Quick Take

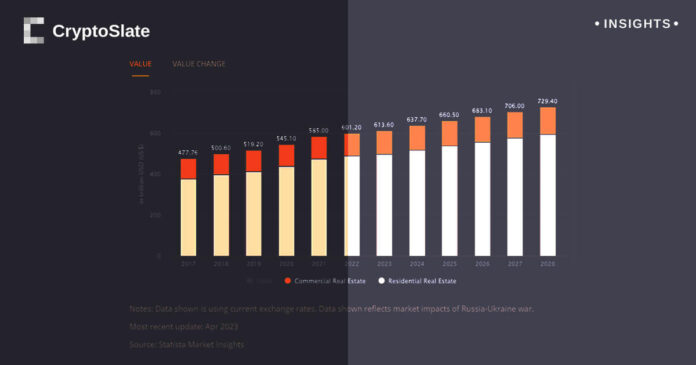

As one of the largest global wealth sources, the real estate sector continues to demonstrate tremendous growth. According to Statista, it’s projected to hit a whopping $613 trillion in 2023 and potentially reach $700 trillion by 2027. Much of this wealth is concentrated in China, the world’s largest real estate asset class, with an estimated value of $131 trillion in 2023, according to Statista. Yet, a financial storm brews on the horizon for China, as discussed previously by CryptoSlate, with the country grappling with deflation and currency issues.

Simultaneously, a dramatic shift is occurring in the Western markets. As reported by The Kobessi Letter, the rates and yields are on a steady upward climb, with the 30-year mortgage rates touching a 21-year high of 7.5%. This rise indicates more capital being funneled into servicing housing loans, leaving less for economic circulation. Additionally, as properties often represent a significant portion of people’s net worth, the resulting decrease in property values due to rising rates could trigger a reverse wealth effect.

The post China’s real estate wealth meets financial storm while Western markets see mortgage rate spike appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Sui

Sui  Pepe

Pepe  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Hedera

Hedera  USDS

USDS  Internet Computer

Internet Computer  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Ethena USDe

Ethena USDe  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Render

Render  Bittensor

Bittensor  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Bonk

Bonk  Arbitrum

Arbitrum  MANTRA

MANTRA  Celestia

Celestia  Filecoin

Filecoin  Cosmos Hub

Cosmos Hub  OKB

OKB