Blockchain project Terra and its native token LUNA have quickly moved from the sidelines to the forefront of DeFi. With over $11.9 billion in TVL, it’s the fifth largest blockchain project, trailing closely behind Avalanche.

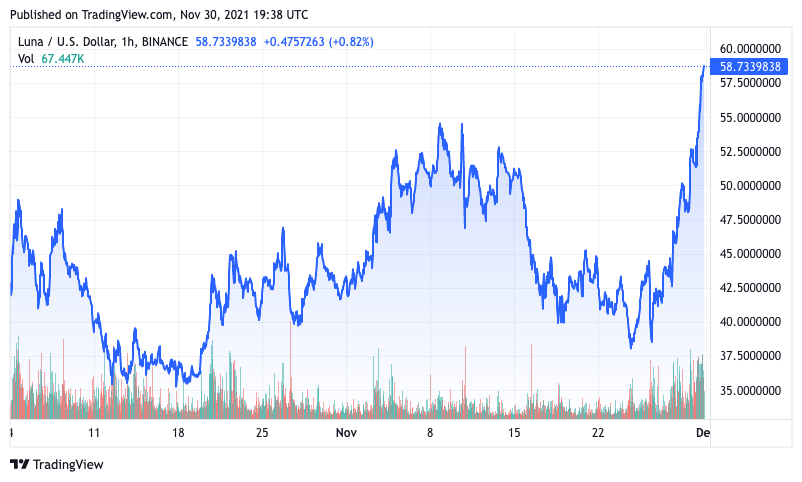

With several major fundamental developments underway, LUNA saw its price increase by over 50% in the past week, with industry insiders believing that this is just the start of a major bull run set to take place in the following weeks.

What’s behind LUNA’s major rally?

After Bitcoin took a massive hit last week, dropping dangerously close to its coveted $50,000 resistance levels, the rest of the market went into the red alongside it. However, the major drag downwards doesn’t seem to have affected LUNA, the native token of the Terra blockchain.

The Layer-1 blockchain platform has quickly risen from the sidelines to the forefront of DeFi, riding a wave of extreme interest in its innovative stablecoin products. Terra enables users to swap their LUNA tokens for a wide variety of stablecoins pegged to different fiat currencies. As minting $1 worth of UST requires burning $1 worth of LUNA, an increasing supply of stablecoins on Terra decreases the circulating supply of LUNA, thus raising its value.

This simple proposal has led to over 3.2 million registered accounts and 15.3 million UST in tax rewards distributed in the past year.

Earlier this month, the Terra community passed a proposal to burn 88.7 million LUNA tokens, worth roughly $4.5 billion at the time. The burn was initiated to mint between 4 and 5 million terraUSD (UST), a decision analysts believe would further boost interest in Terra.

And boost interest it did—the token saw its price increase by over 50% since last week, fueled mostly by a slew of new proposals set to be approved by the community.

The ultimate goal for all of the recently submitted proposals is to have UST become the go-to interchain stablecoin. This process is set to begin by increasing UST liquidity on Curve Finance, Ethereum’s premier AMM for stablecoin swaps, through a 6-month incentive plan through several Terra apps.

1/ A new proposal to significantly increase $UST liquidity on @CurveFinance pools via a 6-month incentive plan through @VotiumProtocol, @ConvexFinance, and @TokenReactor is now posted on Agora 👇https://t.co/PiUnSqWUCw

