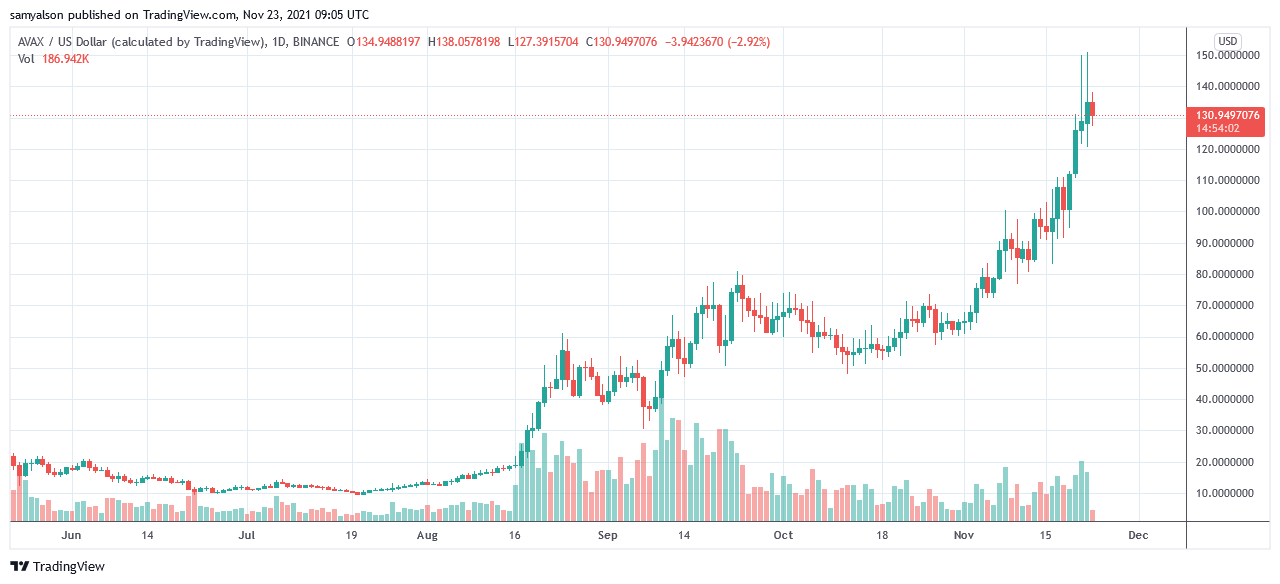

Avalanche (AVAX) defies the broader crypto market sell-off, hitting a solid run of form in which it briefly touched $150 on Binance, a new all-time high.

However, profit-taking saw AVAX give up most of those gains, closing Monday’s daily candle at $135. Nonetheless, the Ethereum-rival still entered the top ten by market cap; as a result, displacing Dogecoin in the process.

But what’s behind AVAX’s soaring price?

Deloitte disaster relief deal

According to Bloomberg, in conjunction with professional services network Deloitte, Avalanche has secured a deal to do with U.S disaster relief funding.

Deloitte’s Government Crisis Management Services is built to help governments handle disasters. They chose the Avalanche blockchain to build its Close as You Go service, and this service simplifies disaster reimbursement applications for victims of natural disasters by aggregating and validating documentation.

The Avalanche blockchain will enable a transparent and cost-effective solution to reduce waste. The process intends to accelerate recovery in areas hit by natural disasters by bringing greater organization of documents and managing operations remotely.

Commenting on the deal, Jonathan Cheesman, the Head of Institutional and OTC sales at FTX, said it highlights the demand for cheaper, more efficient Ethereum competitors. He added that:

“There’s a huge wealth effect and a lot opportunistic and mobile capital.”

Avalanche token burn to date

In a further bout of good news for Avalanche investors, the firm announced on Monday that it had burned over 400,000 AVAX tokens since launching in 2020, around $55 million in fiat terms.

A link to the live burning currently shows 418,792 AVAX burned. As a policy, the team decided to burn all fees, meaning this figure will continue to rise as the token is used.

The act of burning tokens removes them from the available supply, therefore increasing scarcity. In theory, this process should boost the token price if demand stays constant.

While there’s no shortage of Ethereum competitors, Avalanche demonstrates that greater scalability and a focus on DeFi remain important considerations to the market.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Join now for $19/month Explore all benefits

Like what you see? Subscribe for updates.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Toncoin

Toncoin  Sui

Sui  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Pepe

Pepe  Polkadot

Polkadot  LEO Token

LEO Token  Stellar

Stellar  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  POL (ex-MATIC)

POL (ex-MATIC)  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  MANTRA

MANTRA  dogwifhat

dogwifhat  Arbitrum

Arbitrum  Monero

Monero  Stacks

Stacks  OKB

OKB  Filecoin

Filecoin