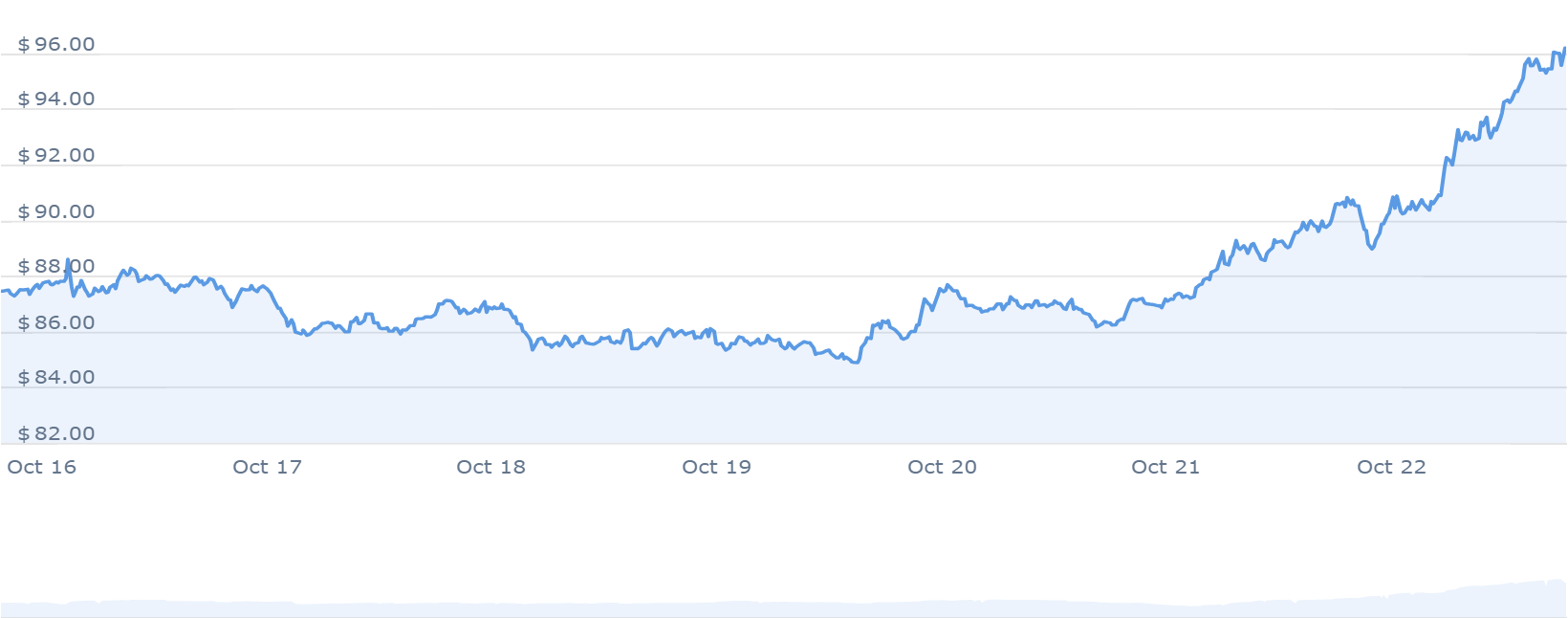

3. Quant (QNT)

Quant aims to enhance interoperability between diverse blockchain networks and applications through the Overledger operating system. Overledger acts as a bridge, overcoming the long-standing challenge of seamless integration between various blockchain projects. Thus enabling blockchain-based projects to interact efficiently.

Moreover, Overledger is a gateway to facilitate connectivity between blockchain-based projects and applications. It fosters intra-blockchain ecosystem connectivity and interconnectivity with different blockchain networks. This connectivity encompasses well-established blockchain networks like Ethereum.

Furthermore, Quant’s approach is structured around creating distinct layers, each catering to different levels of interaction. These layers include transactions, messaging, filtering, and ordering.

Wishing all the delegates at @money2020‘s #Money2020USA a great few days ahead.

The future of money, and particularly #payments, is a topic we’ve given a lot of thought to.

Here is our founder and CEO @gverdian on central bank digital currencies:https://t.co/upjccb38O6

— Quant (@quant_network) October 22, 2023

Likewise, it encompasses an application for sharing and referencing identical messages associated with other applications. This layered framework is designed to provide a comprehensive solution for blockchain interoperability.

According to the analysis, the maximum price projection for Quant is approximately $213.91. Furthermore, a more conservative estimate places the average price of QNT at around $188.74 by 2023.

