Glassnode Special Offer

Explore all the live charts covered in this report in Glassnode Studio.

⚡Special offer⚡

For a limited time, you can save 40% on a monthly or yearly Glassnode Advanced plan and access the data and insights which are helping thousands of crypto traders and investors around the world. Offer ends 29 November.

Find Your Edge at Glassnode

Introduction

The 2022 bear market has been an especially brutal one, with digital asset prices experiencing persistent downtrends, interest rate hikes tightening liquidity conditions, and severe credit contagion taking hold in crypto lending markets.

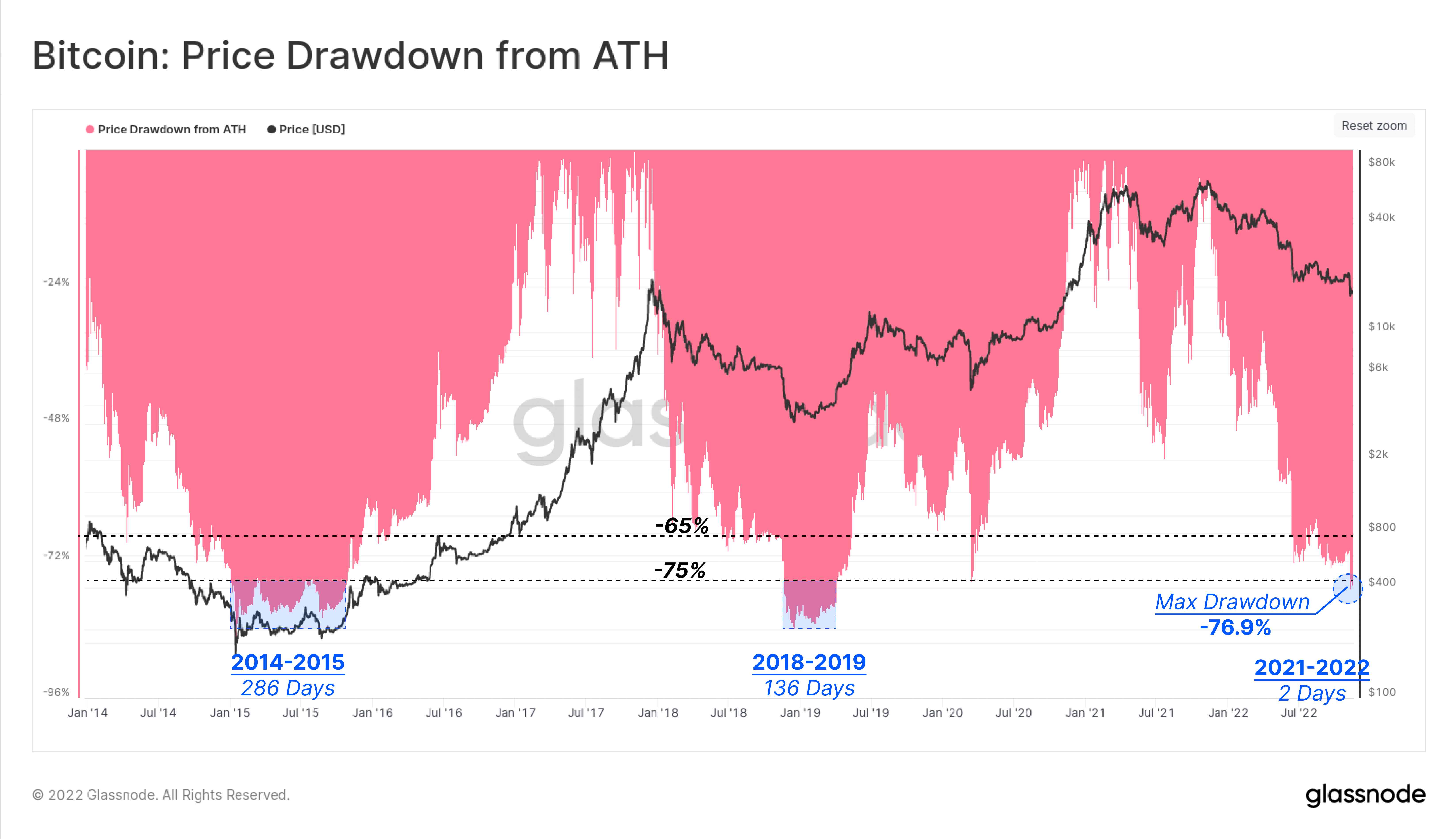

This week, the spot price of Bitcoin dropped to a multi-year low of $15,801 amidst the FTX collapse, with BTC now -76.9% below the cycle top set in November 2021. Previous generational lows have recorded >75% market devaluations from the peak, bringing this bear market in line with prior cycle drawdowns.

BTC drawdowns greater than 75% have persisted for several months in previous cycles, suggesting duration may still be ahead if history rhymes.

