The following is a guest post by web3 strategist Toby Fan, and Aly Madhavji, Managing Partner at Blockchain Founders Fund.

Social media has forever changed how we view and manage financial crises. Banks need a way to tactfully handle what is now being coined “social media risk.” Viral games of the telephone played at an exponential scale allow very little time for nuanced investigation or thoughtful reaction. By incorporating social media into overall risk frameworks, banks can help shape the narrative and public perception through pre-emptive and transparent customer engagement. Aggregation and monitoring tools are becoming increasingly important to monitor for early signs of trouble and navigate this landscape of rapid information ingestion and uncontainable spread.

Recent collapses of some of the largest crypto-associated banks ($SIVB, $SI, $SBNY) have sent jitters through tech, crypto, and banking sectors. Many startups were left wondering whether they could meet payroll obligations, while regional banks caught whiffs of a bank run for the first time since the subprime mortgage crisis.

Crowd-sourced interpretations of information regarding $SIVB’s financial health gave depositors a crash course (no pun intended) in Game Theory 101 — putting many startups and tech companies in the shoes of a prisoner on a textbook payoff matrix: withdraw deposits now or risk holding the bag.

How It All Went Wrong

On Mar 8, Moody’s downgraded $SIVB bank deposit and issuer ratings. On the same day, $SIVB announced a proposed sale of $2.25bn in stock, along with a balance sheet repositioning showing a $1.8bn realized loss from selling fixed-income assets that had lost significant market value with the recent hike in Fed rates.

Like many bank runs before this one, depositors, many of them VC-funded and crypto companies, wasted no time playing a game of chicken. Within a day or two, $SIVB balance sheets were drying up and the stock was, tumbling — by Mar 10, regulators had closed $SIVB and taken control of its deposits. A slew of regional banks followed suit, taking massive drawdowns in market value ($FRC, $WAL, $CMA, $ZION) before recovering on the news of an FDIC backstop in deposit insurance. And while there have been similar instances of bank runs in financial history, what made this one so exceptional was the speed at which it happened and the medium through which the contagion spread.

Financial contagion went viral over social media. Social media platforms like Twitter dominate the crypto and startup space. The velocity of information spread (as well as different interpretations) is an order of magnitude higher than traditional news or linear media. Even regulators have acknowledged the impact of social media on the most recent crisis. House Financial Services Committee chairman Patrick Henry admitted “this was the first Twitter fueled bank run”.

Some may remember Washington Mutual, which experienced similar deposit outflows during the 2007-2008 financial crisis. Like $SIVB, WaMu held over $188bn in deposits but began to write down significant losses due to defaulted mortgages. When Lehman Brothers collapsed on Sept 15, 2008, WaMu depositors began withdrawing in droves – taking out $16.7bn from checking and savings accounts (~11% of total deposits) over ten days. The speed of the outflows was unprecedented at the time, ultimately leading to WaMu’s bankruptcy. Contrast this with $SIVB – where depositors attempted to withdraw $42bn in a single day, equivalent to 25% of total deposits.

This time around, it wasn’t just the velocity of information that was unprecedented but the proximity of social distance (between Twitter followers, friends, and subreddits) that helped the news spread like wildfire. Whereas before in traditional media, news was spread from centralized parties to the masses (a one-to-many transaction) — social media is a many-to-many transaction, and the social distance between sources is much closer, lending these assets a level of social proof that hasn’t always been present in traditional media. And once the information reaches critical mass, it becomes truth as the inertia of the spread causes the story to become ubiquitous. As they say, a person’s perception is their reality.

The Power Of Viral Narratives

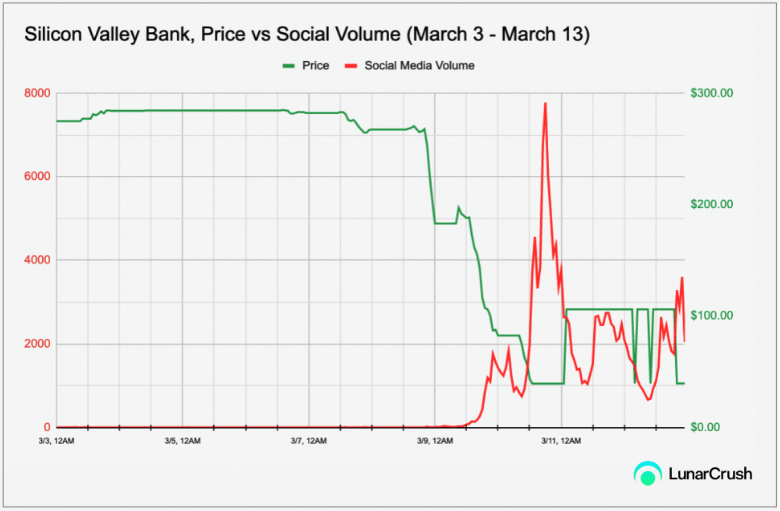

By monitoring aggregate social media data, you can see examples of this rapid spread, even early signals of it. Take, for instance, Silicon Valley Bank:

