Bitcoin (BTC) has made significant strides this quarter because it set a new all-time high (ATH) price of $66,900 on October 20 after 189 days of waiting. Nevertheless, this steam has dried up a bit because the top cryptocurrency has been consolidating between the $60K and $63K ever since.

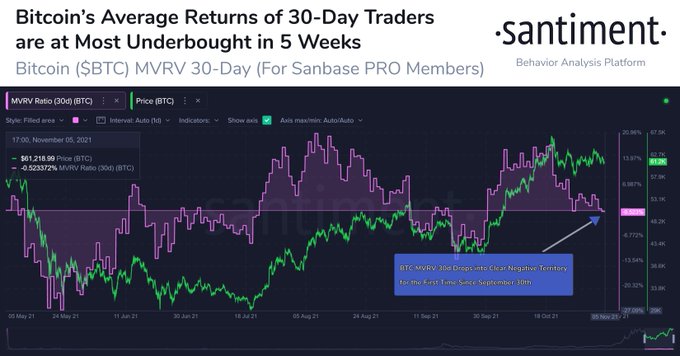

Therefore, this pullback is making Bitcoin underbought, as acknowledged by Santiment. The market insight provider explained:

“Bitcoin’s 30-day MVRV, measuring the returns of 30-day trading addresses, indicates that it’s crept into negative territory for the first time since September 30th. For bulls, this is a great sign, indicating a mild signal of BTC being underbought.”

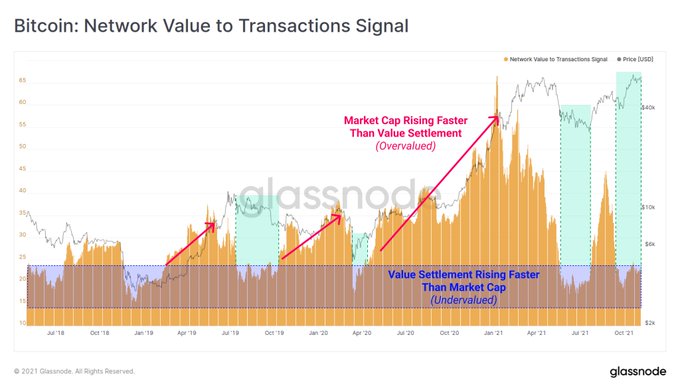

Glassnode echoed these sentiments and noted that Bitcoin is undervalued at the current level. The crypto analytic firm stated:

“Bitcoin transaction value settlement is rising substantially relative to the Market Cap. This has driven the NVT signal metric lower, indicating that even at $61.8k, BTC is historically undervalued relative to utilization as a value settlement layer.”

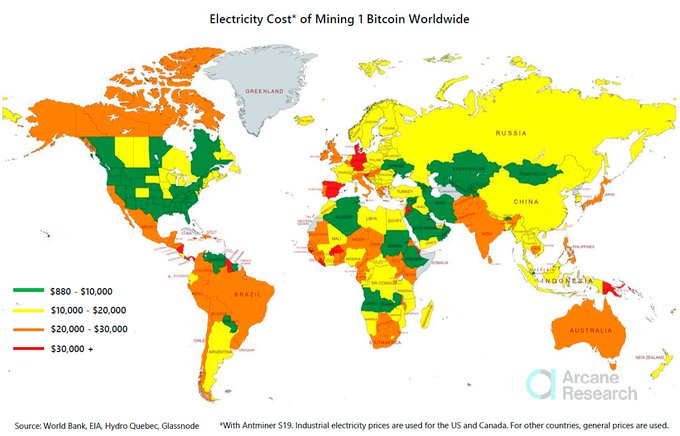

Bitcoin mining has shifted to regions with the lower electricity cost

According to crypto insight provider Arcane Research:

“The countries with the lowest electricity cost of Bitcoin mining are spread relatively evenly around the globe, but we see concentrations in the Middle East, Central Asia and North America.”

A study by the Cambridge Centre for Alternative Finance ranked the United States as the largest Bitcoin mining hub with 35.4% of the global hash rate as of the end of August.

The study noted that Kazakhstan and Russia were positioned in the second and third places, respectively. On the other hand, China’s dominance which once peaked at a high of 75% back in 2019, had hit zero percent as of July, given that Bitcoin mining activities had become unwelcome on Chinese soil.

Image source: Shutterstock

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Toncoin

Toncoin  Stellar

Stellar  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Sui

Sui  NEAR Protocol

NEAR Protocol  Pepe

Pepe  LEO Token

LEO Token  Litecoin

Litecoin  Aptos

Aptos  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Render

Render  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Bittensor

Bittensor  Ethena USDe

Ethena USDe  Bonk

Bonk  Arbitrum

Arbitrum  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Filecoin

Filecoin  Cosmos Hub

Cosmos Hub  Celestia

Celestia  MANTRA

MANTRA  OKB

OKB