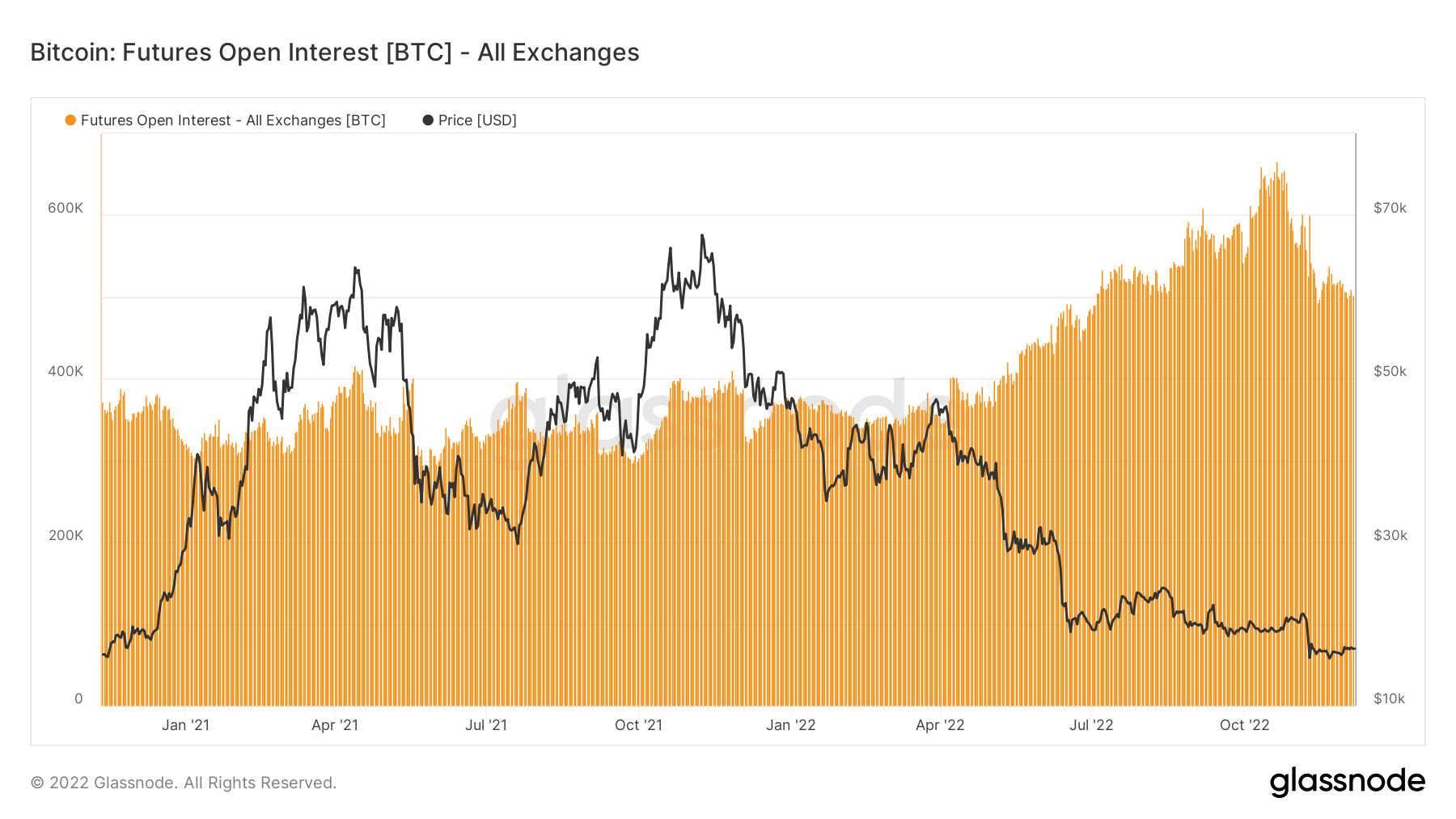

Looking at Bitcoin and Ethereum derivatives shows that they have been affected by the FTX fallout, with data analyzed by CryptoSlate showing that over 160,000 BTC has been unwound since the beginning of October.

This data indicates that roughly $3 billion worth of futures contracts have been closed out in two months.

Cryptocurrency derivatives are an important indicator of the overall health of the market. They also serve as a pointer as to where prices might head next, as they show the amount of leverage the market is sitting on.

The open interest on Bitcoin futures shows a sharp decline in the amount of funds allocated to open futures contracts, which is now back to levels recorded in July 2022.

