Gradually, alongside the cryptocurrency industry, stablecoins are growing in strength and popularity. Their growth results from the stability they offer against cryptocurrency volatility.

At the moment, USDT remains the largest stablecoin by market cap, as USDC, Binance USD, and DAI make up the top 4.

Prominent stablecoins after FTX collapse

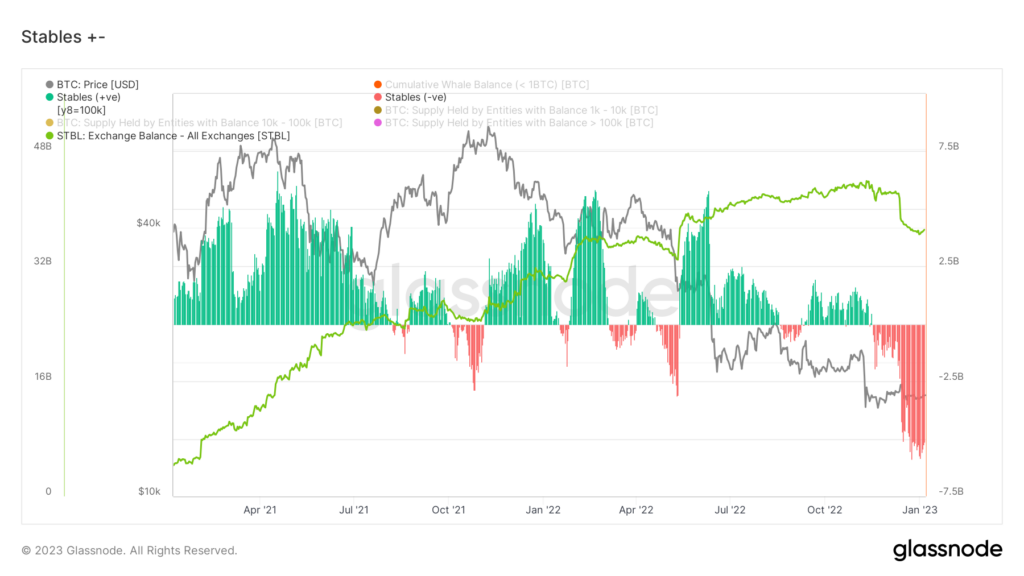

The entirety of the stablecoin sector has a market cap of $138 billion, according to CoinMarketCap. The big four stablecoins contribute more than $130 billion to the figure, dominating the stablecoin market. Despite their growth and popularity, only a minimal amount of stablecoins are on cryptocurrency exchanges.

