On Aug. 17, Bitcoin’s price dropped below the $29,000 mark, settling around $28,500. While this decline might seem insignificant given Bitcoin’s historically volatile nature, the context of its recent trading range magnifies the importance of this move.

Bollinger Bands are a financial tool used to assess the price volatility of various assets, including Bitcoin. The bands contain three lines — one central line and two outer ones. The central line on the chart represents the simple moving average (SMA) of the asset’s price, while the outer bands are determined by the standard deviation, a measure indicating how spread out the prices are from the average.

These bands widen during periods of high volatility and contract during low volatility. These bands are a crucial market indicator, helping traders identify potential buy and sell signals. When an asset’s price moves outside these bands, it can indicate a significant price movement in the breakout direction.

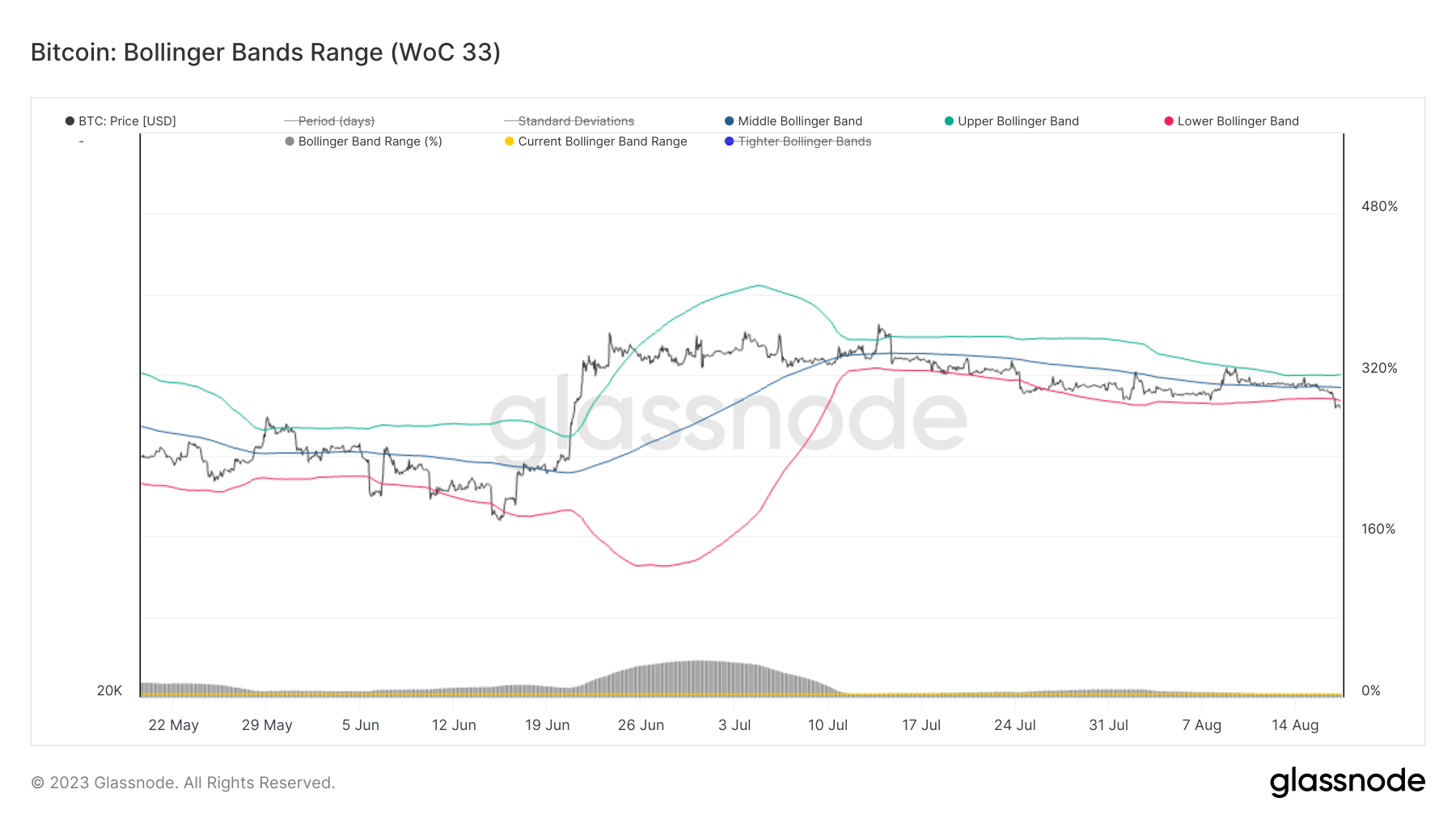

August has seen Bitcoin’s price volatility plummet to historical lows. Before today’s drop to $28,500, the upper and lower Bollinger Bands were separated by a mere 2.9%. Such a tight spread has only been witnessed twice in Bitcoin’s history. With the descent to $28,500, Bitcoin’s price breached the lower Bollinger Band, which stood at $28,794. Consequently, the Bollinger Band range expanded slightly to 3.2%.

