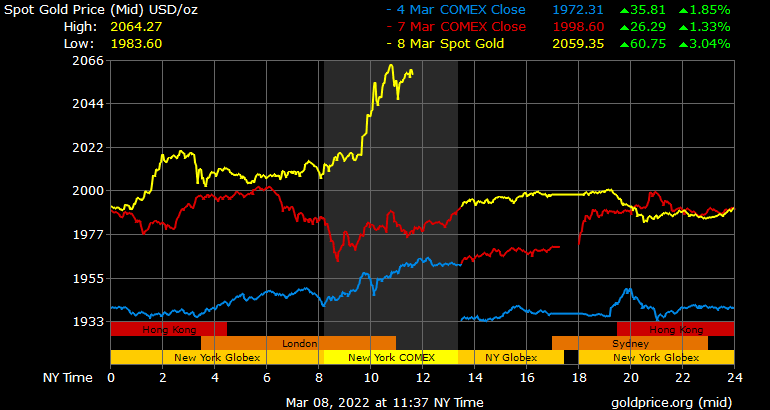

On Tuesday, the price of gold soared to new heights as an ounce of the precious metal surpassed $2K per ounce during the early morning trading sessions (EST). Hours later, gold tapped a high of $2,064.27 per ounce as the Russia-Ukraine war and global commodities surge has fueled demand.

Gold’s Value Surges Higher Amid Commodities Boom

Gold is exchanging hands for prices not seen since August 2020, as the Russia-Ukraine war has caused a significant demand for barrels of oil, commodities, energy stocks, and precious metals. During the last 24 hours, an ounce of .999 fine gold has jumped over 3.15% in value, and an ounce of .999 fine silver spiked by 4.38%. At the time of writing, an ounce of gold has tapped a high of $2,064.27 per unit after it surpassed the $2K zone earlier this morning (EST).

Of course, after gold tapped fresh new highs, the gold bug and economist took to Twitter to praise the shiny yellow metal over bitcoin’s current performance. “Gold is up over $50 per ounce this morning, above $2,050 for the first time ever,” Schiff tweeted on Tuesday. “Meanwhile CNBC hasn’t even mentioned the record-high. Instead, the network is covering the irrelevant rise in bitcoin, which is still trading well below $39,000 and on the verge of a major crash,” the economist added.

As the price of precious metals soar, Asian, European, and U.S. equity markets have been floundering since Monday’s trading sessions. Nasdaq, the Dow, NYSE, and S&P 500 are all down in value at the time of writing. CNBC’s Wall Street coverage called it the “worse selloff since October 2020.” In addition to the massive jump in value both gold and silver experienced during the last 24 hours, a barrel of crude oil rallied northbound to $129 per unit. The price of crude is causing gas stations worldwide to increase the prices of petroleum per liter/gallon.

Aluminum has been soaring in value too, copper is surging, palladium has tapped all-time price highs, alongside nickel, zinc, yellow brass, iron, wheat, and corn. Speaking with the news outlet sharesmagazine.co, the chief investment strategist at research house Edison, Alastair George commented on risk assets dropping in value while gold surged. George highlighted the Russia-Ukraine war and that its “both Putin’s and Russia’s interest for the war to be stopped.”

“This would lead to a rapid reversal of negative sentiment towards risk assets and significant falls in energy and food prices,” the Edison investment strategist added. “With implied volatility in European equity markets already matching the highs of March 2020, it is already too late to ‘panic-sell’, in our view.”

What do you think about the price of gold soaring beyond the $2K mark per ounce on Tuesday? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Toncoin

Toncoin  Sui

Sui  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Pepe

Pepe  Polkadot

Polkadot  LEO Token

LEO Token  Stellar

Stellar  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  MANTRA

MANTRA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  dogwifhat

dogwifhat  Monero

Monero  Stacks

Stacks  OKB

OKB  Filecoin

Filecoin