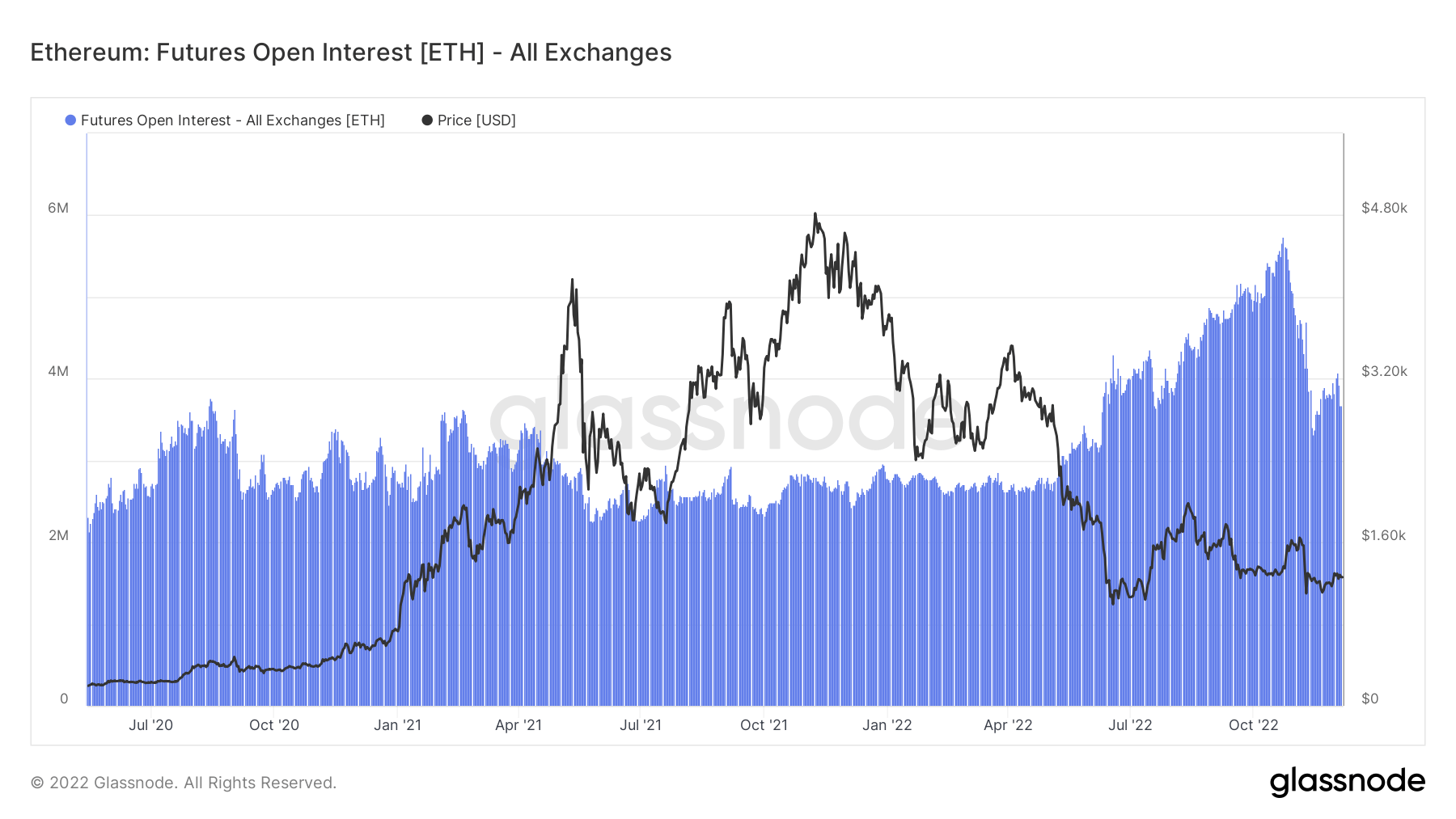

A similar trend is also present in Ethereum derivatives. Around 2 million ETH has been unwound since October, with the open interest on Ethereum futures now back to early 2022 levels.