Hashrate Won’t Slow Down

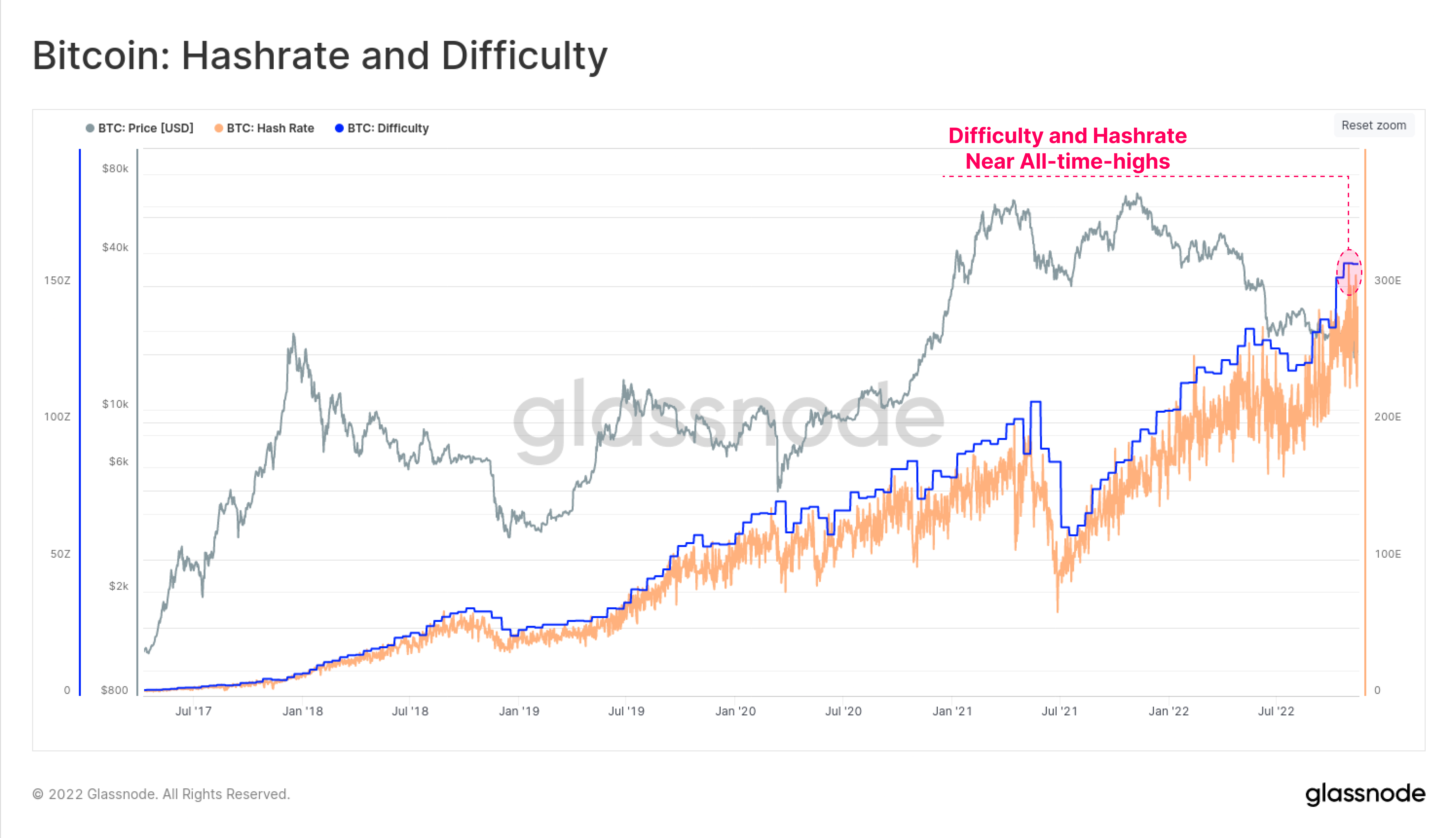

Whilst bear markets can be tough on investors, there is one cohort who are under an extreme amount of financial stress: Bitcoin miners. Not only have coin prices declined, and credit contracted, but mining input energy costs have also been on the rise due to inflation. Furthermore, hashrate has relentlessly climbed to new all-time-highs in recent weeks.

This means that Bitcoin is getting more expensive to produce, and is simultaneously being sold at depressed prices.

Bitcoin miners are being squeezed from all sides, and in this article, we will focus on the implied stress on the industry. The goal is to assess market risks that may arise in response to this pressure on miners.

Throughout prolonged bear markets, it is typical for the cost of Bitcoin production to exceed the spot price. This squeezes miner profit margins, and forces the most inefficient miners to switch off unprofitable equipment. All miners must sell more of the BTC they mine, and eventually, may need to dip into their accumulated treasuries.

The following metric tracks this cyclical behavior, by defining two bands derived from hashrate:

- Lower Band 🔵: 1yr moving average of hashrate.

- Upper Band 🟢: 1yr moving average of hashrate, plus two standard deviations.