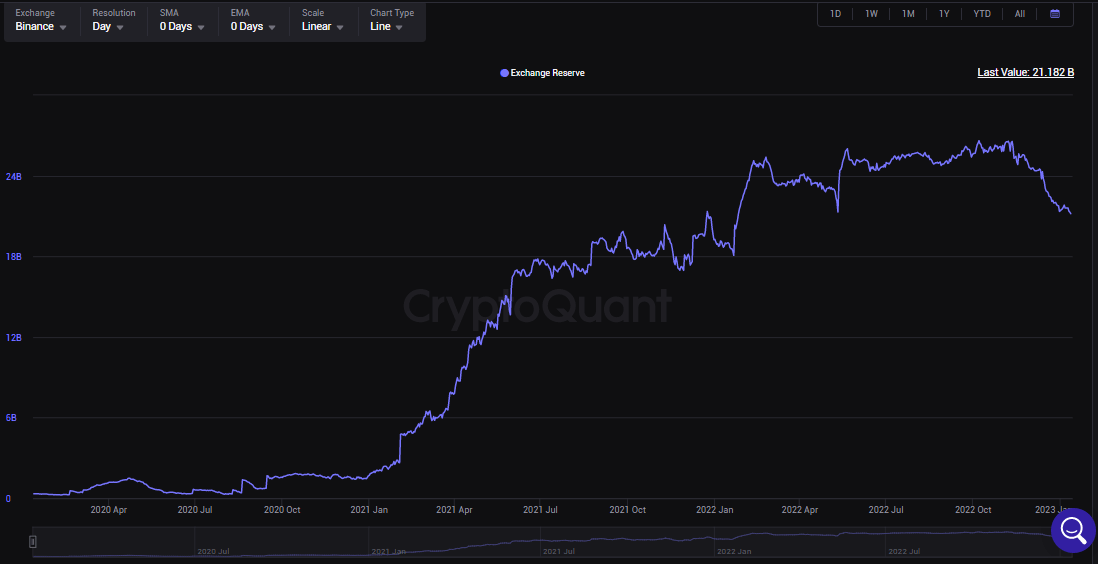

Presently, about 37 billion stablecoins are held in reserves of cryptocurrency exchanges. Binance is the highest contributor to this figure, with about $24 billion in stablecoins in its reserve. Coinbase has more than $973 million, Huobi $709 million, Bitfinex $145 million, Gemini 98 million, and Gate.io $78 million.

Due to market uncertainty and low trust in centralized exchanges after the collapse of FTX, about 3.93 billion stablecoins have left exchanges in the last 30 days.