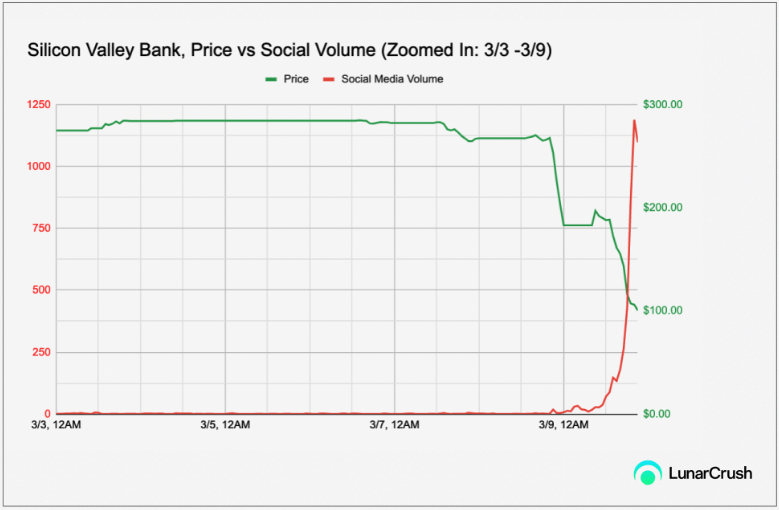

In red, we have social media volume (individual tweets/posts/news articles across Twitter, Reddit, and 1000+ news sources) and the $SIVB stock price in green. You can see an after-the-fact spike in social media volume. However, zooming in further, you can start to see growth in chatter before the parabolic spike in social media volume (signaling the powerful velocity of social media reach):

Zooming in even further into the days leading up to $SIVB’s significant drawdown, you can see the whispers of industry insiders and analysts before a large relative spike right when the stock begins to drop. By doing a bit of additional investigating around the time the social media activity started to pick up, an analyst may have been able to glean hidden gems like this by Matt Harney:

Lower fundraising

+

Cash flow negative businesses (on average)

=

Liquidity draining:

🆘negative $57b in Total Client Funds in 2022 from startups banking at Silicon Valley Bank

– source = latest MS “Venture Vision” pic.twitter.com/ZMD7miBuyE

— Matt Harney (@SaaSletter) March 7, 2023

or this one by Rusil Sarka that may have raised early red flags for any party involved with the bank:

When there is unusual outflow of deposits, the bank needs to sell their assets to meet the withdrawals that is when bonds needs to be marked-to-market.

Same happened to Silicon Valley Bank in 2021, when rates were low. It took $91 billion of that money and invested it in mortgage— Rusil (@rusilsarkar) March 6, 2023