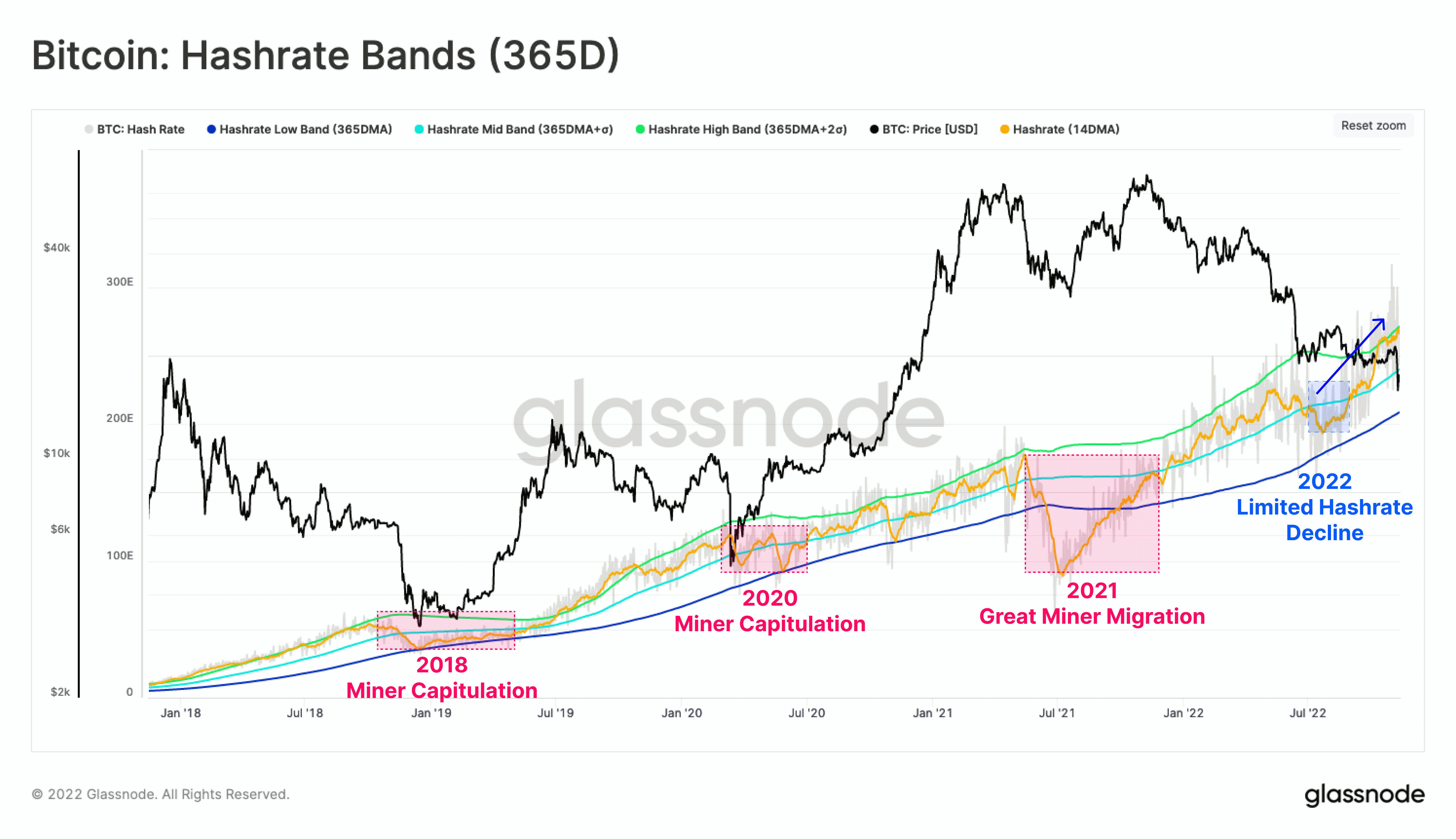

Notice how hashrate oscillates between the Lower and Upper bands over the long term.

One of the standout phenomena of the 2022 bear market is that Hashrate has not seen any significant decline towards the lower band, even with ongoing financial stress on the industry. We can also see the massive scale of the Great Miner Migration in May-July 2021, when approximately 52% of the hashpower in China was shutdown almost over-night.

This steady hashrate growth observed in this bear market is likely a hangover from production and supply chain delays for next generation ASIC chips in 2021. These ASIC machines were purchased last year, but have only just arrived, been installed, and turned operational, driving production costs higher at the lows of an already savage bear market.

