Paxos faces SEC lawsuit over BUSD

On Feb. 13, the U.S. Securities and Exchange Commission (SEC) enforcement division issued a Wells notice to Paxos, ordering the company to stop minting the Binance USD (BUSD) stablecoin.

The notice followed an SEC investigation into Paxos and its relationship with Binance, whose stablecoin it issued, which concluded that the company violated securities laws. However, a Wells notice doesn’t necessarily mean that the SEC will take enforcement action against Paxos. For the SEC to pursue this matter further, its five commissioners must vote to authorize any enforcement litigation or settlement.

According to the notice, the Department of Financial Services (DFS) ordered Paxos to stop minting BUSD due to “several unresolved issues related to Paxos’ oversight of its relationship with Binance.” There were no further explanations of these issues — the CEO of Binance, Changpeng Zhao, said he was only aware of the enforcement action through the media.

Paxos is expected to submit a response to the Wells notice and present its case as to why it should not be sued. In the meantime, the company must stop minting new BUSD and enable all customers to redeem their BUSD for U.S. dollars. Paxos has maintained that it has and always will back all BUSD tokens 1:1 with U.S. dollar-denominated reserves.

BUSD is the only stablecoin backed by long-term maturity assets

These dollar-denominated reserves, however, are far from the norm. Paxos’ unaudited BUSD holdings report shows that the stablecoin is backed mainly by long-term maturity assets. On Feb. 10, the company’s report showed 16.14 billion outstanding BUSD tokens and an equal or higher balance of assets held in custody.

Just under $3.1 billion is held in short-term U.S. Treasury Debt, which will mature by mid-April 2023.

On Feb. 10, $12.5 billion of Paxos’ $16.4 billion BUSD reserves were held in U.S. Treasury Reverse Repurchase Agreements. Only two repurchase agreements mature in 2023 and 2024 — the rest of the $12.5 billion have maturity dates ranging from 2026 to 2052.