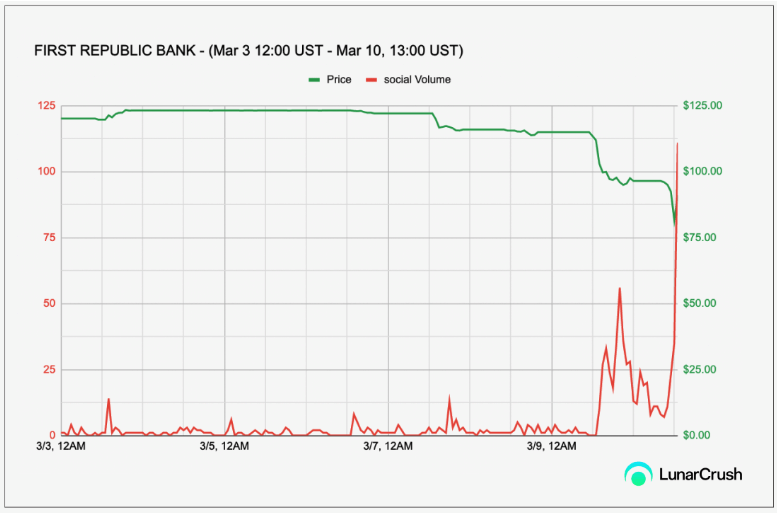

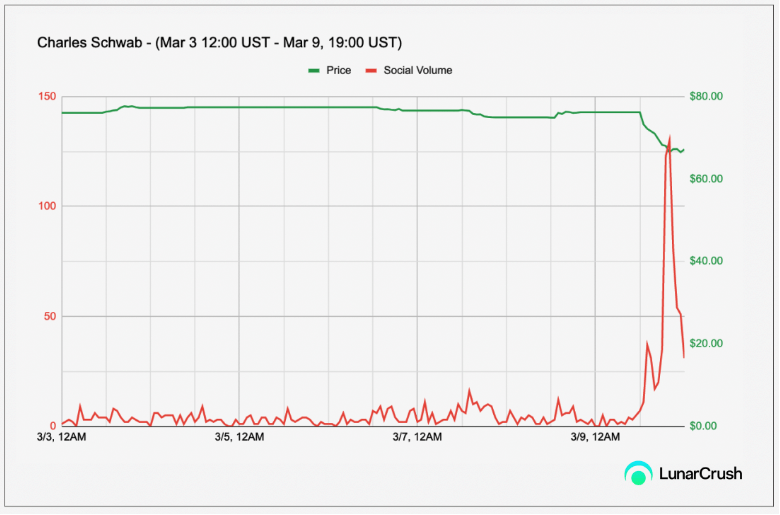

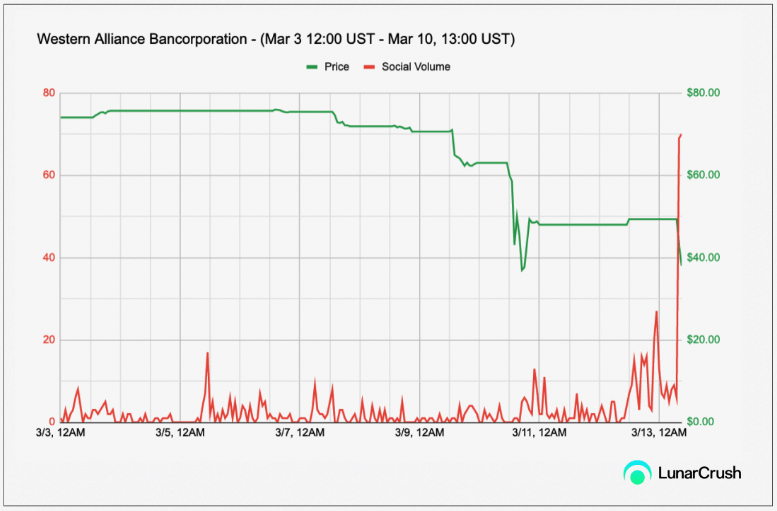

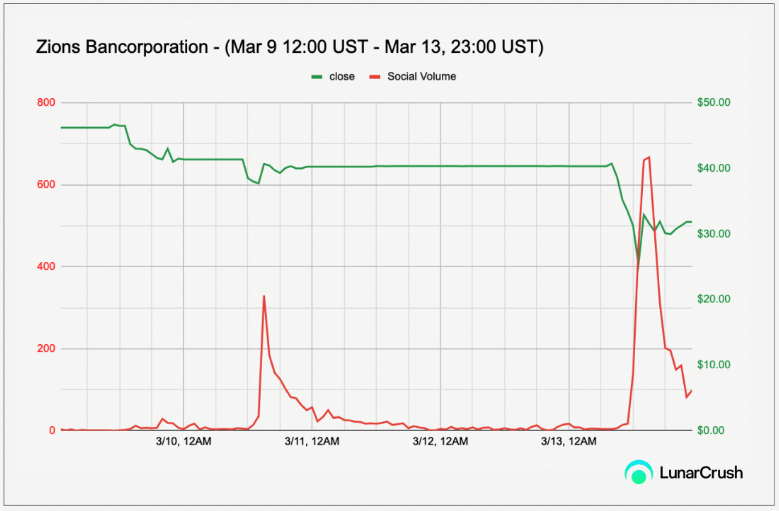

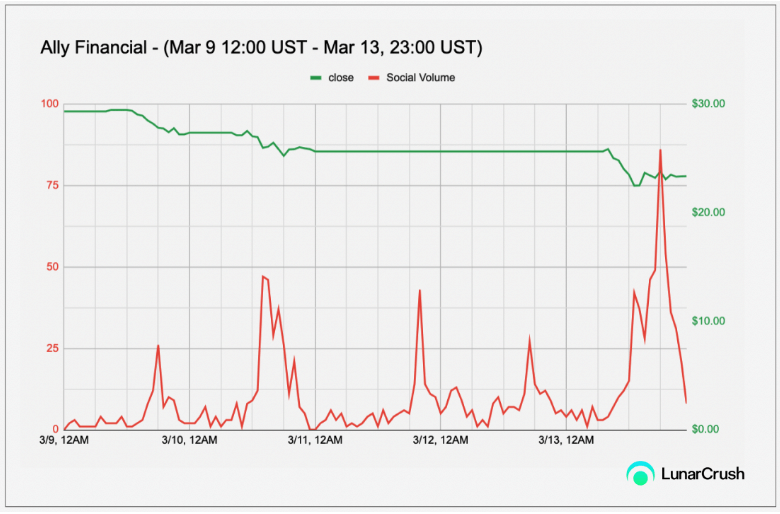

Similar patterns can be found with the stocks of regional banks affected by the fallout of $SIVB, namely banks like First Republic, Western Alliance, Comerica, Zions, and PacWest — who experienced up to 65% drawdowns in a day. All of these large drawdowns were preceded by parabolic rises or sudden upticks in social volume, demonstrating the speed and conviction of social media contagion:

Social Media Is A Real Financial Risk

Monitoring for outsized or abnormal increases in social chatter can help catch early whiffs of quiet (but soon to be not quiet) developments. These large deviations in social activity often carry with them self-fulfilling tidbits of alpha. By capturing mass attention and spurring action in a short period of time — a game theoretic dynamic is often generated where the first person to act usually has the most to gain (or the least to lose) and makes action or participation more attractive for the subsequent party.

“Social media has accelerated the spread of financial information, and with it, the potential for market contagions. Banks need to recognize and manage ‘social media risk’ as part of their overall risk frameworks. Tools like Moonrise by LunarCrush can help monitor and track early warning signs, enabling financial institutions to shape narratives and engage with customers more effectively,” said Joe Vezzani, CEO of LunarCrush.

One thing is clear the dust settles on a rough week in the banking sector. Banks need to meet customers where they are and manage narratives and crises quickly in their preferred medium. A good communication strategy may have helped stem the fallout, but the key would have been first to catch these narratives early in their development. By using intelligent aggregation tools and maintaining a strong, transparent social media presence, industry participants can hopefully be quicker and better prepared to react and manage these crises in the future.