Mining Gets Expensive

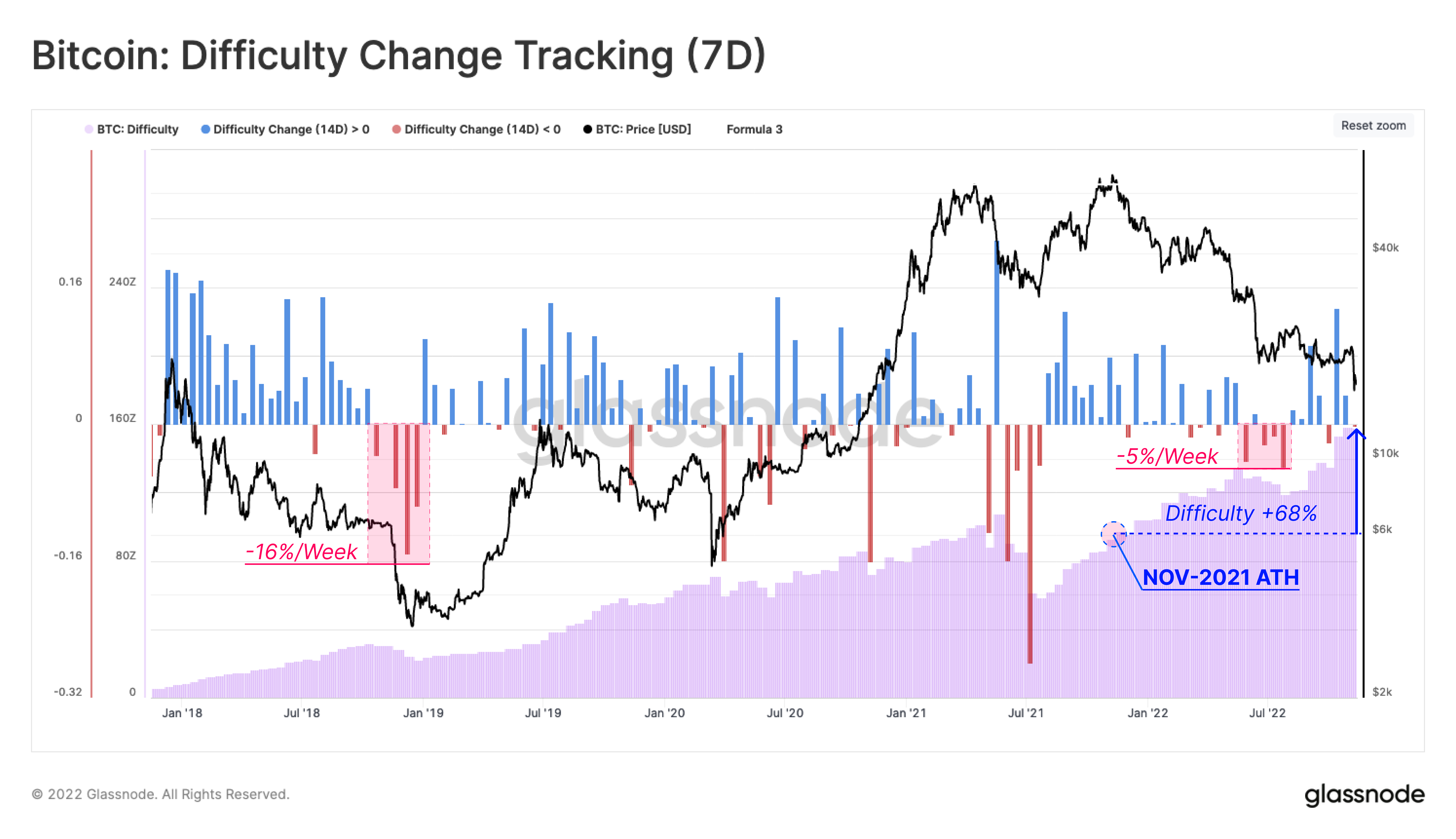

During the bottom formation phase of the 2018-2019 cycle, we can see that difficulty experienced several large declines of up to -16% per week. This shows that miners were going offline due to financial strain.

This pattern has not repeated this cycle. In fact, after a short interval of modest difficulty reductions during the LUNA capitulation, mining difficulty has been increasing, reaching levels +68% higher than the November 2021 ATH.

This means that BTC denominated miner revenue has decreased 68% over the last 12 months, before we even account for the -76.9% decline in BTC prices.

