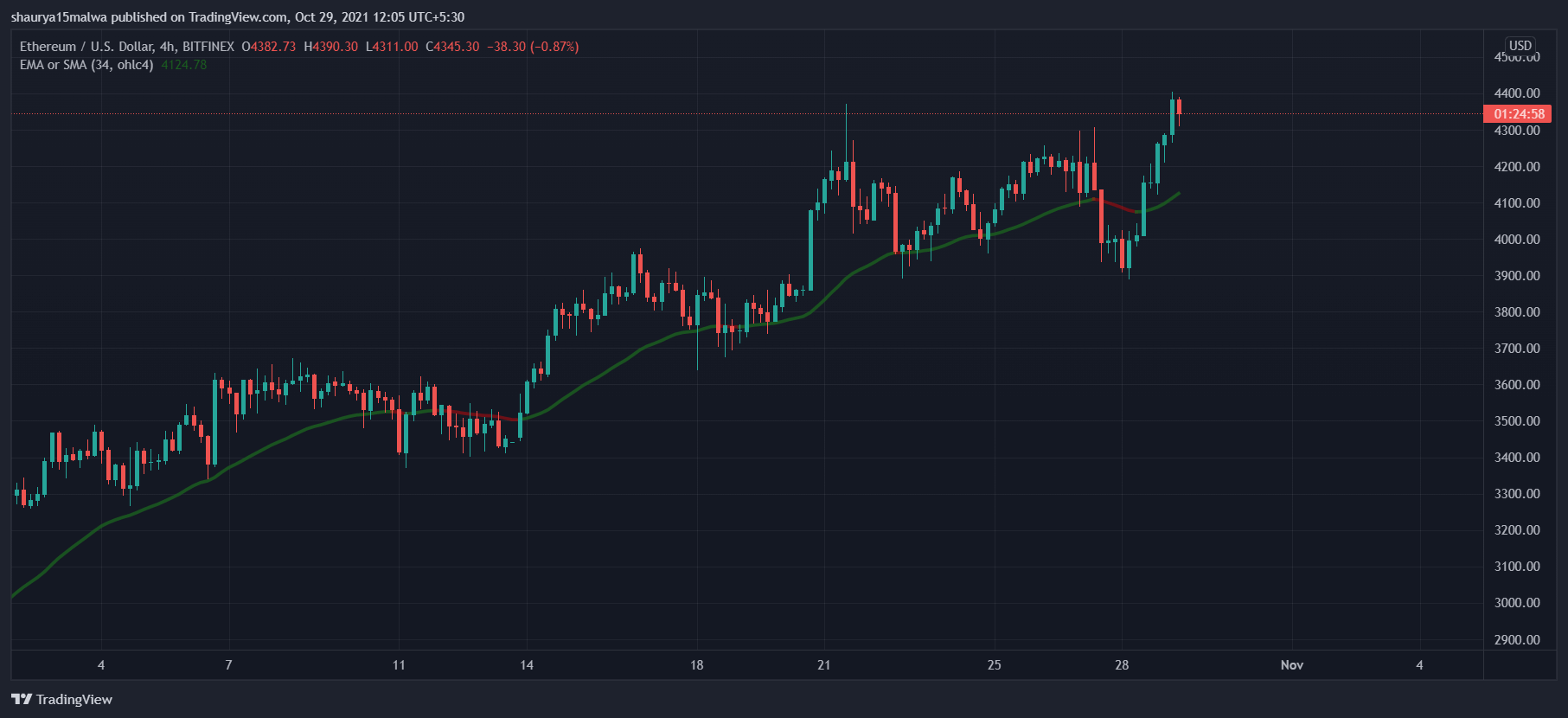

Ethereum temporarily traded above $4,400 this morning, breaching its previous all-time high of $4,390 before resistance saw it fall to the $4,313 level.

ETH trades above its 34-period exponential moving average at press time and forms higher lows and higher highs, showing a bullish trend from the $3,000 level remains intact.

Technicals and fundamentals power the Ethereum ascent

The network is valued at over $511 billion at press time, with several fundamental and technical developments preceding today’s milestone.

On the technical side are the deflationary EIP-1559 proposal and ETH 2.0 staking feature, which went live in the past two years. The former burns a portion of network fees each time an Ethereum transaction is done, while the latter is part of the network’s shift to a proof-of-stake consensus design.

Reports from earlier this year suggested Ethereum found favor among the institutional class. Some strategists expect Ethereum to touch the $5,000 mark before 2022, while some even peg a $25,000 price target for the asset in 2025.

Custodian and clearing service Copper said last month that the increasing use of DeFi applications and non-fungible tokens (NFTs) were helping propel Ethereum ahead of Bitcoin among institutional classes.

“Rather than just being a pure commodity, ETH becomes something of a yield-generating asset, where you can lock it for an interest rate, and you can raise debt against it,” noted Fadi Aboualfa, Head of Research at Copper.

“Despite ongoing issues with congestion on the network, institutional investors have been transfixed by the innovation happening on Ethereum. From stablecoins running on top of it to the numerous DeFi and NFT projects, the Ethereum network is undeniably the most utilized in the entire crypto space,” he added.

Burning ETH

Effects of the deflationary design are in full display. Data from Ethereum tracker WatchTheBurn shows nearly $2.8 billion worth of the asset has been shaved off in the past few months—taking over 669,000 Ethereum out of the circulating supply permanently.

Such market dynamics create a hot bet: continually lowering supply and increased demand mean much higher prices for Ethereum in the future, compared to Bitcoin which has a fixed supply of 21 million and no deflationary mechanics.

But despite such mechanisms and billions of dollars locked up in numerous DeFi protocols, the criticisms remain. Ethereum’s gas fee issue proves to be a perennial problem—gas can cost over $500 during times of network congestion—and transaction times remain slow at 13 tps. Competitors like Solana, Polkadot, and even Cardano are capitalizing on this, promising much faster networks and charging pennies in fees.

Until then, however, the Ethereum bet remains.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Join now for $19/month Explore all benefits

Like what you see? Subscribe for updates.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Toncoin

Toncoin  Stellar

Stellar  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Sui

Sui  NEAR Protocol

NEAR Protocol  Pepe

Pepe  LEO Token

LEO Token  Litecoin

Litecoin  Uniswap

Uniswap  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Render

Render  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Bittensor

Bittensor  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Bonk

Bonk  Arbitrum

Arbitrum  Stacks

Stacks  Filecoin

Filecoin  Cosmos Hub

Cosmos Hub  Celestia

Celestia  OKB

OKB