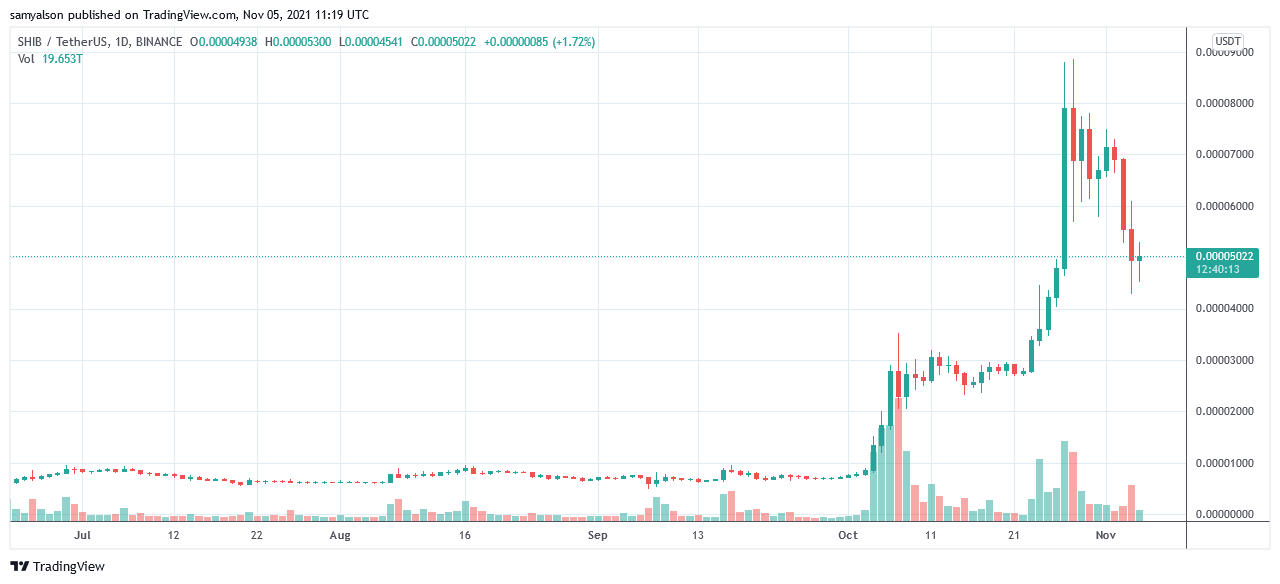

Shiba Inu has been making moves of late, hitting an all-time high of $0.00008876 last week and crashing the top ten to leapfrog Dogecoin in the process. However, since then, momentum for the divisive meme coin has slowed considerably, triggering a sell-off that bottomed at $0.00004264 on Thursday – a 52% drop in seven days.

Given the severity of the drop, and at a time when large caps including Bitcoin have been largely stable, critics are calling this the turning point for worse to come. But are they right?

Shiba Inu crashes back down to Earth

Shiba Inu’s price performance in October stunned naysayers by closing the month up 730%. Analysts say this was mainly due to rumors about Robinhood and Kraken listing the $SHIB token. But, so far, these rumors have failed to materialize.

This week, things took a turn for the worse when a Shiba Inu whale moved billions of $SHIB tokens sparking fears of a large-scale exit. What’s more, the incident highlighted the issue of whale dominance in the Shiba Inu ecosystem.

As October came to a close, it emerged that one trader had invested $8,000 into $SHIB last August, which has since grown to a colossal $5.7 billion.

Tom Robinson, the co-founder of Elliptic, a crypto forensics blog, commented that this same investor is responsible for moving the billions of dollars of tokens, which he calculates at $2.78 billion in total over four transactions.

“It looks like there were four transactions out of that account yesterday, each sending $695 million of SHIB to a different account — so a total of $2.78 billion.

Whoever it is purchased the SHIB on Uniswap about a year ago, for not very much.”

$SHIB is whale dominated

Address analysis shows the top ten holders currently control 67% of the Shiba Inu tokens. This is slightly down from October 30, when the figure stood at 72%.

Critics have jumped on this as further evidence of poor fundamentals. In this case, with regards to the concentration of tokens in just a few hands.

Crypto investor Aaron Brown said legitimate crypto projects have an underlying solid use case, and they do not rely on hype or “who holds how much of it” to move the price. Brown raised concerns that $SHIB’s concentration of ownership points to “a rigged game.”

“But for crypto with no underlying economics—whose value is determined only by speculation—concentrated ownership suggests a rigged game.”

Robinhood CEO Vladimir Tenev dismissed the possibility of listing $SHIB, citing regulatory scrutiny as the reason. And while Kraken said they would list the token if they got 2,000 likes on a tweet, they have since gone cold on the idea despite getting 80,000 likes.

With meme coins taking a pounding these past few days, it’s time to ask whether the hype train has expired.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Join now for $19/month Explore all benefits

Like what you see? Subscribe for updates.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Toncoin

Toncoin  Sui

Sui  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Pepe

Pepe  Polkadot

Polkadot  LEO Token

LEO Token  Stellar

Stellar  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  MANTRA

MANTRA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  dogwifhat

dogwifhat  Arbitrum

Arbitrum  Monero

Monero  Stacks

Stacks  OKB

OKB  Filecoin

Filecoin