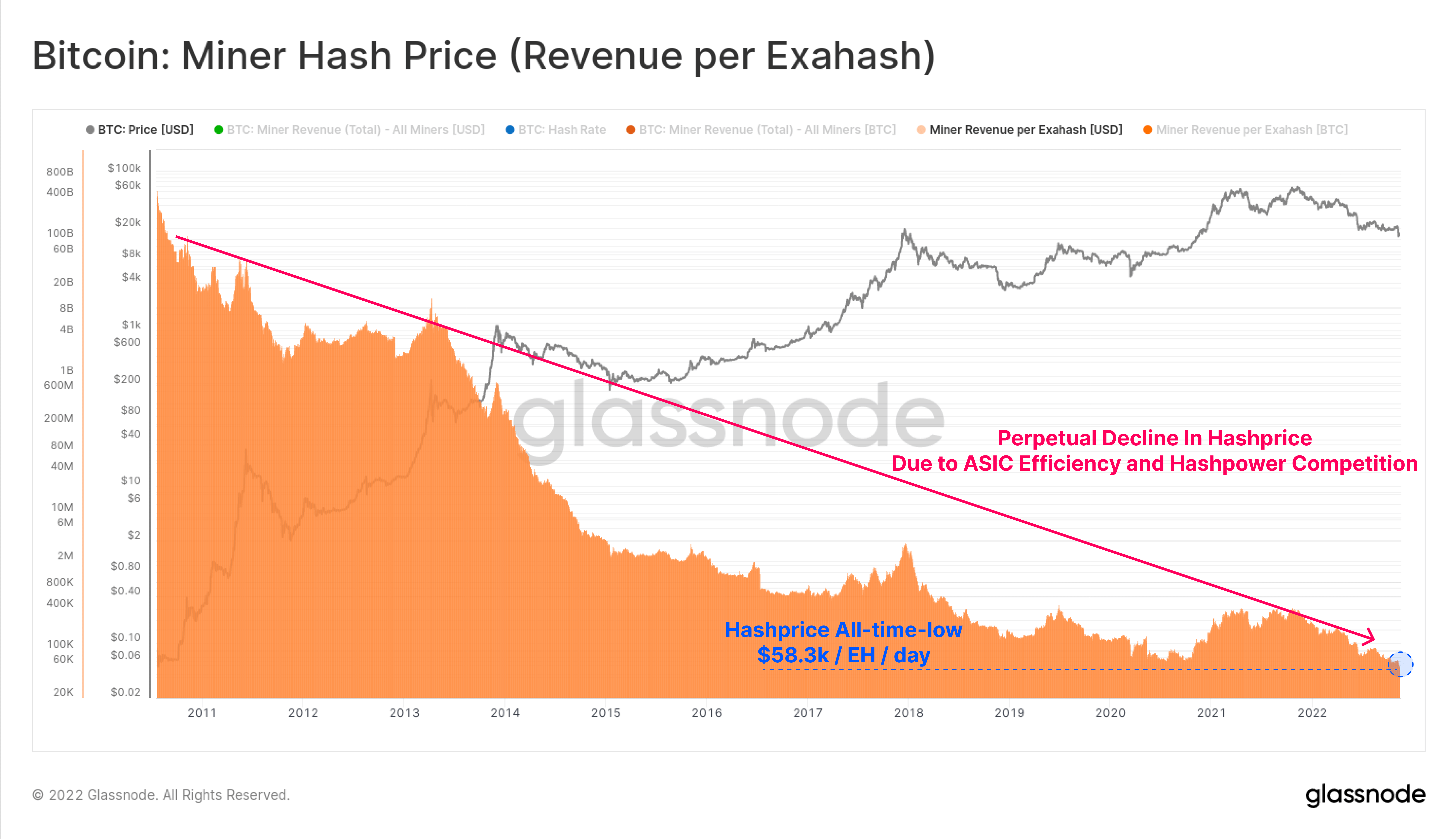

To track USD denominated revenues, we can use a metric called the Hash Price, which models the revenue earned per Exahash. This is now at an all-time-low of $58.3k earned per Exahash per day, showing that mining is the most competitive it has ever been.

