Quick Take

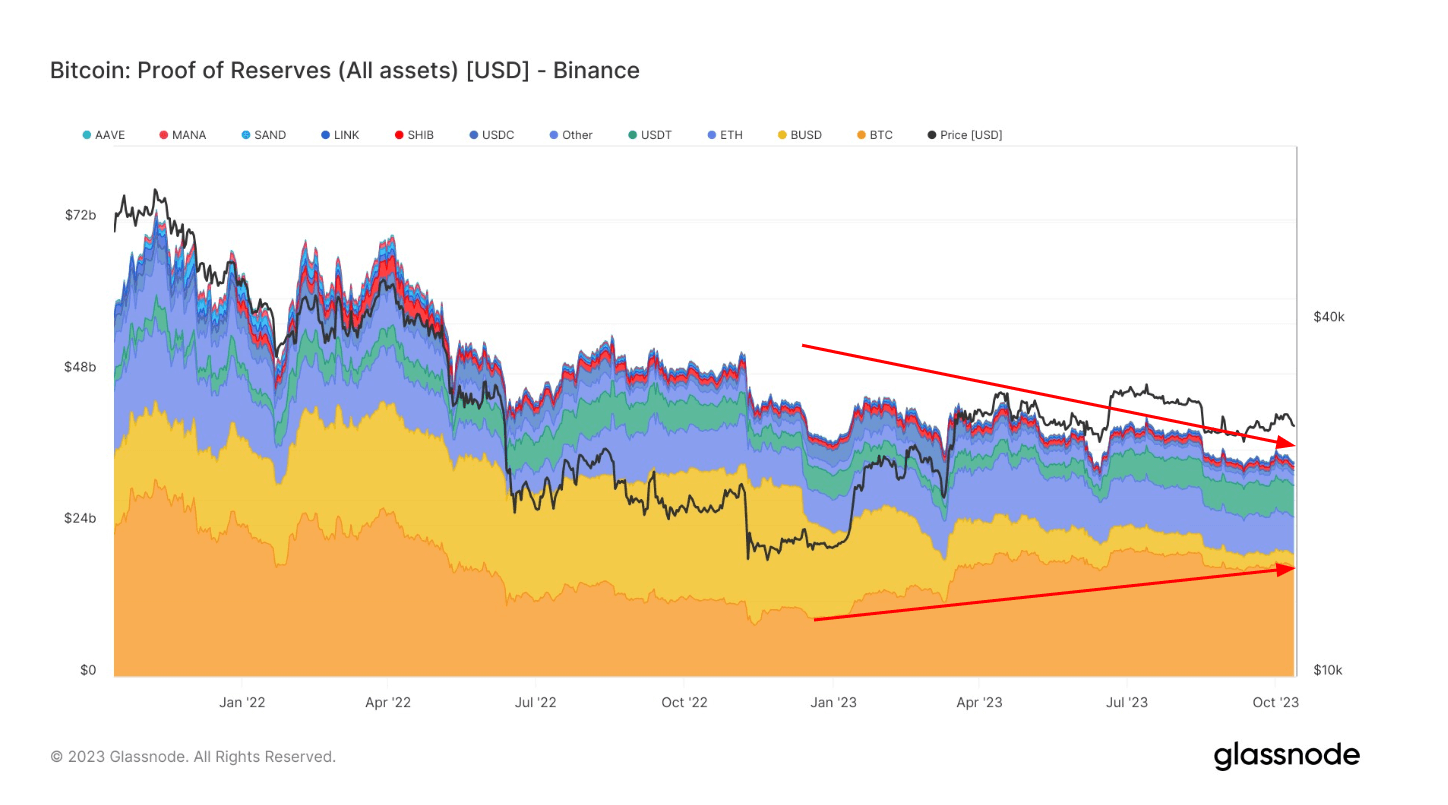

Year-to-date data for 2023 reflects significant shifts in Binance’s proof of reserves, an official disclosure of the exchange’s on-chain assets.

Bitcoin, buoyed by a 60% appreciation, has seen Binance reserves double from $9.4 billion in January to $17.5 billion in October. This surge has boosted Bitcoin’s share in Binance’s reserves from 27% at the start of the year to approximately 50% by October.

However, there has been a steep decline in BUSD, Binance’s proprietary stablecoin, whose reserves have plummeted from $13 billion to $2 billion. Ethereum reserve figures remained relatively stable, increasing slightly from $5.4 billion to $5.9 billion, despite the cryptocurrency appreciating 30% year-to-date. The Tether (USDT) reserves have grown from $3.8 billion to $5 billion, contrasting sharply with USD Coin (USDC), which tumbled from $2.6 billion to a mere $720,000.

This observation is backed up by Andre Dragosch, the Head of Research at Deutsche Digital Assets, who noted a paradoxical trend: While Bitcoin rallied by 80% since November 2022, there has been a noticeable decline in overall crypto reserve assets during the same period.

These shifts underline a clear trend: Bitcoin is becoming an increasingly dominant reserve for Binance amidst varied market dynamics.

The post Binance Bitcoin reserves double, while proprietary stablecoin BUSD plummets in 2023 appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Shiba Inu

Shiba Inu  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Chainlink

Chainlink  Polkadot

Polkadot  Pepe

Pepe  Stellar

Stellar  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Cronos

Cronos  USDS

USDS  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Render

Render  Bittensor

Bittensor  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  MANTRA

MANTRA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  dogwifhat

dogwifhat  Arbitrum

Arbitrum  Monero

Monero  Stacks

Stacks  Filecoin

Filecoin  OKB

OKB