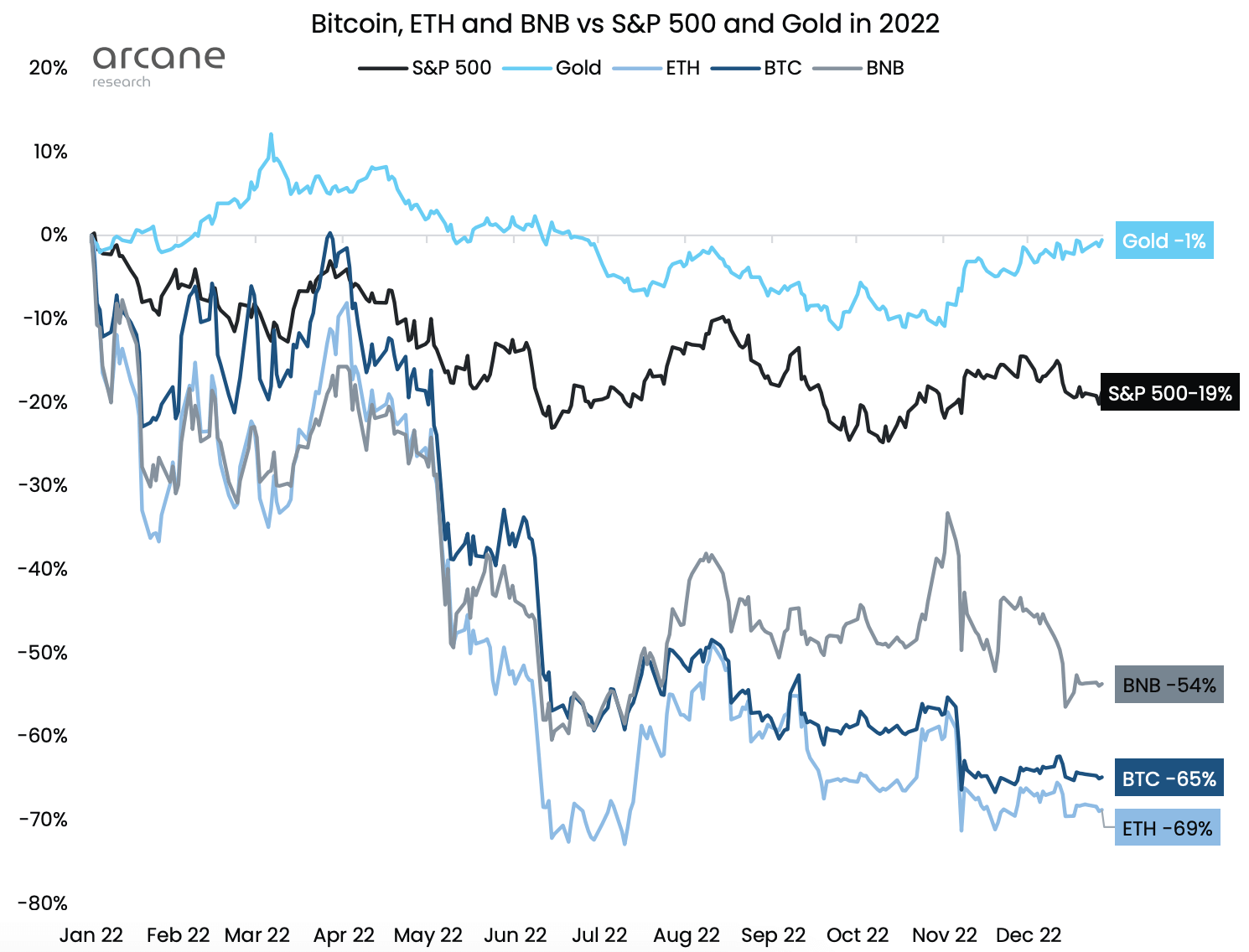

Arcane Research’s 2022 year-end report cited that 2022 was the second-worst-performing year for Bitcoin (BTC), as the leading crypto saw a 65% decrease throughout the year, only beaten by the 73% sink recorded in 2018.

BTC’s performance was the second-worst of the year compared to Binance Coin (BNB), Ethereum (ETH), S&P 500, and Gold. ETH recorded the most significant decrease by falling 69%. Gold was the most resilient, recording only a 1% fall.