$1 billion worth of stablecoins leave Ethereum

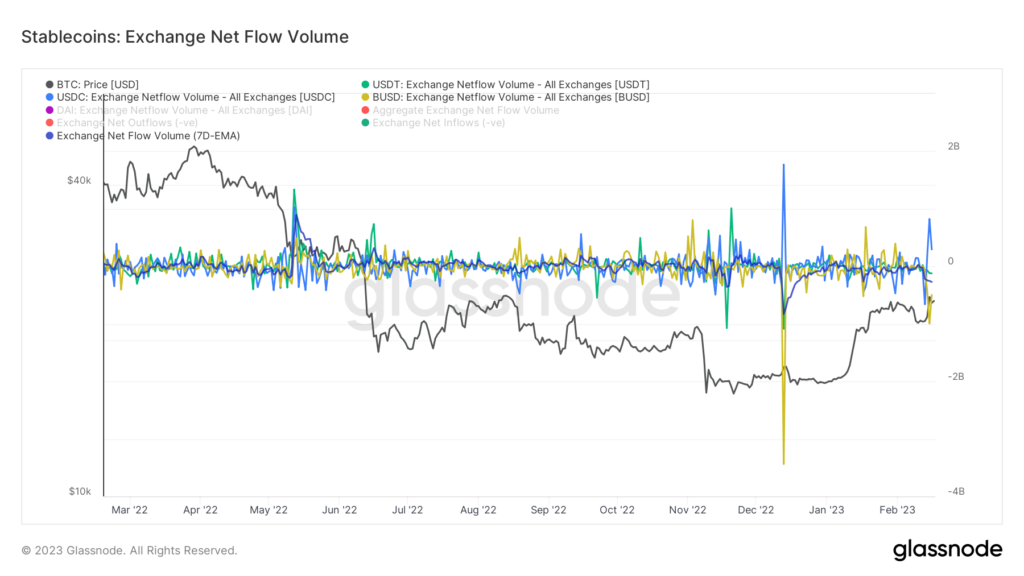

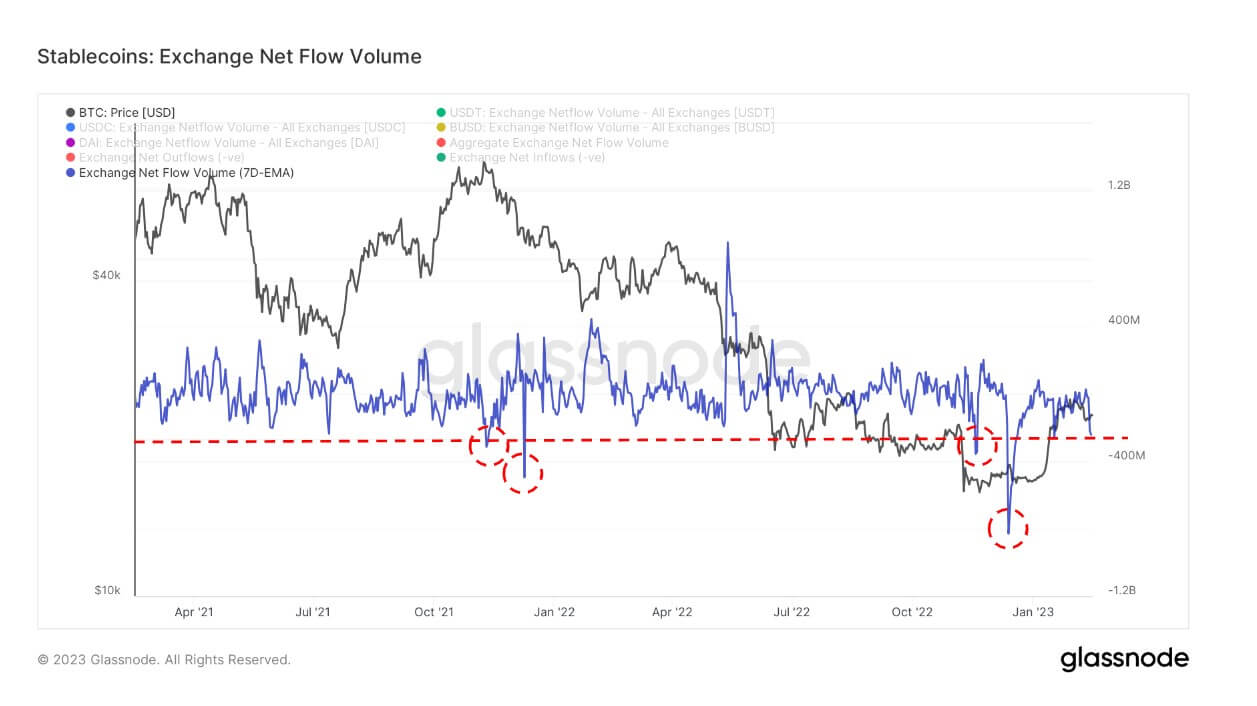

The scrutiny over BUSD caused unprecedented FUD in the market. This was evident in the massive outflows of stablecoins from exchanges – since Feb. 13, over $1 billion worth of various stablecoins left the Ethereum network.

The majority of this loss can be attributed to BUSD, which saw the total number of outstanding tokens decrease by around 700,000 between Feb. 10 and Feb. 14.

This is the fifth-largest outflow of stablecoins on Ethereum in the past two years. And while the $271 billion in outflows recorded on Feb. 16 are a fraction of the $830 billion recorded on Dec. 13, it still shows the impact the SEC’s probe into Paxos has on the market.