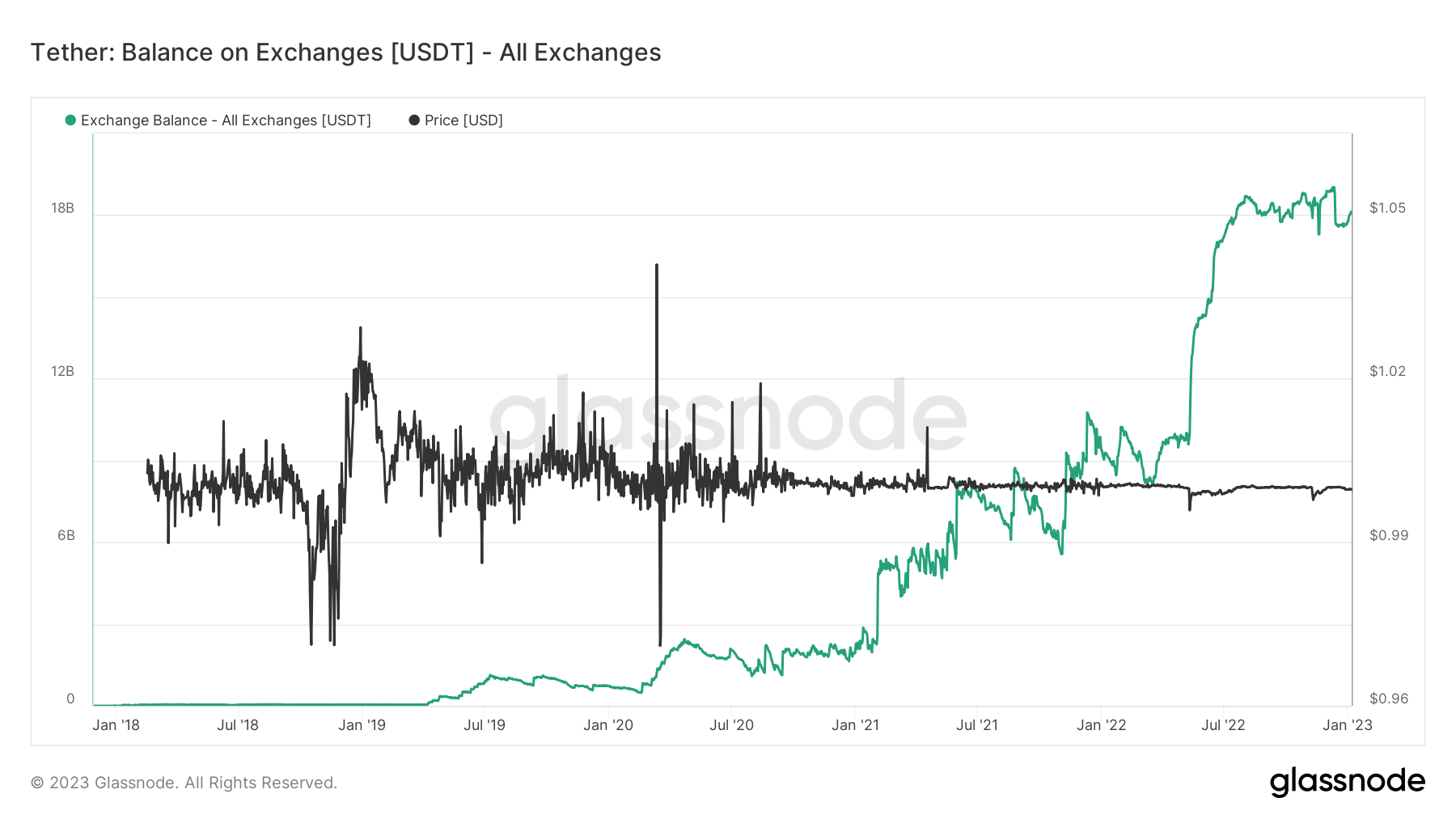

Despite the prevailing crypto winter, USDT has enjoyed more of a stable presence in the reserve of cryptocurrency exchange. Since August 2022, USDT has largely stayed flat at $18 billion in the reserve of cryptocurrency exchanges.

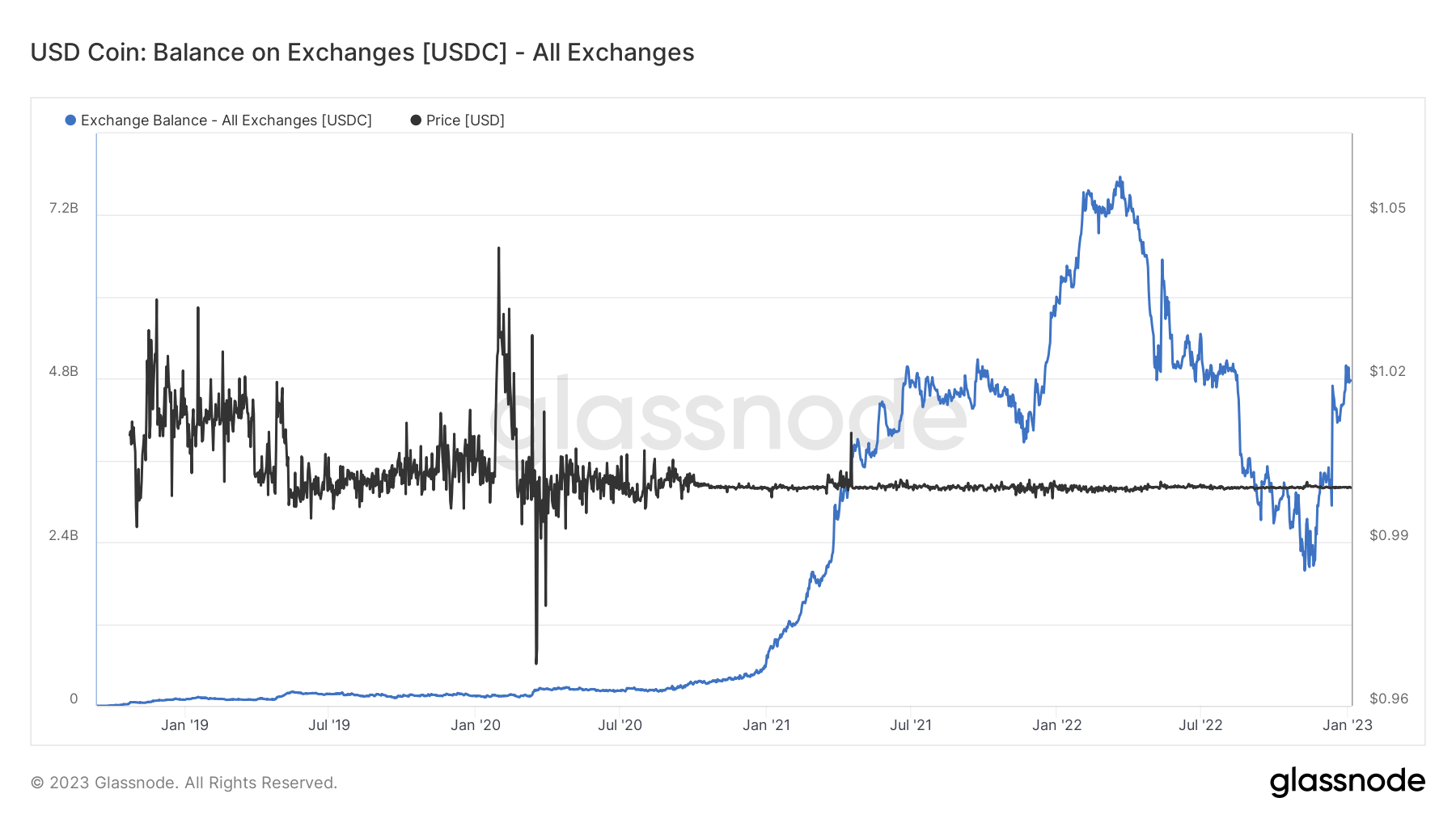

USDC, on the other hand, has enjoyed some growth while trying to curb USDT’s dominance in the stablecoin market. Since the collapse of FTX in early November 2022, the amount of USDC in the reserve of cryptocurrency exchanges doubled to $5 billion.