— Terra (UST) 🌍 Powered by LUNA 🌕 (@terra_money) November 30, 2021

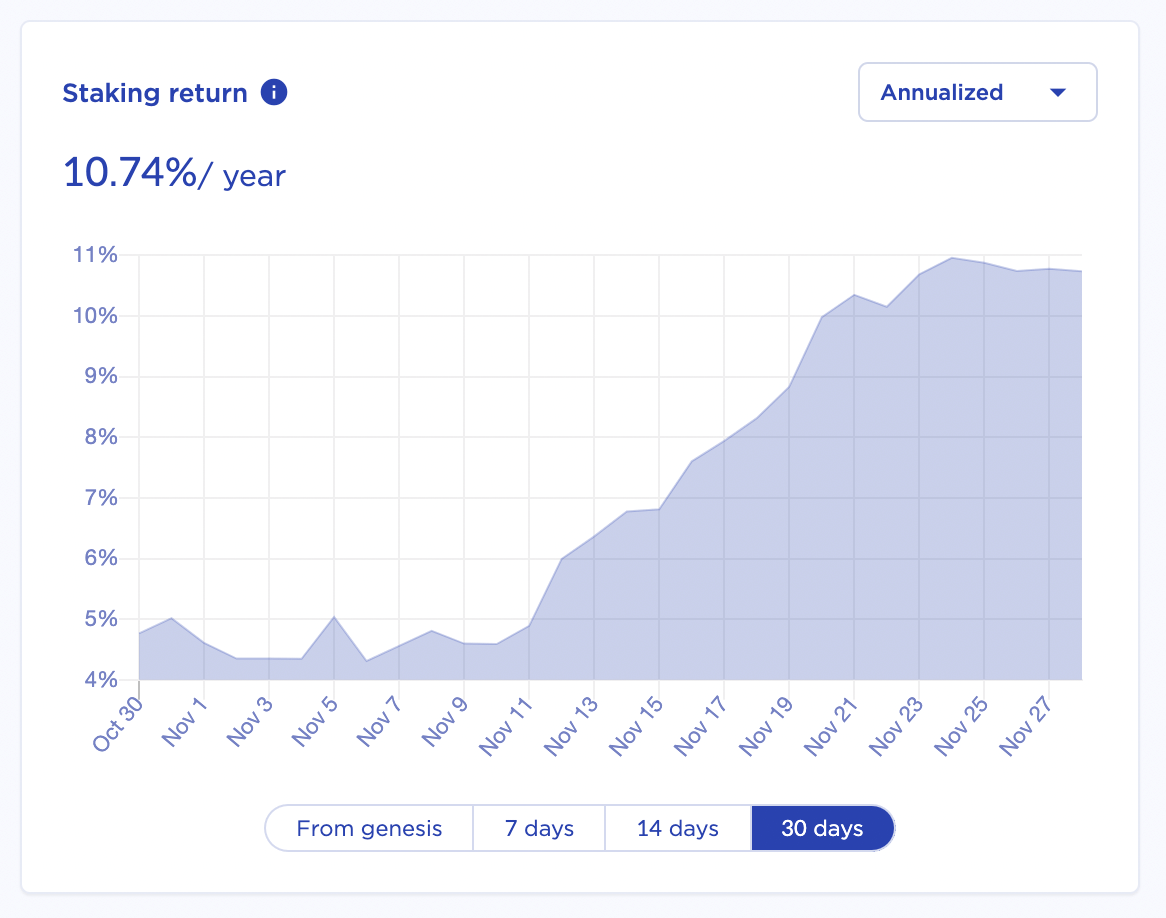

All of the previous LUNA burns have caused a huge increase in the annualized staking return for the token, which jumped from 4.61% at the beginning of November to 10.74% at the end of the month.

According to Nicholas Flamel, one of the more prominent Terra community members, we are about to see an even bigger increase in LUNA’s price in the coming weeks.

“The Terra economy is in full expansion,” he told CryptoSlate. “I’m fairly confident that we have seen nothing yet.”

Flamel said that both the Terra community and its development team anticipate that UST will reach $10 billion in market capitalization by the end of the year. And as minting 1 UST requires burning $1 worth of LUNA, the Terra ecosystem is about to go parabolic.

“This means we will have to buy/burn around $2.5 billion worth of LUNA in the next 4 weeks. This is big. I’m not sure we have ever seen such massive buying pressure incoming on a coin like this before.”

CryptoSlate Newsletter

Featuring a summary of the most important daily stories in the world of crypto, DeFi, NFTs and more.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Join now for $19/month Explore all benefits

Credit: Source link

Swell Ethereum

Swell Ethereum  L2 Standard Bridged WETH (Blast)

L2 Standard Bridged WETH (Blast)  Reserve Rights

Reserve Rights  Hashnote USYC

Hashnote USYC  Usual USD

Usual USD  Non-Playable Coin

Non-Playable Coin  Trust Wallet

Trust Wallet  LayerZero

LayerZero  PONKE

PONKE  Stader ETHx

Stader ETHx  Zilliqa

Zilliqa  Osmosis

Osmosis  OriginTrail

OriginTrail  Zerebro

Zerebro  Amp

Amp  cWBTC

cWBTC  Celo

Celo  Livepeer

Livepeer  Holo

Holo  Jito

Jito  Binance-Peg BUSD

Binance-Peg BUSD  Gigachad

Gigachad  Baby Doge Coin

Baby Doge Coin  Degen (Base)

Degen (Base)  EthereumPoW

EthereumPoW  Golem

Golem  0x Protocol

0x Protocol  Polygon Bridged WBTC (Polygon POS)

Polygon Bridged WBTC (Polygon POS)  Siacoin

Siacoin  Dogs

Dogs  BENQI Liquid Staked AVAX

BENQI Liquid Staked AVAX  Drift Protocol

Drift Protocol  Enjin Coin

Enjin Coin  Apu Apustaja

Apu Apustaja  Liquid Staked ETH

Liquid Staked ETH  pumpBTC

pumpBTC  Dash

Dash  Dymension

Dymension  Ankr Network

Ankr Network  Polymesh

Polymesh  Simon's Cat

Simon's Cat  JUST

JUST  Kusama

Kusama  Verus

Verus  Olympus

Olympus  Ether.fi

Ether.fi