Quick Take

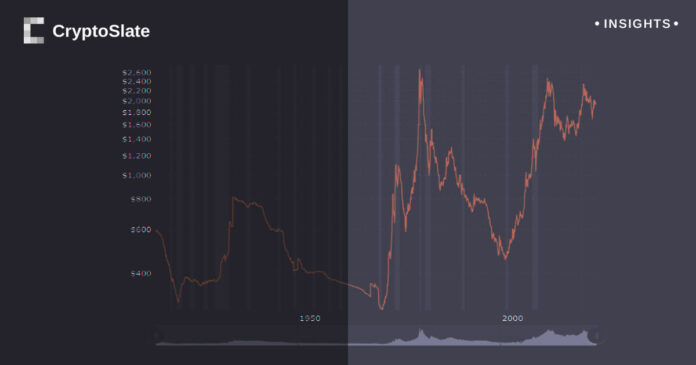

An examination of the real, inflation-adjusted gold prices since 1915, using the headline Consumer Price Index (CPI), reveals a striking pattern of peaks and troughs. Particularly noteworthy is the peak in January 1980, when an ounce of gold reached $2,675, its highest ever in inflation-adjusted terms.

Since then, despite two subsequent peaks in August 2011 and August 2020, at $2,472 and $2,327 respectively, gold has not yet reclaimed its inflation-adjusted high from 1980. This data suggests a significant resistance level for real gold prices, indicative of underlying economic factors and market sentiment that prevent a return to the 1980 high.

As gold is often seen as a hedge against inflation, this trend might also shed light on different periods of economic stability and inflationary pressures.

The post Analysis of inflation-adjusted trends shows gold unable to break 1980 high appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Sui

Sui  Pepe

Pepe  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Hedera

Hedera  USDS

USDS  Internet Computer

Internet Computer  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Ethena USDe

Ethena USDe  Render

Render  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Arbitrum

Arbitrum  Cosmos Hub

Cosmos Hub  Bonk

Bonk  MANTRA

MANTRA  Filecoin

Filecoin  OKB

OKB  Celestia

Celestia