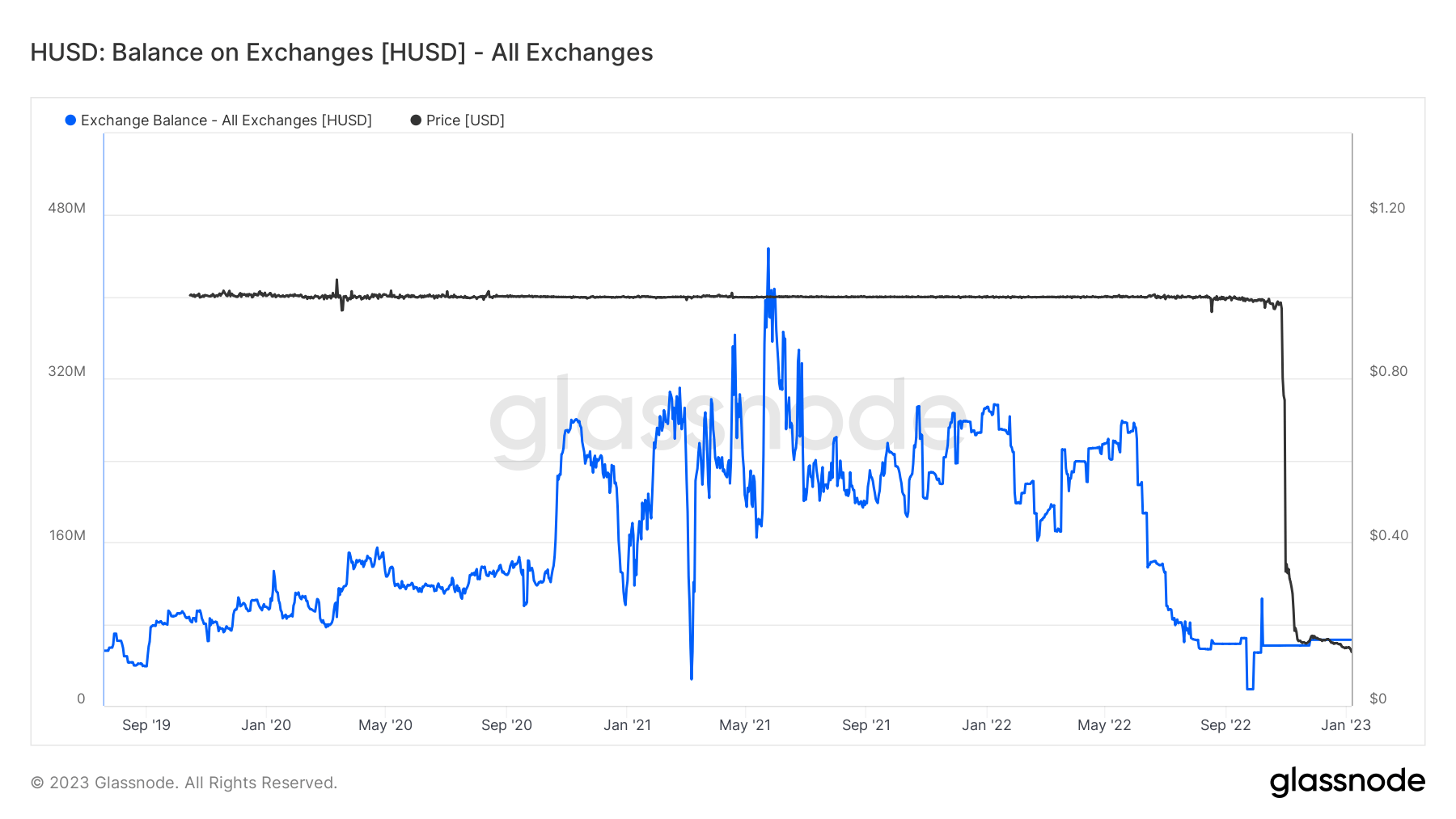

However, the resilience the stablecoin sector has been enjoying since the collapse of Terra Algorithm stablecoin UST is somewhat under threat. Following the announcement of Huobi Global to delist the HUSD stablecoin, the token has suffered a massive decline.