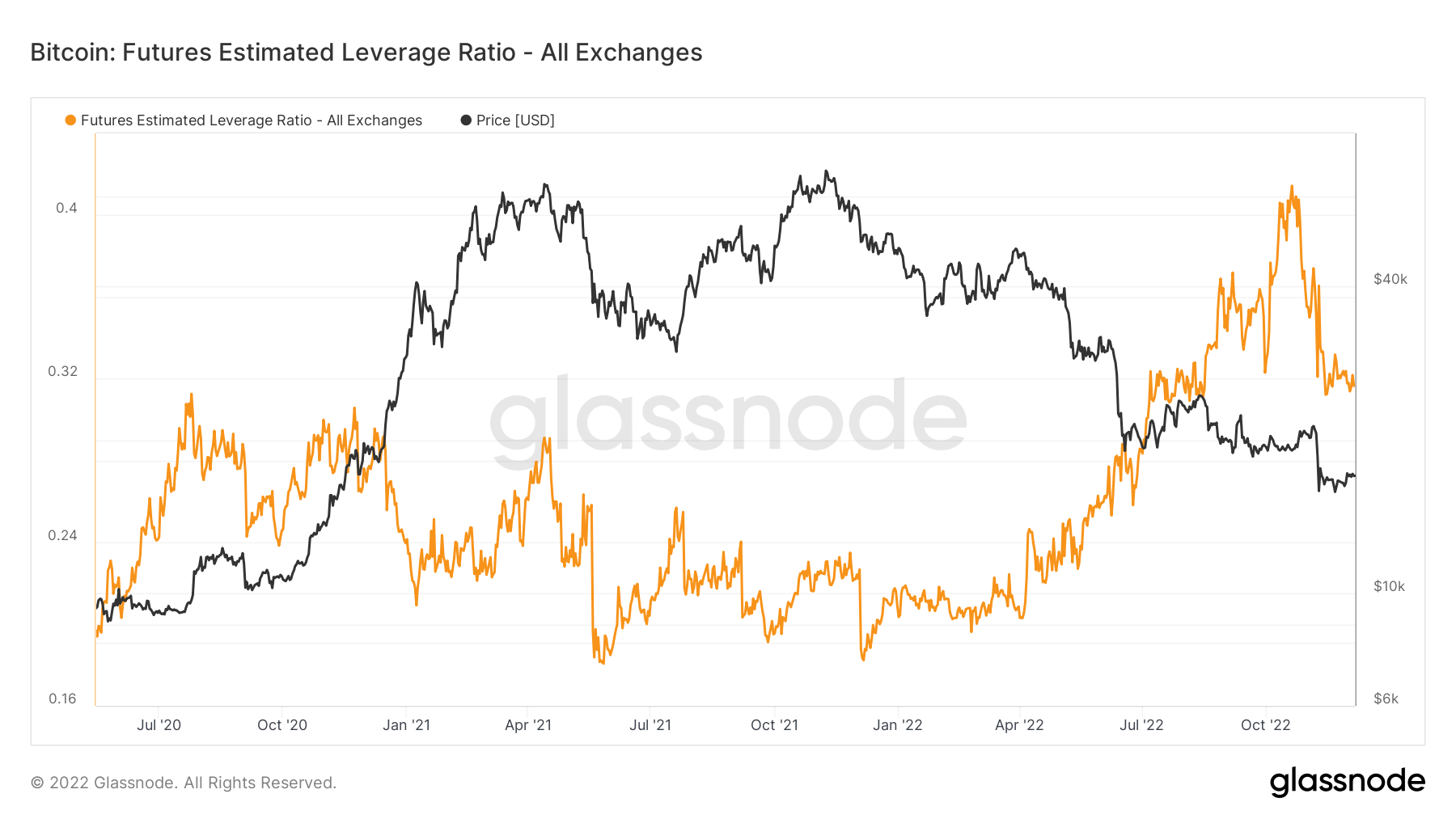

Aside from open interest in futures contracts, another way of estimating the amount of leverage in the market is by looking at the Estimated Leverage Ratio (ELR). The Estimated Leverage Ratio is the ratio of open interest in futures contracts divided by the reserves of corresponding exchanges. It shows how much leverage there is on exchanges and can be used to measure traders’ sentiment. A high ELR indicates an overleveraged market and incoming volatility. A low ELR, on the other hand, shows a deleveraged market and indicates stability.

When the ELR begins decreasing, it shows that more investors are beginning to take off leverage risk and close their positions. And while an increasing ELR might show confidence in leveraged positions, it usually indicates that the market is ripe with high-leverage risk.

In October 2022, ELR peaked at 0.41 when Bitcoin’s price hovered around $19,000. Since then, the ratio decreased significantly and currently stands at 0.32. This decrease shows that a significant number of derivatives positions have been unwound in just two months, bringing a certain degree of stability to the market.

But, ELR still remains elevated when compared to last year. If the ratio starts increasing or remains on a sideways trajectory, more leverage will continue to unwind.

And while this could threaten Bitcoin’s price, diving deeper into its derivatives shows some hope for stability.

