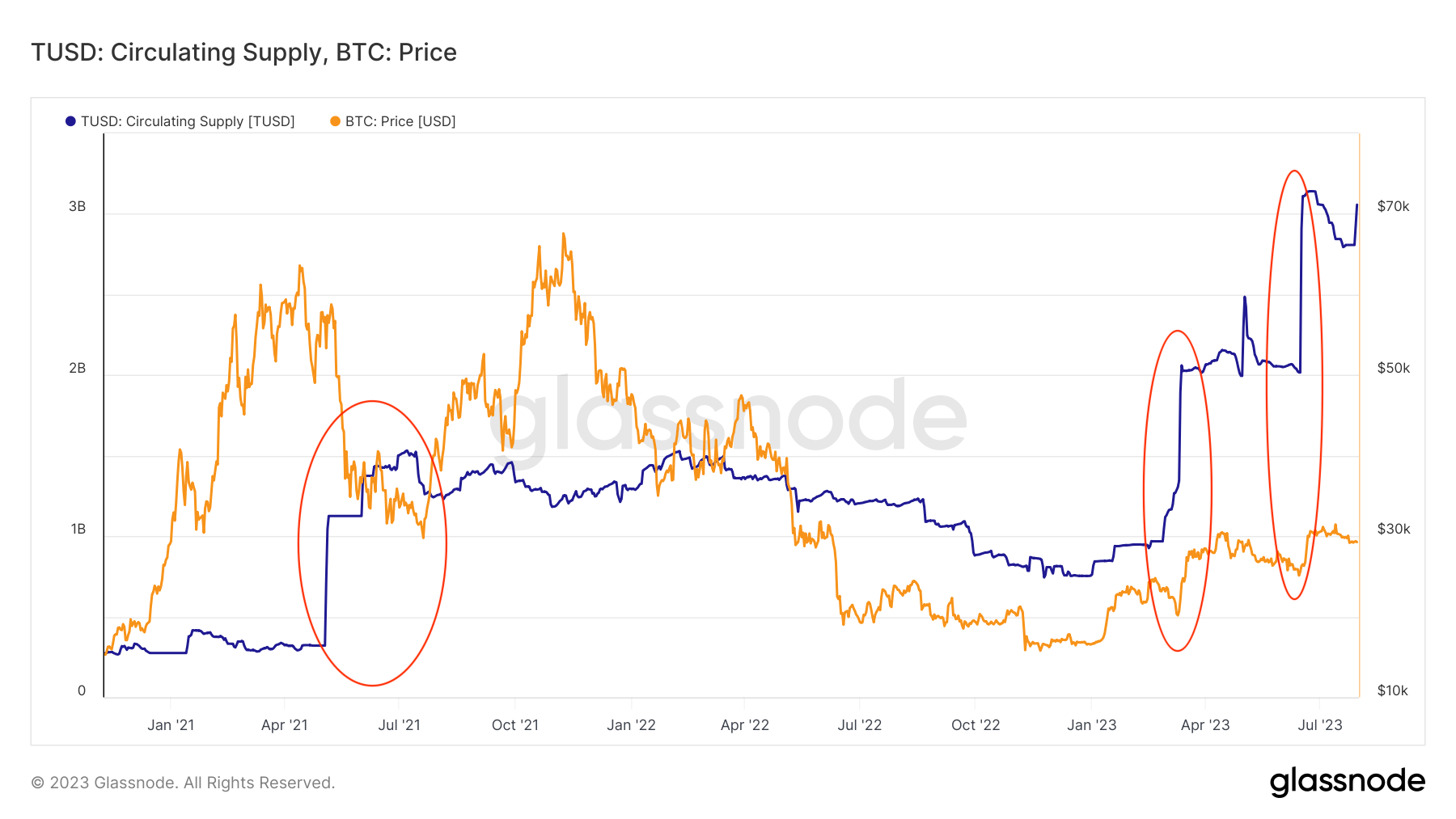

The circulating supply of TrueUSD (TUSD), a highly liquid stablecoin, has seen a significant increase of almost $250 million between July 29 and July 30.

While this might appear as a minor uptick for a stablecoin with a circulating supply exceeding $3 billion, historical data suggests that notable price rallies have often followed such spikes in the stablecoin’s supply in Bitcoin.

For instance, in early May 2021, TUSD added $800 million to its supply within just five days. Then, in mid-July, following an additional increase of $400 million that took the TUSD supply to a peak of $1.5 billion, Bitcoin began a significant rally. In the days following this peak, Bitcoin’s price soared from $30,800 to its ATH of $68,000 by November.

A similar pattern emerged in February 2023. Between February 26 and March 15, the TUSD supply grew by almost $1.1 billion. This substantial increase in supply preceded a Bitcoin rally that pushed its price from $20,000 to $30,000.

More recently, between June 14 and June 26, TUSD supply experienced another significant increase of $1.1 billion. This surge in supply coincided with Bitcoin reclaiming its position above $30,000 for the second time this year.

