The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

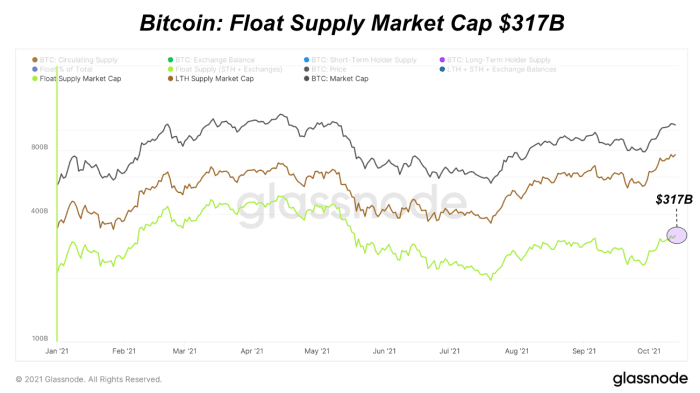

When looking at the bitcoin supply, it’s important to consider the state of the float supply, an estimation of the available bitcoin on the market for sale. One way to estimate the float is to look at short-term holder supply plus the supply balance on exchanges in total and as a percentage of circulating supply. If you were to add in long-term holder supply to these two, supply is nearly identical to circulating supply.

The current float supply is 5.52 million bitcoin worth $317 billion at today’s market price. But we know that any sizable bids to take the bitcoin float off the market may drive the price up, all else equal, increasing the USD market value with every new bid.

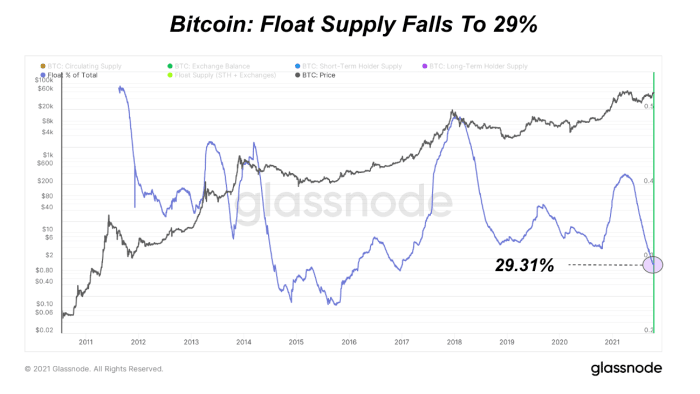

That float supply estimation is now at 29.31% of circulating supply which has fallen from 49% at the top of the 2018 cycle and 41% at the top of the March 2021 all-time highs. This is the lowest level of float supply in over the last four years, since January 2017, when the price went on to 21x in just 12 months.

Float supply also peaks with the bull cycle top nearing 50% as long-term holders flood the market with more bitcoin, taking profits. As price increases, we will see a similar activity to 2018 with float supply increasing as some long-term holders take profits moving bitcoin to short-term holders until buying is exhausted.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Shiba Inu

Shiba Inu  Avalanche

Avalanche  Toncoin

Toncoin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Pepe

Pepe  Polkadot

Polkadot  LEO Token

LEO Token  Stellar

Stellar  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  USDS

USDS  Hedera

Hedera  Cronos

Cronos  Internet Computer

Internet Computer  Bonk

Bonk  Render

Render  Ethereum Classic

Ethereum Classic  MANTRA

MANTRA  Bittensor

Bittensor  POL (ex-MATIC)

POL (ex-MATIC)  dogwifhat

dogwifhat  Dai

Dai  Ethena USDe

Ethena USDe  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Stacks

Stacks  Arbitrum

Arbitrum  OKB

OKB