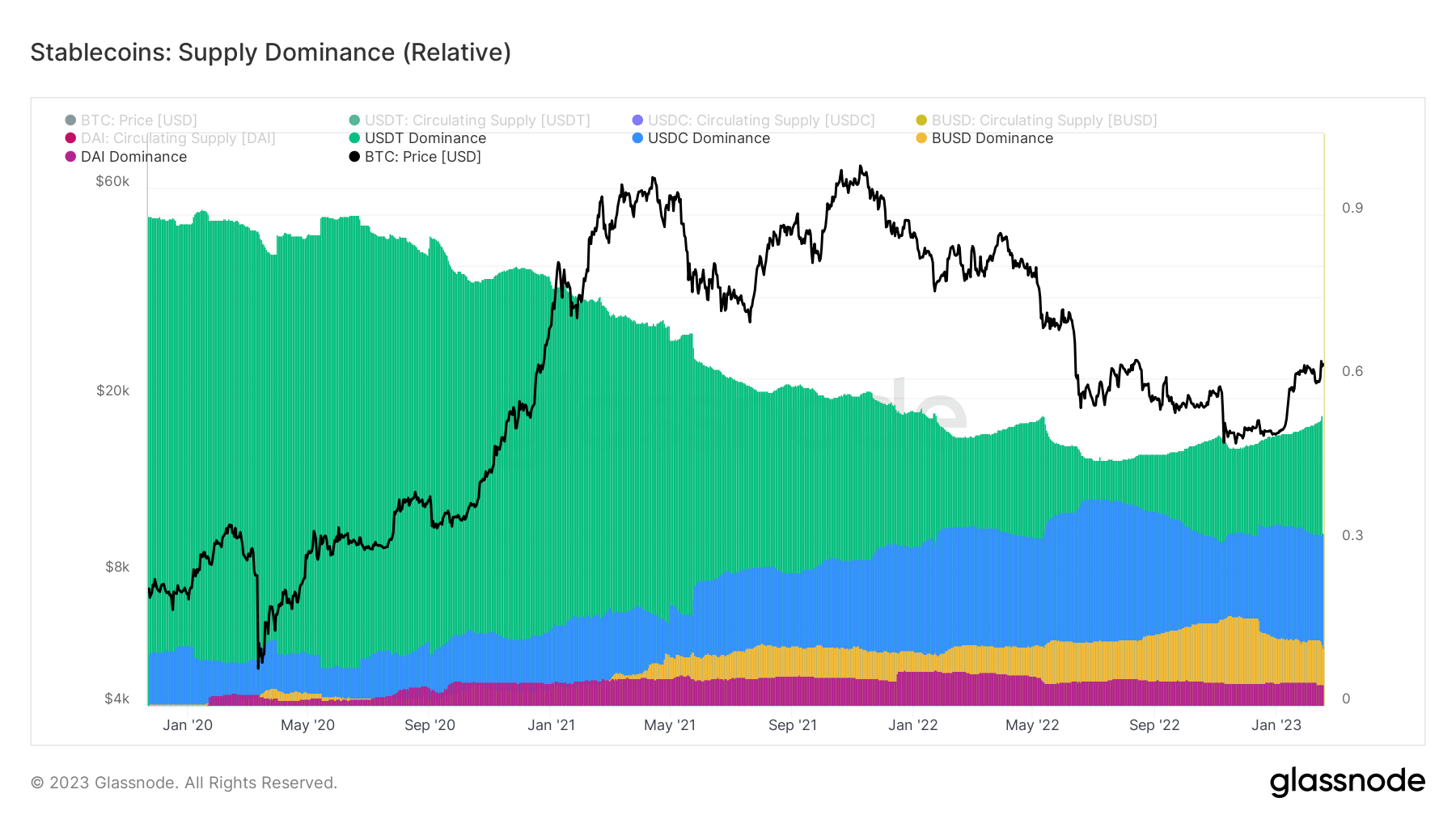

BUSD sees its dominance decrease

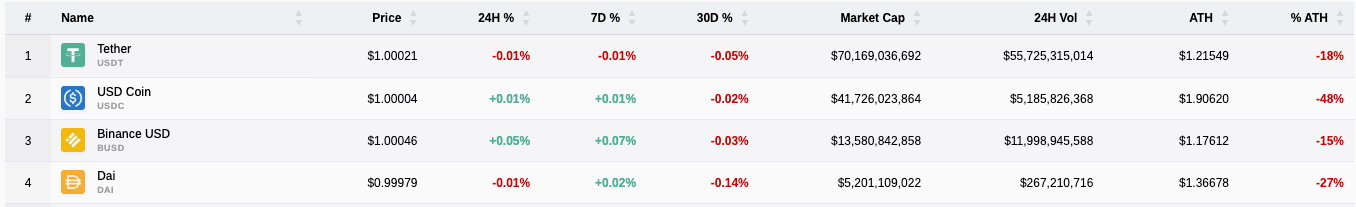

Being the third-largest stablecoin by market cap, any changes in volume BUSD experiences are bound to impact the rest of the stablecoin sector profoundly. The coin has decreased its dominance from 17%, recorded in November 2022, to 12% on Feb 14.

The same goes for the top-ranked stablecoins, USDC and DAI, both of which have seen decreased market dominance since the beginning of the year.

A reverse trend can be observed in USDT. Tether’s stablecoin has seen its dominance increase since November 2022, surpassing 53% on Feb 15, 2023.

Changpeng Zhao, the CEO of Binance, said that the SEC’s order to Paxos will cause BUSD’s market cap to decrease over time. While Paxos will continue to service the product, the market expects the redemptions will continue to deplete BUSD’s supply even further until a decision from the SEC is made.

Until then, we could see USDT’s market cap and sector dominance increase even further. The largest stablecoin by market cap, USDT, has already seen a notable inflow since SEC’s probe into Paxos.

Tether’s stablecoin saw a significant increase in liquidity on Binance last September when the exchange delisted USDC, USDP, and TUSD-denominated pairs from the platform. The move aimed to improve price discovery and the overall liquidity on the exchange. However, many saw it as Binance’s attempt at achieving vertical integration, as most of its trading pairs – and the most liquid ones — were tied to BUSD.