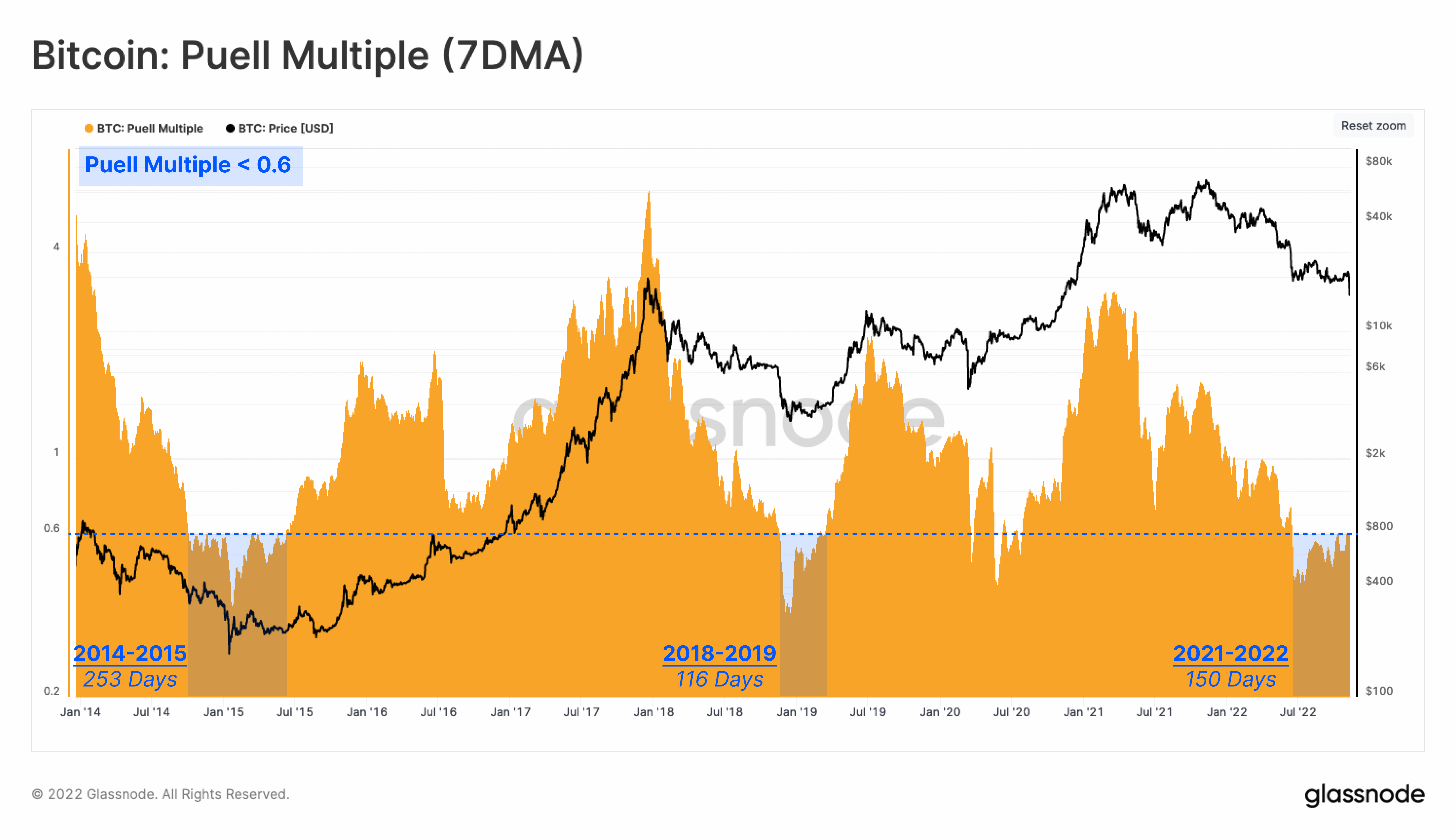

The Puell Multiple is an oscillator tracking USD miner income relative to the yearly average. We can currently see that Bitcoin miners are experiencing a -41% contraction in their income stream compared to last year.

Mining incomes have been under this extreme stress for 150-days so far, which is comparable to previous bear market lows.