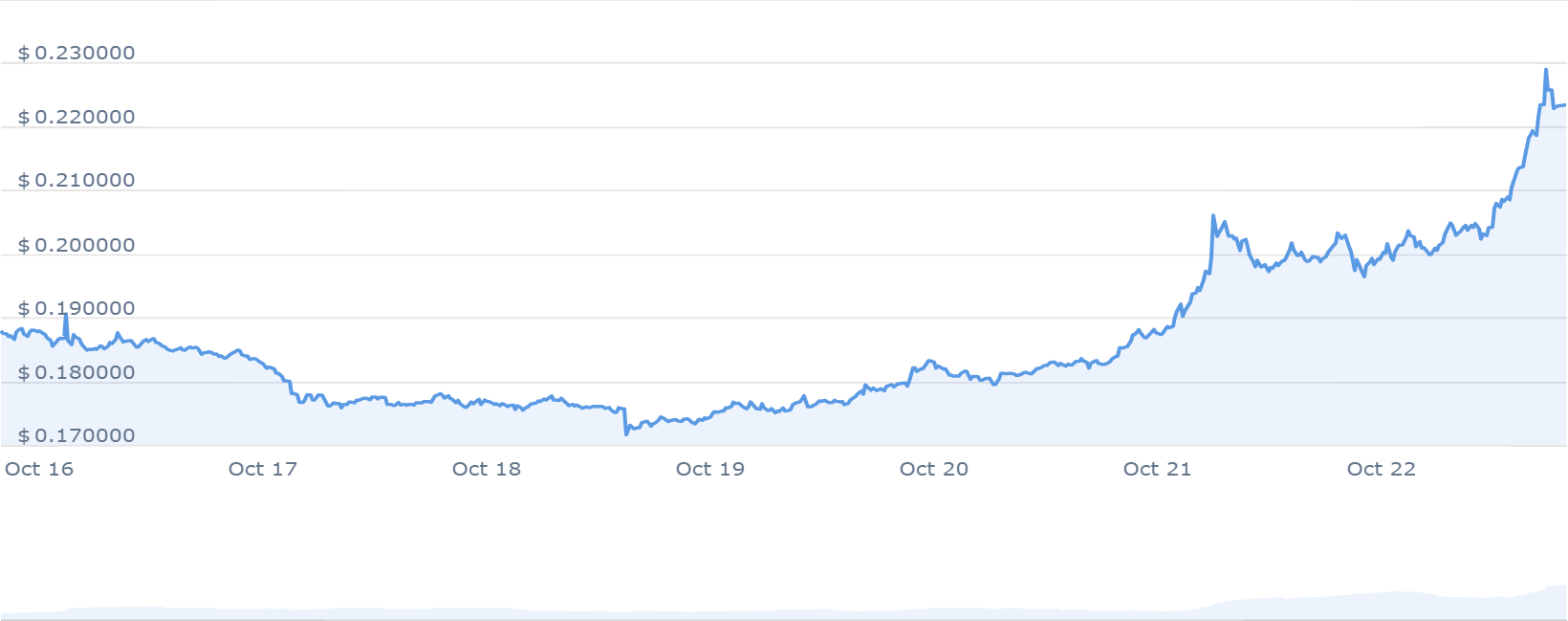

4. Fantom (FTM)

Fantom is a blockchain platform that operates on a Directed Acyclic Graph (DAG) structure and utilizes its proprietary consensus mechanism, Lachesis. Its primary mission is to provide developers with decentralized finance (DeFi) services.

FTM, the platform’s native PoS token, is the backbone for transactions, allowing for fee collection, staking activities, and user rewards. Furthermore, it enables swift and cost-effective transactions. As such, users can also engage in on-chain governance by utilizing FTM tokens for voting.

One feature of Fantom is its claim to significantly enhance transaction speed, reducing it to less than two seconds. This aligns with its goal of being a fast, secure, and cost-efficient payment platform for various applications, including DeFi.

Fantom aims to attract developers interested in deploying decentralized solutions, positioning itself as a competitor to Ethereum. The project’s mission is to achieve compatibility between all global transaction systems.

> Go to @FantomFDN X

> Click the bell icon

> Notifications ON

> Don’t miss news

> 10.24.23

> Simple!— Fantom Foundation (@FantomFDN) October 20, 2023

Regarding price predictions, it’s anticipated that the maximum price for Fantom will remain near $1.12 as the broader crypto market regains its value. However, in the event of a significant bearish trend in the crypto market, the minimum price could drop to $0.84 by 2023.