Shortly after the announcement, the stablecoin fell 72% off its dollar peg, and now HUSD is trading at 13 cents. In a sharp dip, the amount of HUSD in cryptocurrency exchange reserves is about to surpass its all-time low of $65 million.

Stablecoin reserve in centralized exchanges

Following the collapse of FTX, investors began to doubt the reliability of Centralized exchanges. As of January 12, Binance recorded about $5.202 billion outflow of stablecoin since the collapse of FTX.

Likewise, within two months after the demise of FTX, Coinbase Pro saw a net outflow of $690 million, Huobi $277 million, Bitfinex $125 million, Gemini $398 million, and Gate.io $42 million.

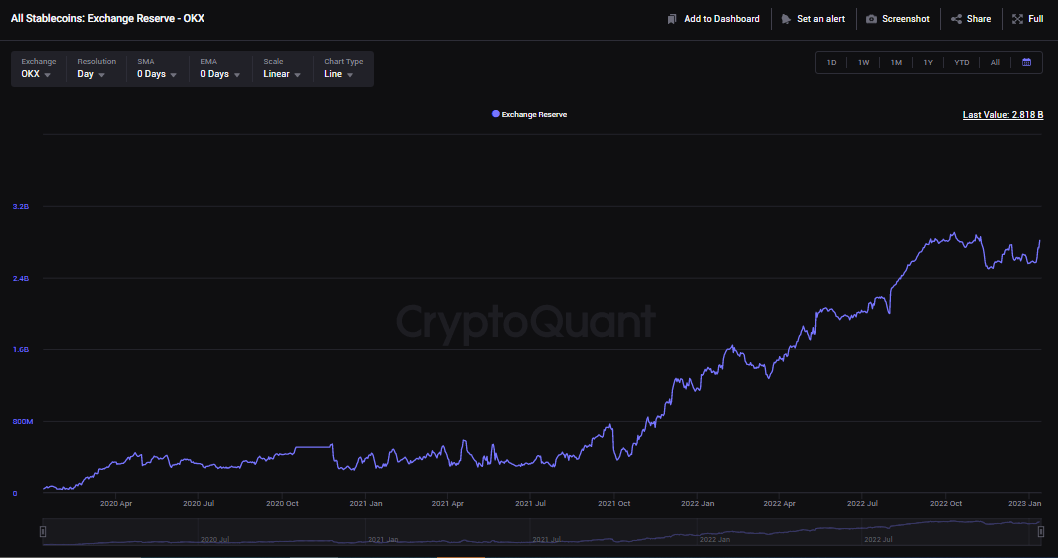

OKX, on the positive side, didn’t record a deficit; instead, the cryptocurrency exchange enjoyed a $43 million net inflow.

Within this period, cryptocurrency exchanges witnessed about $6.2 billion net outflow of stablecoin, with Binance suffering the most, according to Cryptoquant. However, the outflow cannot be considered significant since Binance held about $39.9 billion worth of stablecoin, according to its proof of reserve report from Nov. 10.

Exchanges like Binance and Crypto.com released proof-of-reserves with Mazars in November to establish users’ trust. Even so, the firms later faced backlash from the community as some argued that the report did not reveal the full reserve of the exchanges.

In a harsh consequence, Binance, within a day, witnessed a massive withdrawal of stablecoins that amounted to about $2.1 billion.

It’s apparent from the charts that users still have trust issues with centralized exchanges since stablecoin reserves continue to fall.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Chainlink

Chainlink  Polkadot

Polkadot  Stellar

Stellar  Pepe

Pepe  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Render

Render  Bittensor

Bittensor  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  MANTRA

MANTRA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  dogwifhat

dogwifhat  Arbitrum

Arbitrum  Monero

Monero  Stacks

Stacks  Filecoin

Filecoin  OKB

OKB