- On-chain profit metrics have picked up as the Bitcoin price has risen

- Net realised profits have been positive for 17 days, the longest streak in a year

- 74% of the Bitcoin supply is in profit, three months after it dipped below 50% after FTX collapsed and the Bitcoin price fell towards $15,000

- Volatility has picked up but it is the thin liquidity which is really helping Bitcoin make a run

- It’s been a great quarter for investors, but there remains peril, writes our Analyst

Bitcoin had an unforgettable year in 2022 for all the wrong reasons, a collapse in price coinciding with several ugly scandals that rocked the cryptocurrency market at large.

Thus far this year, however, it has been bouncing back. Up 71% as we close out Q1, it is trading north of $28,000 for the first time since June 2022.

Looking into on-chain metrics, the positive sentiment is clear.

Net realised profit at one-year highs

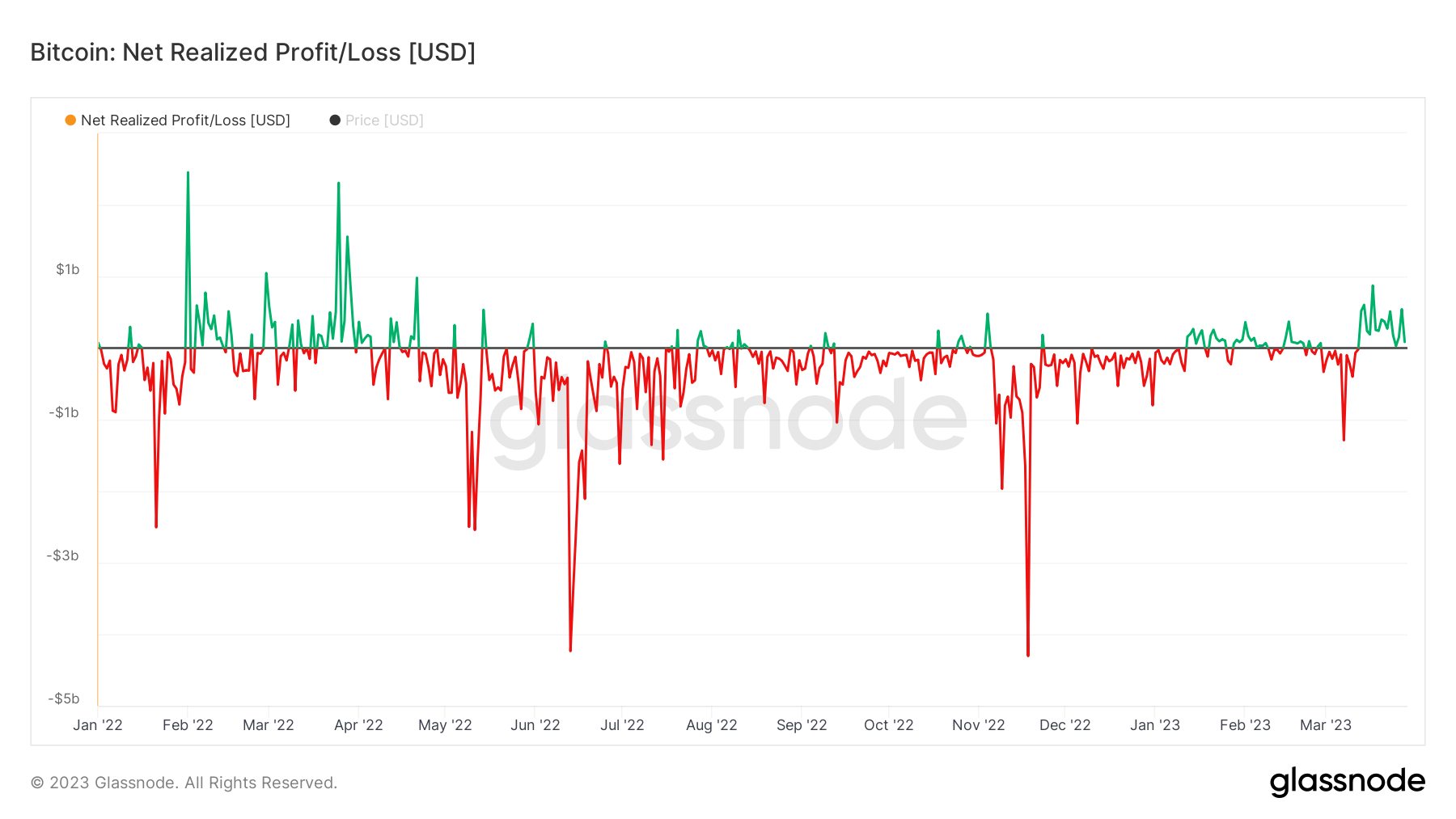

The net realised profit of all coins, that is the difference between the price at which a coin moves and the last price it moved at, is on its longest positive run since this time last year, in March 2022.

For seventeen days now, the net realised profit has been positive. In other words, coins are moving at prices higher than what they were bought at (or the price at which they last moved).

There was an 18-day positive streak in late March / early April last year, and beyond that, we need to go back to Q4 of 2021 to see such a streak, when Bitcoin was trading at all-time highs.

Granted, the size of the profits over the last two weeks have not been as outsized as we have seen in previous periods, but the very fact that it is a positive run after the year Bitcoin has had is notable.

Three quarters of the supply is in profit

Another way to see how much things have changed is that three-quarters of the total supply is currently in profit.

Just before Christmas, I reported when this figure dipped below 50%, meaning for the first time since the brief flash crash at the start of COVID in March 2020 when the financial markets all went bananas, the majority of the Bitcoin supply was loss-making.

Three months later, the picture is a lot brighter, with 74% of the total supply now in profit.

Liquidity remains low as stablecoins fly off exchanges

Interestingly, this rise in prices and profit positions is all occurring at a time when liquidity is extremely low in the market.

In a deep dive yesterday, I compiled an analysis showing that the balance of stablecoins on exchanges has fallen 45% in the last four months and is currently the lowest since October 2021.

Perhaps that is not a coincidence. The markets are ultra-thin right now, and Bitcoin, which is volatile at the best of times, has found it easier to move aggressively as a result. This also helps explain why it has outperformed the stock market so significantly, despite being so tightly correlated with it recently (although some believers are arguing it is due to banking failures pushing people to Bitcoin, but that feels like a reach).

Then again, Bitcoin is going to Bitcoin, and its recent volatility is not anything to write home about when looking historically, even if it has picked up compared to the relatively serene period post FTX collapse.

To wrap this up, it’s been a superb few months to kick the year off for Bitcoin, which is a welcome reprieve for investors who got absolutely battered last year. On-chain profit metrics have come right up as sentiment improves and prices jump.

But there is also low liquidity which is helping it run-up, while the wider economy presents plenty of uncertainty. Sure, it’s a great start, but it’s not out of the woods yet.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Toncoin

Toncoin  Sui

Sui  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Pepe

Pepe  Polkadot

Polkadot  LEO Token

LEO Token  Stellar

Stellar  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  MANTRA

MANTRA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  dogwifhat

dogwifhat  Monero

Monero  Stacks

Stacks  OKB

OKB  Filecoin

Filecoin