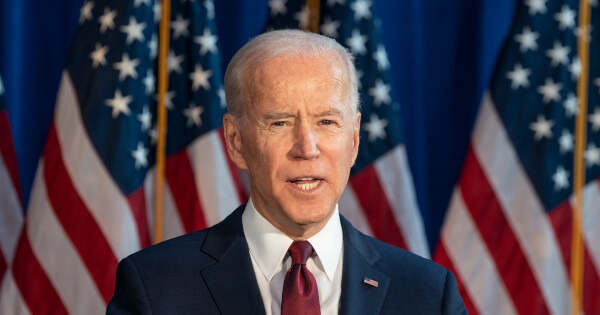

President Joe Biden’s upcoming budget proposal includes a few surprises for crypto traders and investors, as it seeks to raise around $24 billion through changes to crypto tax treatment. The proposal includes a crackdown on crypto wash sales, which are not currently subject to the same rules as stocks and bonds under current wash sale rules, and a doubling of the capital gains tax for certain investors.

One of the proposals aims to eliminate the tax-loss harvesting strategy used by crypto traders. This strategy allows traders to sell assets at a loss for tax purposes before immediately repurchasing them. The proposal seeks to put an end to this strategy, which is not permitted when stocks and bonds are involved, by applying the same wash sale rules to digital assets. If implemented, this change could have significant implications for many crypto holders who entered the market during the 2021 market peaks and are currently suffering from heavy losses.

The Biden budget proposal also seeks to raise the capital gains tax rate for investors making at least $1 million to 39.6%, nearly double the current rate of 20%. This change would only apply to a certain subset of investors, according to a Bloomberg report.

These proposed changes to crypto tax treatment are part of Biden’s plan to reduce the deficit by nearly $3 trillion over the next decade. The budget proposal also includes plans to raise income levies on corporations and wealthy Americans.

The crackdown on crypto wash sales and the proposed doubling of the capital gains tax rate have sparked concerns among crypto traders and investors. However, some experts believe that these changes are an inevitable consideration for the U.S., as it would put it on par with other jurisdictions such as Canada and Australia, where crypto wash sales apply.

Overall, the Biden budget proposal represents a significant shift in the government’s approach to regulating the crypto industry. If these proposals are implemented, they could have far-reaching implications for the industry and its participants.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Sui

Sui  Pepe

Pepe  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Internet Computer

Internet Computer  Cronos

Cronos  USDS

USDS  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Render

Render  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena USDe

Ethena USDe  Arbitrum

Arbitrum  Cosmos Hub

Cosmos Hub  Bonk

Bonk  Filecoin

Filecoin  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  MANTRA

MANTRA  dogwifhat

dogwifhat  Celestia

Celestia