Since the beginning of 2023, a new form of non-fungible tokens (NFTs), known as Bitcoin Ordinals Inscriptions, has ignited widespread interest in the crypto space.

The popularity of Inscriptions can be attributed to their novelty and the unique value proposition they offer. They provide a way for users to immortalize messages on the immutable Bitcoin blockchain, adding a new layer of functionality to Bitcoin’s utility as a store of value. This has opened up a new avenue for creativity and personal expression within the Bitcoin ecosystem, allowing users to create a lasting legacy on the blockchain.

Moreover, the advent of Inscriptions signified a significant milestone for Bitcoin, marking its entry into the NFT space, a domain previously dominated by Ethereum and other smart contract platforms.

However, the surge in popularity of Inscriptions had a significant impact on the Bitcoin network. The increased demand for these novel NFTs led to a substantial rise in transaction costs and network congestion, resulting in an unprecedented spike in mining revenue due to the increased transaction fees.

However, recent data suggests that the enthusiasm surrounding Inscriptions has cooled off. Various miner-related metrics indicate a return to pre-Inscriptions levels, signaling market normalization.

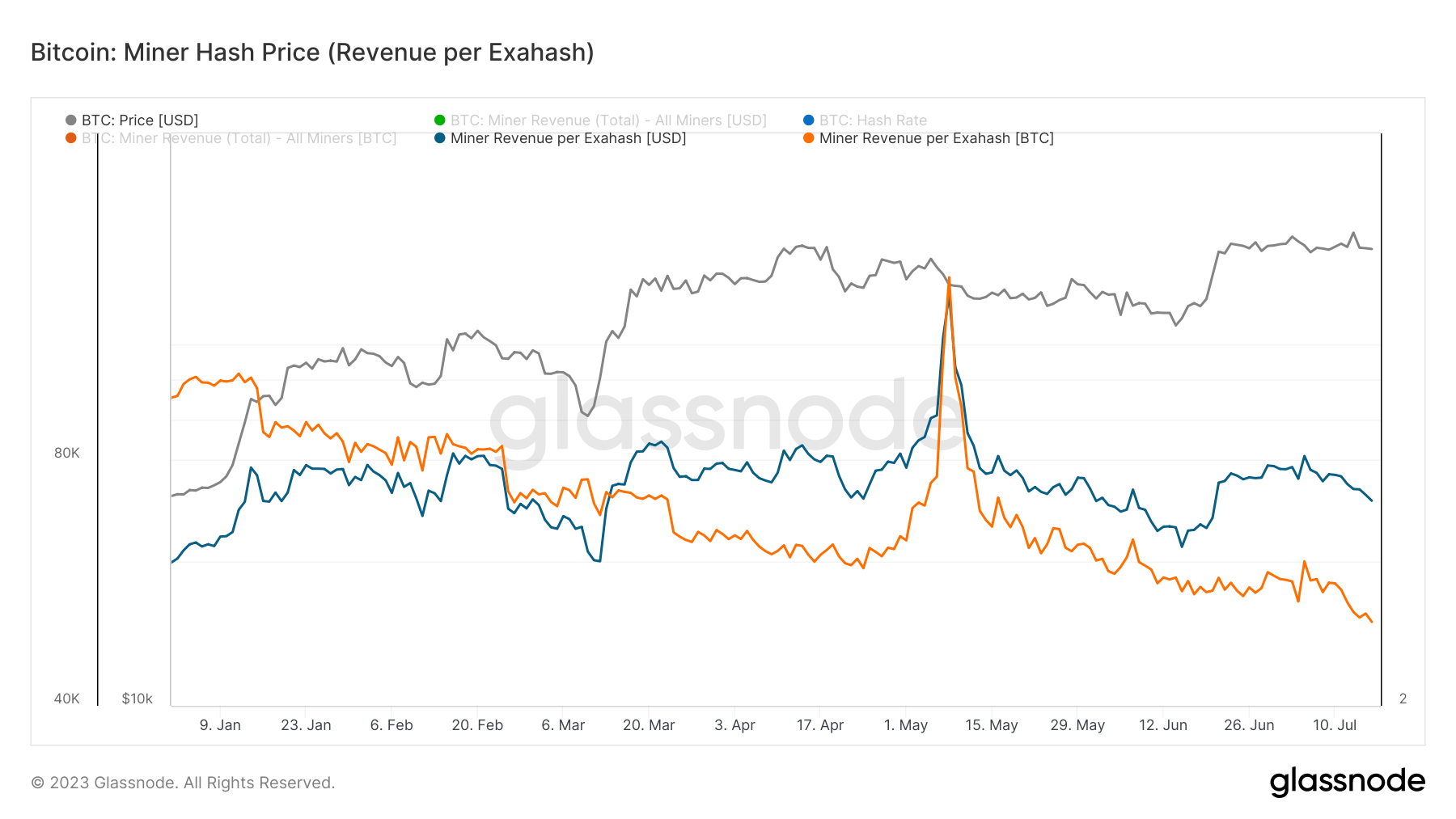

Miner revenue per exahash, a measure of the revenue miners earn for each exahash of computational power they contribute to the network, has seen a significant decrease since its peak on May 8, 2023. The USD-denominated revenue per exahash decreased by more than 44% since May 8, following a 110% rise from January to May.

When denominated in BTC, miner revenue saw a similar trend, decreasing by 48% since May 8.