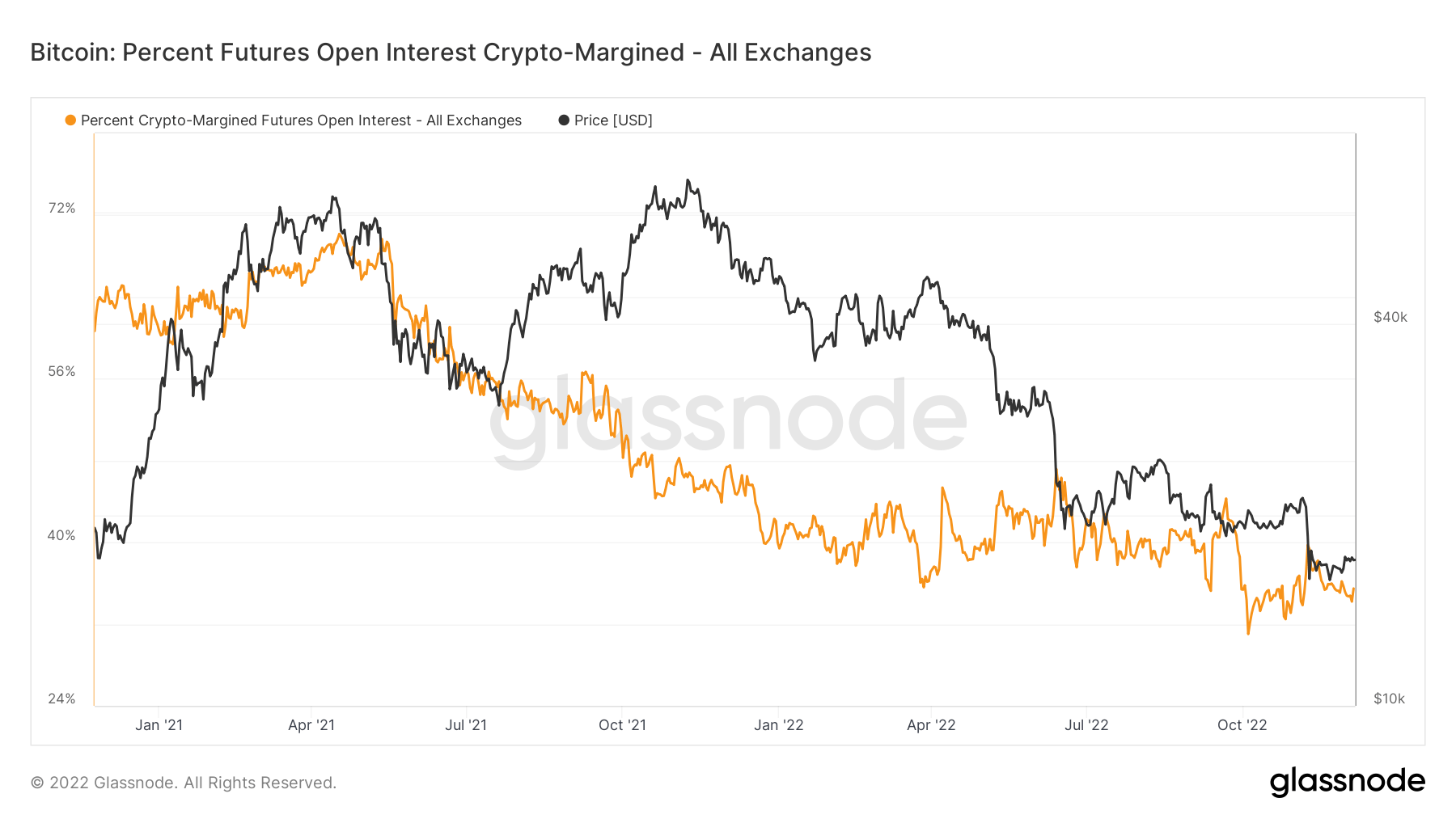

The percentage of open interest margined in Bitcoin is much smaller than the open interest margined in USD and USD-pegged stablecoins. Around 35% of open interest is crypto-margined, down from around 41% at the beginning of the year.

A decreasing percentage of crypto-margined open interest shows investors are taking less risk with their Bitcoin. The unwinding that’s currently going on will ultimately have a positive effect on the market. Flushing out leveraged positions will cause short-term volatility but lead to a healthier market in the long term, creating a solid foundation for future accumulation.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Shiba Inu

Shiba Inu  Avalanche

Avalanche  Toncoin

Toncoin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Pepe

Pepe  Polkadot

Polkadot  LEO Token

LEO Token  Stellar

Stellar  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  USDS

USDS  Hedera

Hedera  Cronos

Cronos  Internet Computer

Internet Computer  Bonk

Bonk  Render

Render  Ethereum Classic

Ethereum Classic  MANTRA

MANTRA  Bittensor

Bittensor  POL (ex-MATIC)

POL (ex-MATIC)  dogwifhat

dogwifhat  Dai

Dai  Ethena USDe

Ethena USDe  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Stacks

Stacks  Arbitrum

Arbitrum  OKB

OKB