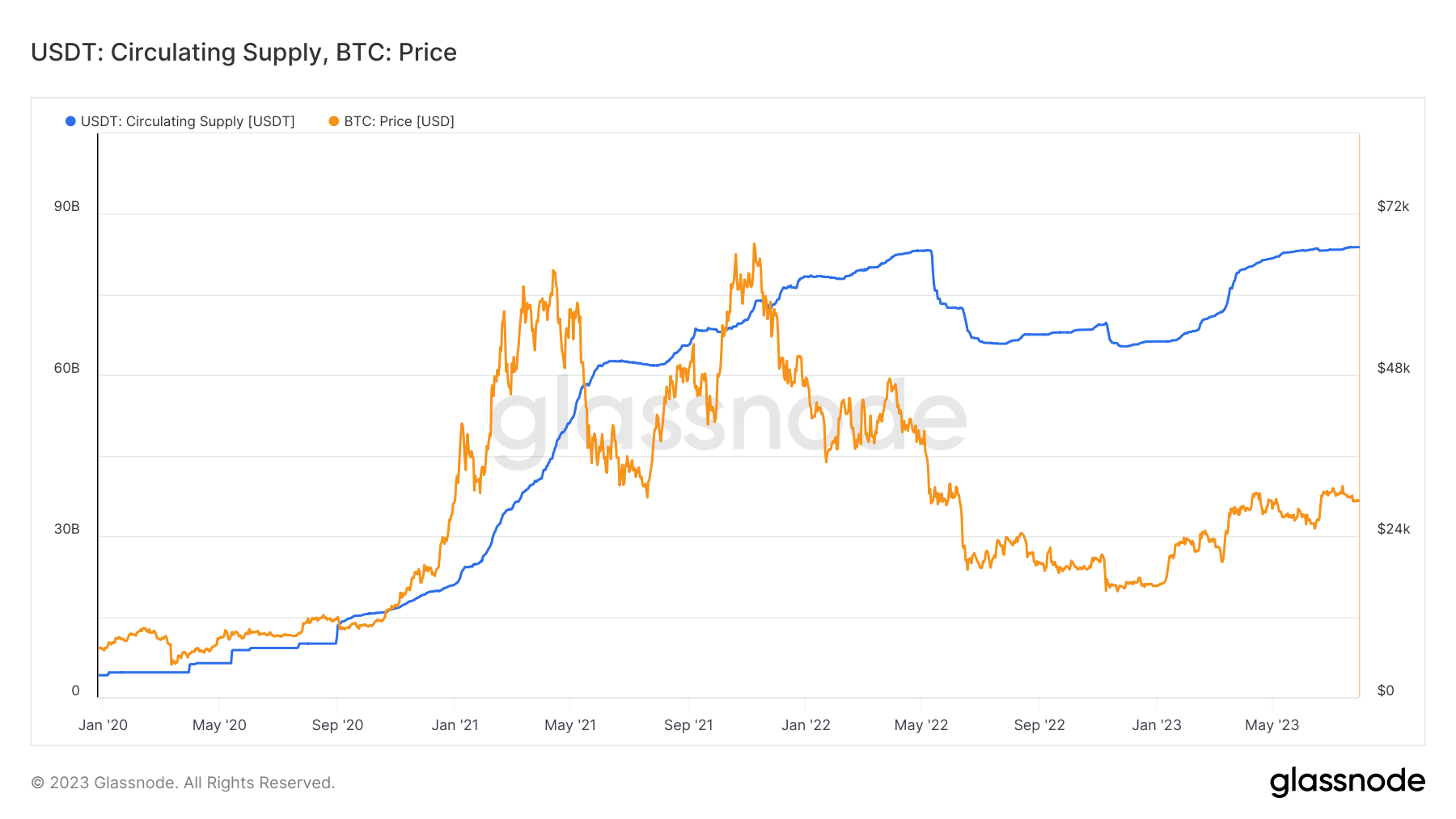

Interestingly, this correlation appears to be unique to TUSD. Other stablecoins, such as Tether (USDT), have not demonstrated a similar pattern.

For instance, changes in USDT supply have typically occurred in tandem with Bitcoin’s price movements rather than preceding them.

The recent surge in TUSD supply could potentially signal another Bitcoin rally on the horizon. However, investors should approach this correlation with caution.

While the data suggests a pattern, it does not necessarily mean that a surge in TUSD supply will always lead to a Bitcoin rally.

The post Could a new surge in TUSD supply trigger another Bitcoin rally? appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  Cardano

Cardano  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Toncoin

Toncoin  Stellar

Stellar  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Sui

Sui  WETH

WETH  Pepe

Pepe  LEO Token

LEO Token  Litecoin

Litecoin  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Render

Render  Bittensor

Bittensor  Ethena USDe

Ethena USDe  Bonk

Bonk  WhiteBIT Coin

WhiteBIT Coin  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  dogwifhat

dogwifhat  Dai

Dai  MANTRA

MANTRA  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Filecoin

Filecoin