Binance

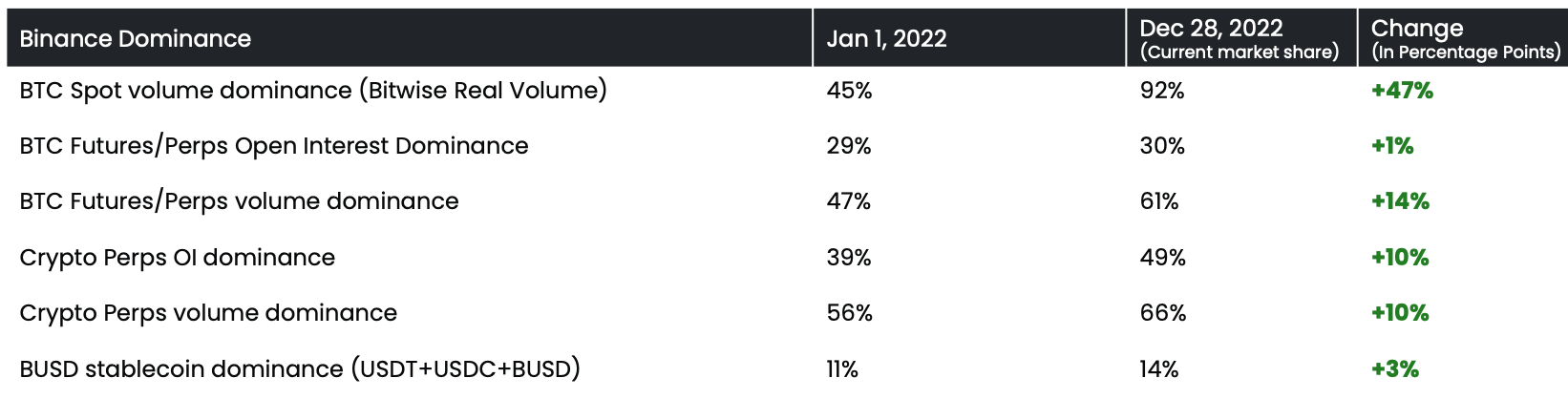

Crypto exchange Binance’s growth was another highlight of 2022. Binance’s dominance in BTC spot volume grew by 47% throughout the year, increasing to 92% at the current market share from the 45% recorded on the first day of the year.

Binance was responsible for 66% of the crypto perp volume and 61% of the BTC derivatives volume as the year concludes. The exchange recorded a 10% increase in both areas, compared to 49% and 56% at the beginning of the year.

The report predicted Binance’s dominance in the spot market will decline, and the BUSD dominance will increase.

BTC and equities correlation

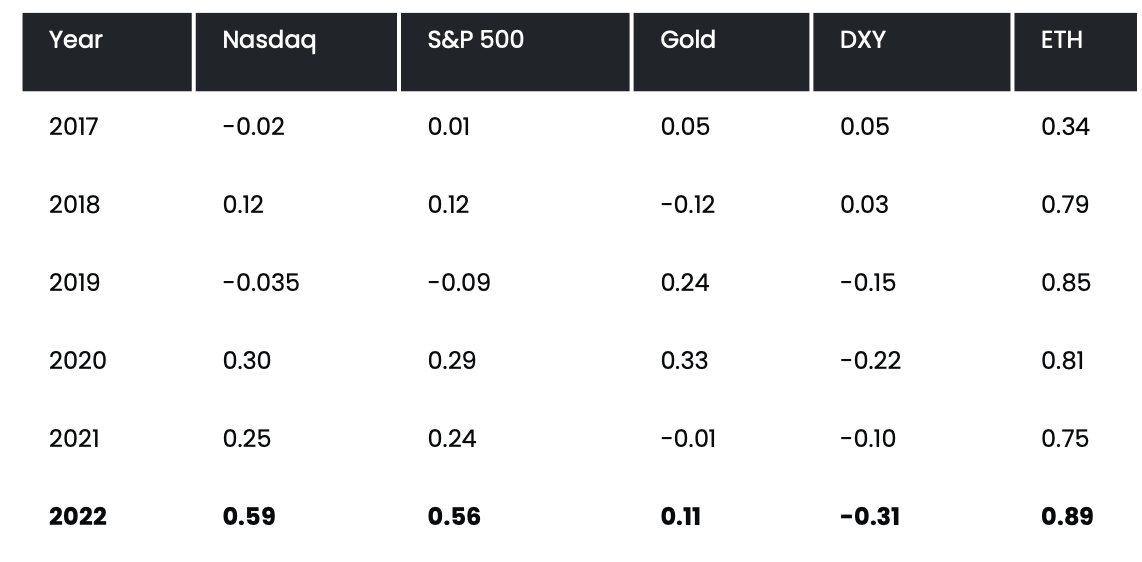

BTC’s correlation with other equities has also been significantly high in 2022. The report looked into BTC’s annual correlation with Nasdaq, S&P 500, Gold, DXY, and ETH since 2017.

The data showed that BTC’s correlation with ETH has been strong since 2017. However, 2022 was the first year BTC demonstrated such a strong correlation with other equities.

BTC’s correlation with Nasdaq was robust throughout the year at 0.59, closely followed by S&P 500 at 0.56. However, the report expects BTC’s correlation with other assets to decline in the following years as the trading activity in crypto declines.

Stablecoins

Stablecoins’ market cap relative to BTC also grew exponentially in 2022, increasing to 41% from 15% at the beginning of the year.

The report claimed that the growing stablecoin dominance has a self-evident explanation. It stated:

“Cryptocurrency valuations have deteriorated this year, and stablecoins are stable.”

The combined market cap of stablecoins represented 28% of BTC’s and ETH’s combined market cap and 17% of the total crypto market cap. This percentage was 10% and 6% at the beginning of the year.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Chainlink

Chainlink  Polkadot

Polkadot  Stellar

Stellar  Pepe

Pepe  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Render

Render  Bittensor

Bittensor  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  MANTRA

MANTRA  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  dogwifhat

dogwifhat  Arbitrum

Arbitrum  Monero

Monero  Stacks

Stacks  Filecoin

Filecoin  OKB

OKB