Quick Take

Tether, the issuer of USDT, has recently experienced one of its largest redemptions since the FTX collapse in Nov. 2022, according to Paolo Ardoino, Tether’s CTO.

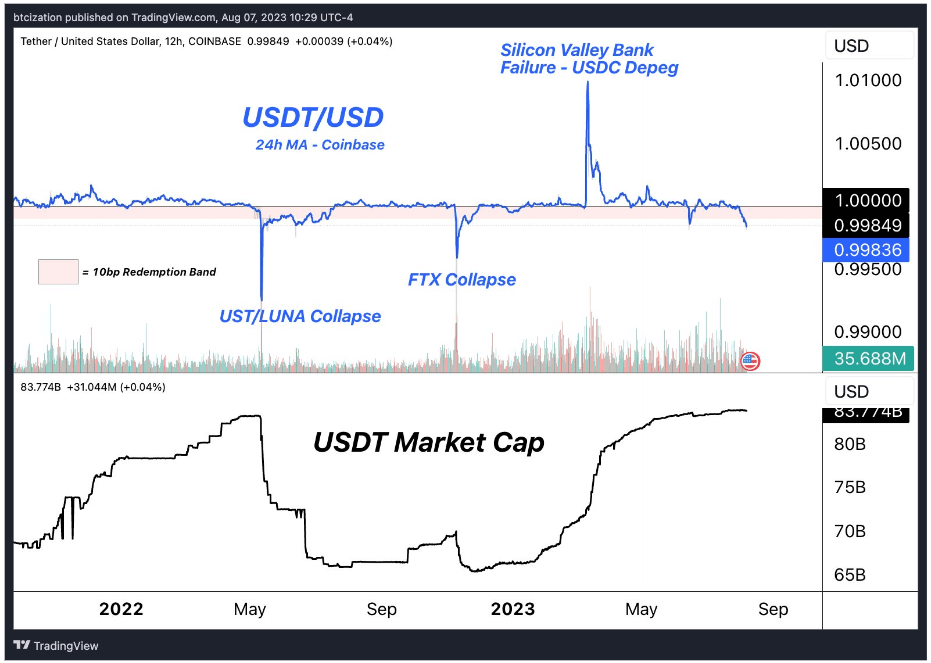

A total of approximately 325 million USDT was redeemed, marking a significant event in the stablecoin’s history.

This comes as the circulating supply of USDT is near record highs of around 83 billion, indicating the resilience and demand for this particular stablecoin.

An intriguing note is the USDT/USD redemption rate, which, according to Dylan LeClair, has fallen below the 10bp mark over the past 24 hours. This is the lowest rate seen since the FTX collapse and may suggest a change in market behavior or sentiment towards the stablecoin.

This data provides a snapshot of Tether’s activity and the ongoing influence of past market events, like the FTX collapse, on present occurrences. Further tracking of these redemption rates and circulating supply trends could offer valuable insight into the broader market dynamics and the stablecoin’s role within it.

PayPal launched its own stablecoin PYUSD on Aug. 7, which currently has a market cap of just $26 million, suggesting USDT redemptions are not directly linked to the increased competition.

The post Market sentiment sways as Tether sees largest redemption since FTX collapse amid PYUSD launch appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Chainlink

Chainlink  Polkadot

Polkadot  Stellar

Stellar  Pepe

Pepe  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Render

Render  Bittensor

Bittensor  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  MANTRA

MANTRA  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  dogwifhat

dogwifhat  Arbitrum

Arbitrum  Monero

Monero  Stacks

Stacks  Filecoin

Filecoin  OKB

OKB