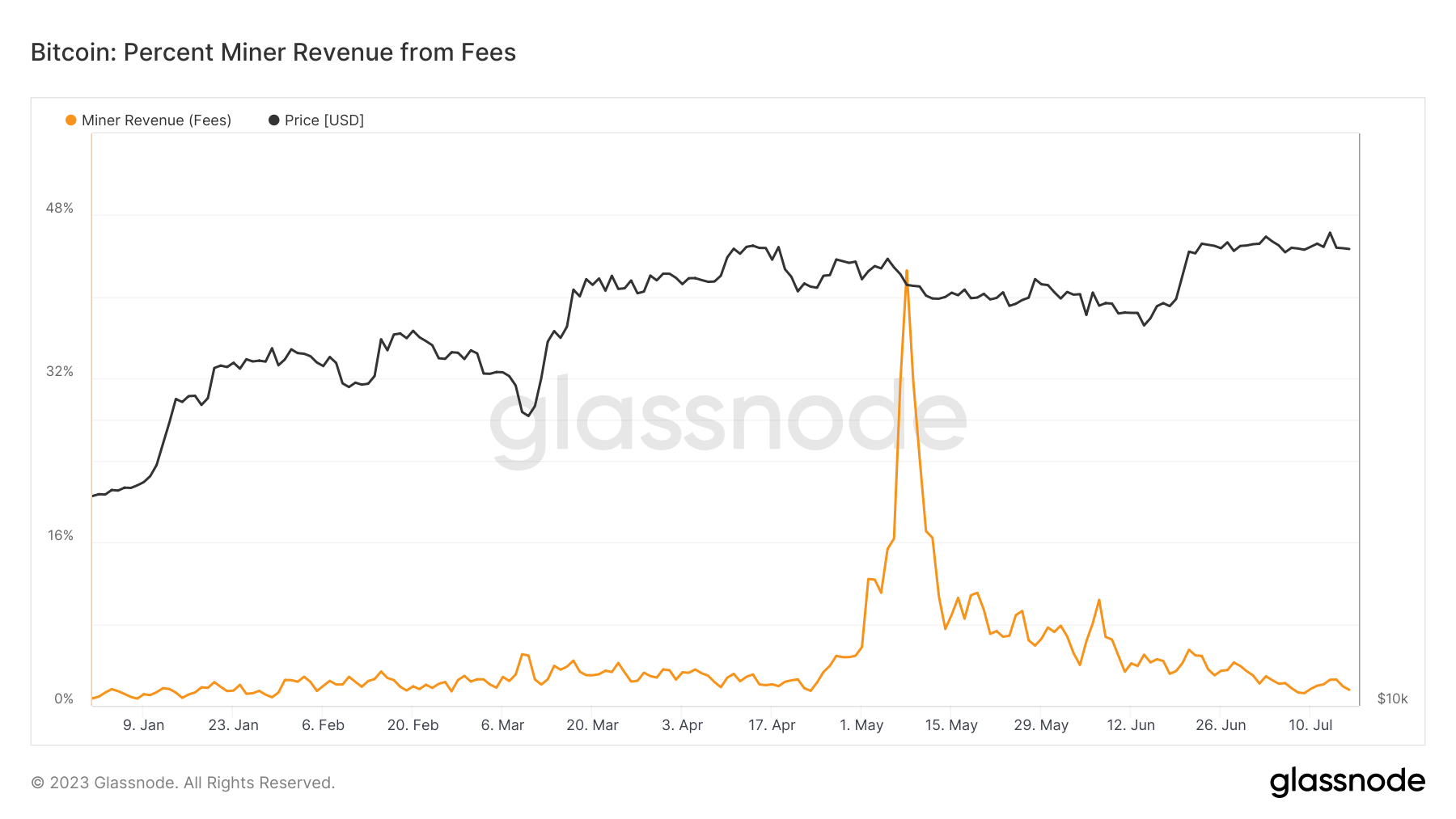

The Inscriptions craze had a significant impact on the composition of miner revenue. On May 8, transaction fees accounted for 42.59% of all miner revenue, marking the second-highest recorded level. The all-time high was recorded on December 22, 2017, during Bitcoin’s rally to $20,000, when transaction fees comprised 43.57% of total revenue.

To put this into perspective, the percentage of miner revenue from transaction fees on January 1, 2023, was a mere 0.73%. As of June 16, 2023, transaction fees account for around 1.56% of miner revenue, indicating that most income is derived from block rewards.

The normalization of miner revenue and the decrease in transaction fees suggest that the market has adjusted to the Inscriptions phenomenon. While the Inscriptions trend provided a temporary financial boon for Bitcoin miners, it appears that the Bitcoin network is returning to its usual operations.

This return to normalcy is a positive sign for the Bitcoin network, indicating its resilience and ability to adapt to new developments and trends.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Toncoin

Toncoin  Stellar

Stellar  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Sui

Sui  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Litecoin

Litecoin  Aptos

Aptos  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Hedera

Hedera  USDS

USDS  Internet Computer

Internet Computer  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Render

Render  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena USDe

Ethena USDe  Bittensor

Bittensor  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Celestia

Celestia  Arbitrum

Arbitrum  Bonk

Bonk  Filecoin

Filecoin  MANTRA

MANTRA  Cosmos Hub

Cosmos Hub  OKB

OKB