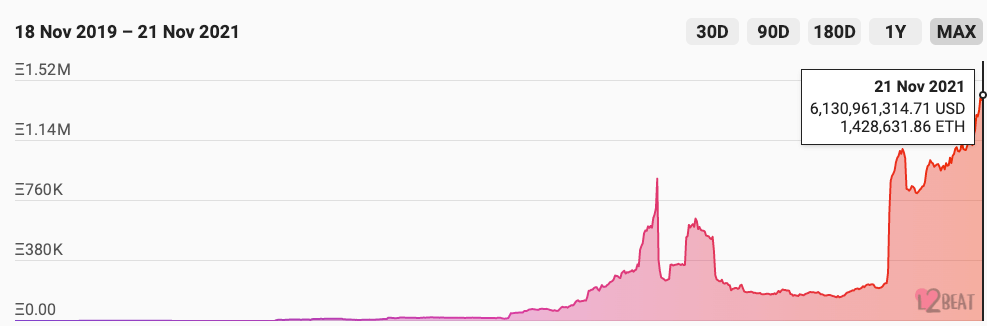

According to data from analytics platform L2BEAT, there has never been more value locked in Ethereum’s layer-2 scaling solutions.

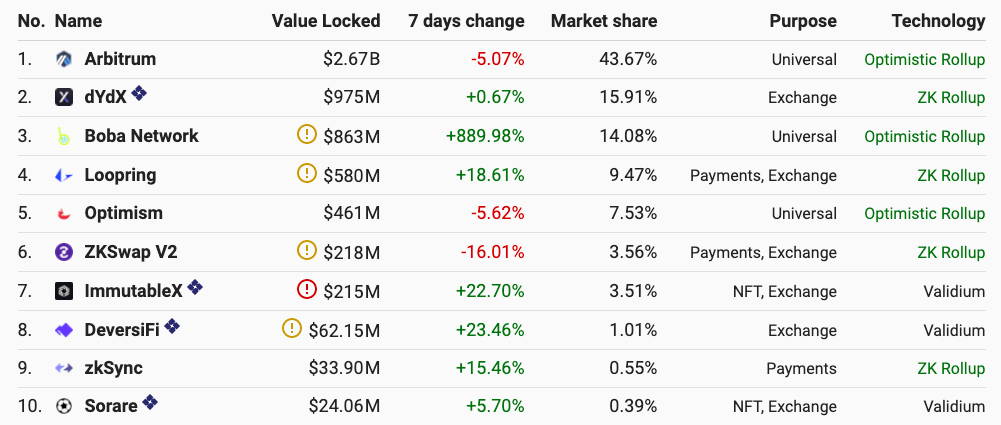

With increasing gas fees driving the adoption of networks such as Arbitrum, Optimism, and Loopring, layer-2 TVL increased by more than 44% in less than a month.

Users pour their money into L2s as Ethereum fees skyrocket

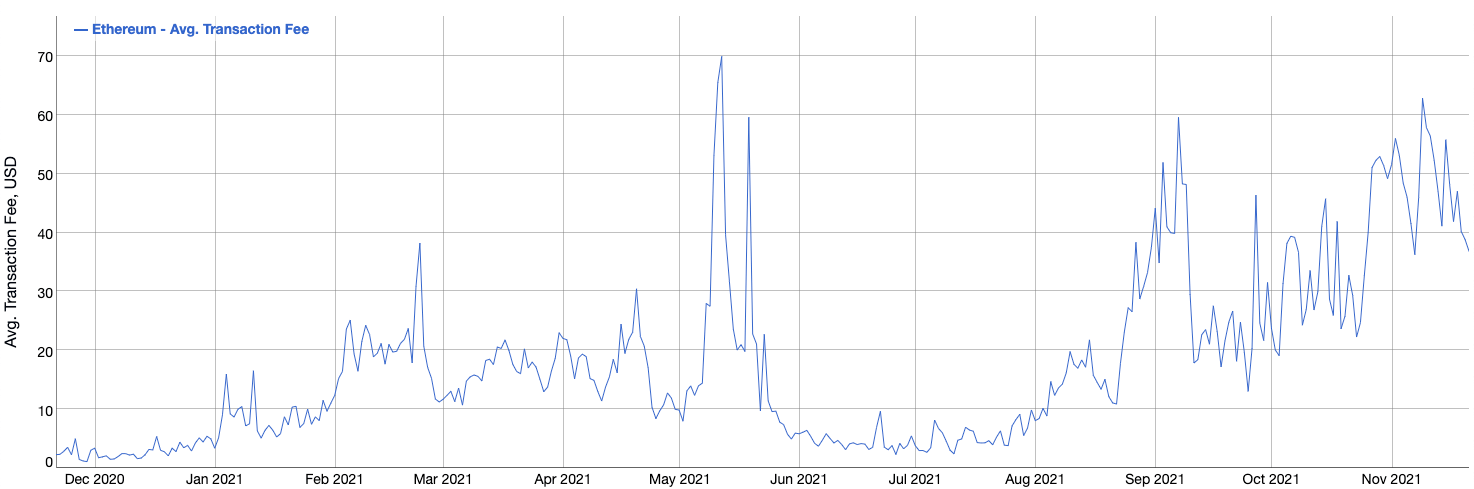

With the average transaction fee on Ethereum inching dangerously close to its all-time high, the network has become increasingly unattainable for the average user.

And while the price of transactions has managed to consolidate around $36, data from BitInfoCharts showed that the average transaction fee on Ethereum cost over $62 at the beginning of November.

This has pushed a record number of users to the network’s Layer 2 solutions, which offer drastically lower fees and much faster transaction finality.

According to data analytics platform L2BEAT, the total value locked (TVL) in Ethereum’s Layer2 solutions has reached its all-time high, surpassing 1.4 million ETH. At current prices, this equates to around $6.13 billion.

Arbitrum accounts for the largest share of the Layer2 market, capturing just over 43% of the TVL, worth around $2.67 billion. dYdX ranks second with a 15% of market share worth $975 million, while the newly launched Boba Network came in third with $863 million.

The more well-known Loopring, Optimism, and ZKSwap V2 have $580 million, $461 million, and $218 million in TVL, respectively.

The data seems to support the overall market sentiment towards Ethereum. Even the industry’s most prominent investors have been vocal about Ethereum’s fee problem, with many actively exploring engaging with its competitors such as Avalanche.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Join now for $19/month Explore all benefits

Like what you see? Subscribe for updates.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Polkadot

Polkadot  Hedera

Hedera  Hyperliquid

Hyperliquid  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  Monero

Monero  MANTRA

MANTRA  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Ethena

Ethena