The data here is courtesy of the LunarCrush API, a social media monitoring engine that provides access to accurate, high-latency data on over 4000+ crypto assets, 300+ NFT collections, and 700 stocks.

Author(s):

Toby Fan, Web3 Strategist Twitter | LinkedIn:

Toby Fan, Web3 Strategist Twitter | LinkedIn:

Toby Fan is the Head Web3 Strategist at LunarCrush, which provides aggregated real-time social media data on crypto, NFT, and traditional equities. He is a graduate of UC Santa Cruz, where he double majored in Econometrics and Information Systems and helped lead departmental research on commodity market dynamics in China and the US. Toby is also an active contributor for CoinMonks (https://medium.com/@tobyornottoby) and a member of the BlockBros DAO. Aly Madhavji, Managing Partner at Blockchain Founders Fund and LP at Loyal VC & Draper Goren Holm Twitter | LinkedIn

Aly Madhavji, Managing Partner at Blockchain Founders Fund and LP at Loyal VC & Draper Goren Holm Twitter | LinkedIn

Aly Madhavji is the Managing Partner at Blockchain Founders Fund, which invests in, and venture builds top-tier startups. He is a Limited Partner on Loyal VC and Draper Goren Holm. Aly consults organizations on emerging technologies, such as INSEAD and the UN, on solutions to help alleviate poverty. He is a Senior Blockchain Fellow at INSEAD and was recognized as a “Blockchain 100” Global Leader by Lattice80.

Disclosure: Blockchain Founders Fund is an early-stage investor in LunarCrush. None of the information here is meant to be construed as financial advice.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Toncoin

Toncoin  Sui

Sui  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Pepe

Pepe  Polkadot

Polkadot  LEO Token

LEO Token  Stellar

Stellar  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  POL (ex-MATIC)

POL (ex-MATIC)  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  MANTRA

MANTRA  dogwifhat

dogwifhat  Arbitrum

Arbitrum  Monero

Monero  Stacks

Stacks  OKB

OKB  Filecoin

Filecoin