The total value of assets locked (TVL) in liquid staking projects has continued to climb despite the overwhelming bearish sentiments present in the market.

DeFillama’s data reveals an impressive surge in the category’s TVL, which has reached almost $20 billion in the past year. Notably, this growth has outpaced other sectors in decentralized finance, including lending and decentralized exchanges, during the same timeframe.

Liquid staking protocols, such as Lido (LDO), Frax Ether (FXS), and Rocket Pool (RPL), offer users the unique opportunity to earn staking rewards while retaining liquidity for other crypto activities. The sector’s growth is largely due to the Ethereum (ETH) Shanghai upgrade, which allowed stakers to withdraw their staked ETH easily.

This upgrade reignited enthusiasm within the crypto community for these protocols. For context, Nansen’s Ethereum Shanghai dashboard shows a trend of ETH staking deposits outpacing withdrawals since the process began. These deposits are concentrated on liquid staking platforms, with Lido dominating.

Furthermore, the recent regulatory actions in the United States targeting centralized staking service providers like Kraken have provided liquid staking protocols with a distinct advantage over their centralized counterparts.

Lido remains dominant

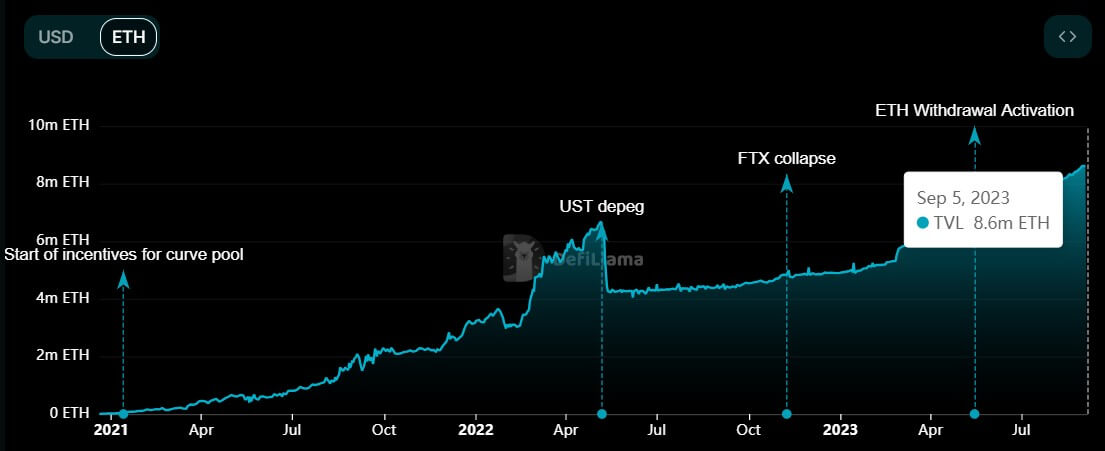

Lido stands out as a prime example of the dynamic growth in liquid staking. In April 2022, the protocol’s TVL peaked at $20.32 billion, according to DeFillama data. However, it faced a setback following Terra’s UST depeg, plummeting to $4.51 billion.

This decline was largely influenced by the sharp drop in ETH prices during that period. Concurrently, Lido’s Ether TVL declined from 6.59 million to 4.27 million.

Subsequently, Lido has experienced a resurgence in its Ether TVL, soaring to an all-time high of 8.63 million.

Nevertheless, this remarkable growth in ETH TVL has yet to translate into an equivalent increase in its dollar TVL, primarily due to the prevailing price of ETH. Currently, ETH is trading at $1,623, marking an 11% decrease over the past 30 days.

Meanwhile, other liquid staking protocols, including Rocket Pool and Frax Ether, have also witnessed substantial expansions in their TVL during this period.

The post Liquid staking outperforms bearish market as Lido growth fuels $20B TVL appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Toncoin

Toncoin  Sui

Sui  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Pepe

Pepe  Polkadot

Polkadot  LEO Token

LEO Token  Stellar

Stellar  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  POL (ex-MATIC)

POL (ex-MATIC)  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  MANTRA

MANTRA  Arbitrum

Arbitrum  dogwifhat

dogwifhat  Monero

Monero  Stacks

Stacks  OKB

OKB  Filecoin

Filecoin