5. Launchpad XYZ (LPX)

Launchpad XYZ, a blockchain startup, has set its sights on a pivotal role in the Web 3.0 investment landscape. Their core objective is to empower crypto investors, newcomers, and experienced traders with valuable information to facilitate well-informed decisions.

Gain an edge in the #Crypto markets with #LaunchpadQuotient! 🔥

Our #LPQ leverages over 400 data points so you can make smarter decisions 🔥#LPQInsights #Trading #Web3 pic.twitter.com/zx3v7JkFyp

— Launchpad.xyz (@launchpadlpx) October 22, 2023

Launchpad XYZ allows investors to leverage opportunities in a bullish market with an enticing offer of a 12% bonus on LPX tokens. However, the ongoing bonus is limited to two days before it ends. Furthermore, LPX tokens can be acquired using USDT during this presale, with each investment yielding LPX tokens in return.

The presale has successfully raised a substantial amount, totaling $1,928,302.29. Also, the current exchange rate values 1 LPX token at 0.0445 USDT, providing investors with a clear financial overview.

In addition to the investment opportunity, Launchpad XYZ offers a range of investor benefits. These include access to the Launchpad XYZ platform and exclusive privileges such as priority access to trading signals, guides, newsletters, etc.

6. Gnosis (GNO)

In recent developments within the decentralized finance (DeFi) sector, the Gnosis chain Total Value Locked (TVL) has experienced an increase. According to data from DeFiLlama, the TVL on the Gnosis chain has grown by 92% over the past month, surpassing the $150 million milestone. This surge can be attributed to the recent launch of sDAI, attracting approximately $50 million in assets.

In addition, the introduction of sDAI on the Gnosis chain has garnered attention within the DeFi community. Thus allowing users to generate interest and actively engage in the DeFi ecosystem.

Moreover, the increased Gnosis chain TVL indicates a growing confidence in DeFi as a viable financial ecosystem. Data from DeFiLlama underscores the rapid adoption and heightened interest in sDAI. This suggests that more users are diversifying their portfolios and exploring the DeFi landscape for new opportunities.

https://t.co/3hzrLqlLw0

— GnosisDAO (@GnosisDAO) October 12, 2023

In the evolving DeFi landscape, Gnosis’s sDAI is well-positioned to be at the forefront of this transformation. Its competitive interest rates and robust integration with MakerDAO make it an option for those looking to enter the DeFi space or expand their portfolios.

7. Solana (SOL)

According to data from DeFiLlama, Solana’s DeFi sector has registered a 12.2% increase, reaching $20 million within the last 24 hours. This development has positioned Solana as the ecosystem with the highest Total Value Locked (TVL) increase among the top 10 ecosystems. Thus surpassing competitors like Binance Smart Chain (BSC), Ethereum, and Polygon.

Notably, this surge in TVL reflects Solana’s substantial growth, amounting to over 40% since its recorded value of $210 million on January 1. Also, the uptick in TVL can be attributed to investors’ growing interest in the DeFi ecosystem facilitated by Solana.

Furthermore, strategic partnerships orchestrated by the Solana team have played a pivotal role in attracting investor attention. The team forged notable collaborations with prominent entities such as Visa and Shopify during the current year.

Blockchains should be accessible, fast, and frictionless.

Hear from the co-founders of @orca_so, @rawfalafel & @oritheorca, about how Solana’s low latency and high throughput enables them to focus on building their product 🐋#OnlyPossibleOnSolana pic.twitter.com/3OL5pQJ1hW

— Solana (@solana) October 20, 2023

Solana’s performance has remained consistently positive, aligning with the general trends in the cryptocurrency market. Over the past seven days, SOL has witnessed a significant increase of 33.9%, surpassing the $30 threshold. The token currently trades at $30.40, reflecting an intraday gain of 4.01%. This consistent growth underscores the increasing investor interest in Solana and its DeFi ecosystem.

Read More:

New Crypto Mining Platform – Bitcoin Minetrix

- Audited By Coinsult

- Decentralized, Secure Cloud Mining

- Earn Free Bitcoin Daily

- Native Token On Presale Now – BTCMTX

- Staking Rewards – Over 1,000% APY

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Toncoin

Toncoin  Sui

Sui  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Pepe

Pepe  Polkadot

Polkadot  LEO Token

LEO Token  Stellar

Stellar  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  MANTRA

MANTRA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  dogwifhat

dogwifhat  Monero

Monero  Stacks

Stacks  OKB

OKB  Filecoin

Filecoin