Historical data suggests that when Bitcoin’s price breaks below the lower Bollinger Band, it is often followed by a swift recovery and an upward trajectory. This pattern has been observed multiple times, reinforcing the significance of the Bollinger Bands as a predictive tool.

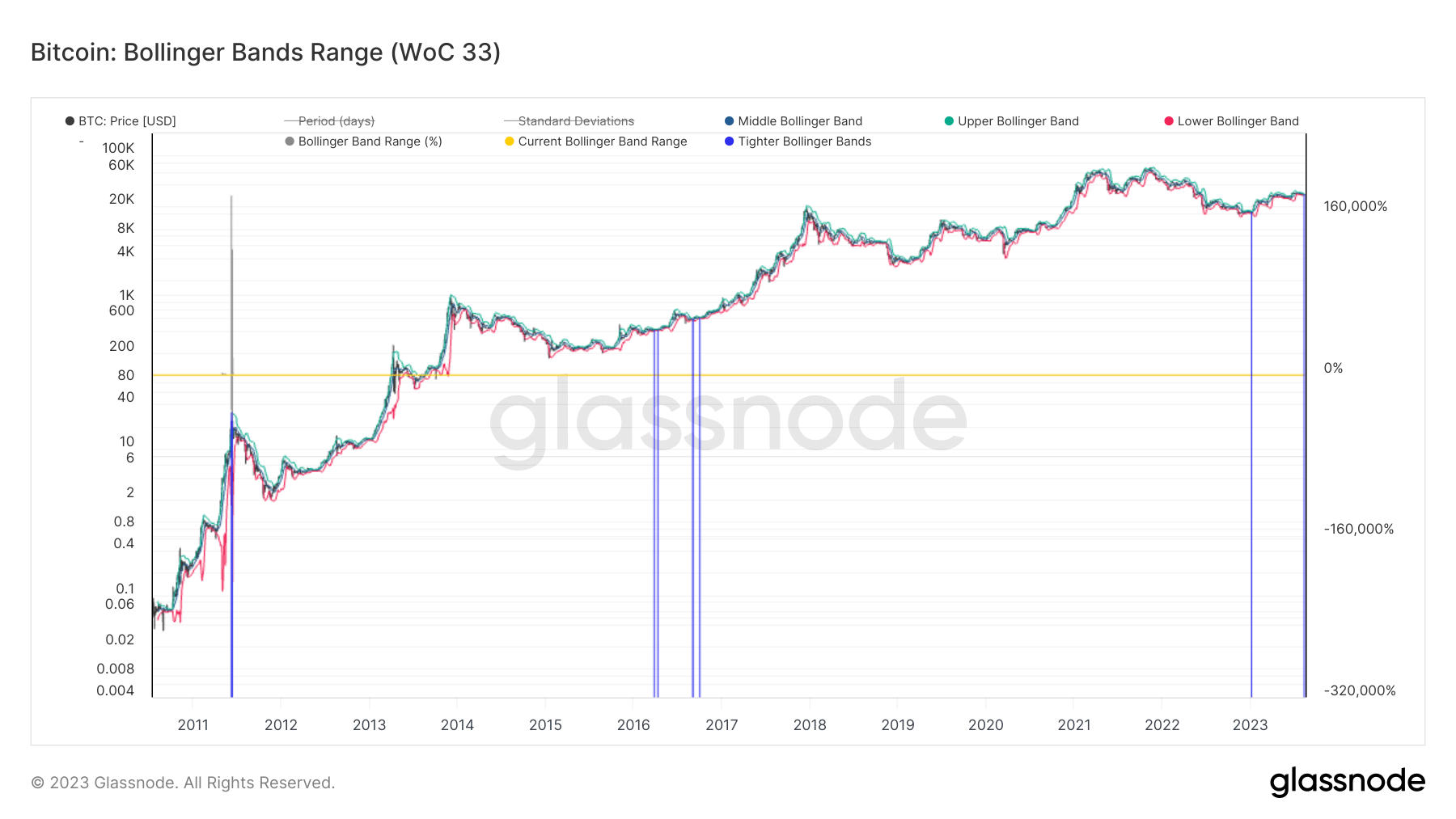

Furthermore, every instance of extremely tight Bollinger Bands in Bitcoin’s history has preceded a notable price swing. For instance, several occurrences of equally tight bands were recorded in 2016. This period was the precursor to the rally that propelled Bitcoin to its all-time high in 2018. More recently, in January 2023, Bitcoin’s price remained stagnant at around $16,800, with the bands indicating low volatility. Shortly after, Bitcoin surged, nearly doubling its value to $30,000.

So, what do these observations imply for the market? The current tightness of the Bollinger Bands, combined with Bitcoin’s price movement below the lower band, suggests a potential for a significant price upswing in the near future.

The post Bitcoin at $28.5K: Unpacking the significance of tight Bollinger Bands appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Toncoin

Toncoin  Sui

Sui  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Pepe

Pepe  Polkadot

Polkadot  LEO Token

LEO Token  Stellar

Stellar  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  MANTRA

MANTRA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  dogwifhat

dogwifhat  Monero

Monero  Stacks

Stacks  OKB

OKB  Filecoin

Filecoin