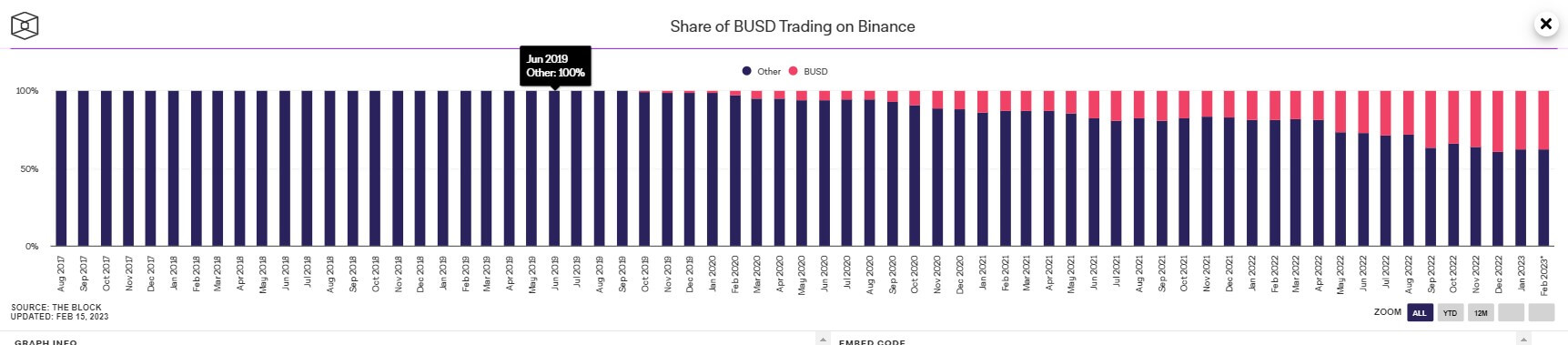

The share of BUSD pairs on Binance has been growing steadily since its launch in late 2019 but has seen notable increases since the exchange delisted USDC, USDP, and TUSD.

As BUSD’s market cap declines, we can expect the share of BUSD pairs on the exchange to drop even further. And while there hasn’t been a notable increase in the share of USDT pairs on the exchange, there is a chance it could increase by the end of the quarter.

Binance’s troubles with maintaining stablecoin peg reserve

The SEC’s enforcement action against Paxos is set to have a negative effect on Binance. The SEC’s notice cited Paxos’ relationship with the exchange as the reason behind the enforcement. And while Binance isn’t based in the U.S. and thus isn’t subject to U.S. regulation, targeting BUSD has certainly shaken the market’s confidence in the exchange.

Since it witnessed historical withdrawals in November 2022 following the FTX collapse, Binance has been under heavy scrutiny. In January this year, the exchange acknowledged it failed to maintain the reserves of Binance-peg BUSD, a stablecoin it issues on other blockchains whose value is pegged to the Paxos-issued BUSD on Ethereum.

Data compiled by blockchain analytics company ChainArgos and analyzed by Bloomberg showed that the Binance-peg BUSD was frequently undercollateralized between 2020 and 2021. On three separate occasions, the gap between BUSD reserves held by Binance and the supply of Binance-peg BUSD surpassed $1 billion.

The exchange has acknowledged its past troubles in maintaining the reserve for Binance-peg BUSD and said it has since improved the process with enhanced discrepancy checks to ensure the token is backed 1:1 with BUSD.

BNB begins slow recovery

Binance’s native token, BNB, hasn’t been immune to the Paxos news.

The token saw its price drop by over 11% in less than 24 hours as investors mulled over the prospect of increased regulatory scrutiny into Binance. However, the slip in confidence seems to have been short-lived, as BNB regained most of its losses on Feb. 16, jumping by over 9% since the Feb. 13 news.

Conclusion

The full effects of the SEC’s probe into Paxos are yet to be felt.

If the SEC decides to take enforcement action against Paxos and take it to court over securities law violations, the market could enter into a period of unprecedented volatility. Many analysts have argued that BUSD doesn’t pass the Howey Test, a set of criteria set by the SEC to determine whether an asset classifies as a security. If the Commission continues to pursue the matter in court, it could set a precedent for the rest of the crypto industry and threaten all other major stablecoin issuers.

Increased regulatory uncertainty could destabilize the market, which has just begun a slow recovery from the collapse of FTX. It could also drastically change the crypto landscape in the U.S., as many companies could seek to set their roots in a more regulatory-friendly environment.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Toncoin

Toncoin  Sui

Sui  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Pepe

Pepe  Polkadot

Polkadot  Stellar

Stellar  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  MANTRA

MANTRA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  dogwifhat

dogwifhat  Arbitrum

Arbitrum  Monero

Monero  Stacks

Stacks  Filecoin

Filecoin  OKB

OKB