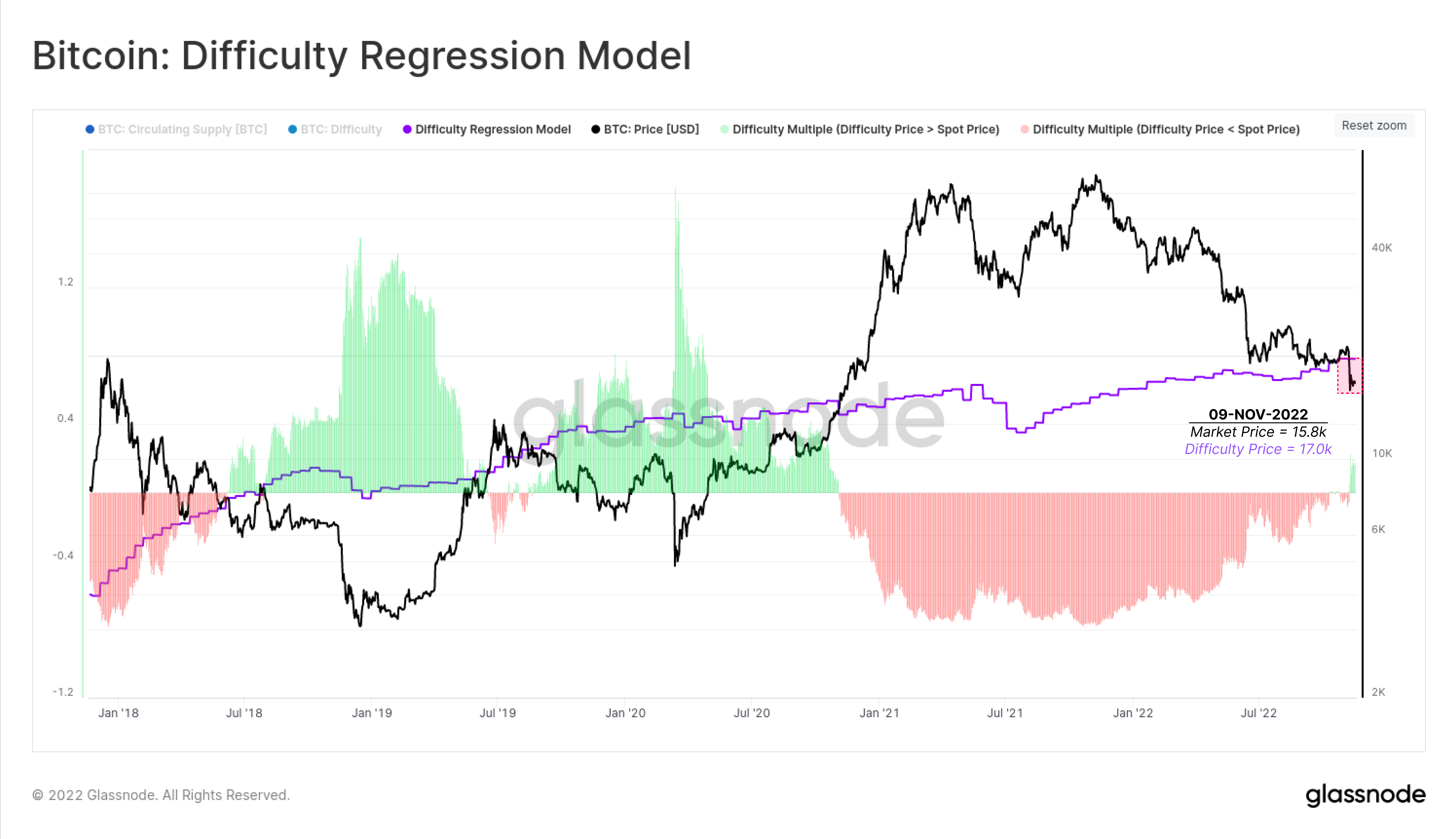

As Mining Difficulty climbs, so does the BTC production cost. The model below derives a relationship between Difficulty and Market Cap to estimate the average production cost per unit of BTC.

This production cost model is currently trading at $17,008, which is 7% higher than the spot price. As a result, the average miner is at, or above their pain threshold, and it is increasingly likely that hashrate will begin to stall, or decline in the months ahead.

Elevated Capitulation Risk

Now that we have confirmed that mining revenues are squeezed, and production costs are high, we have a very high-risk environment for a miner capitulation event. The next step is to investigate the potential market impact if this comes to pass.

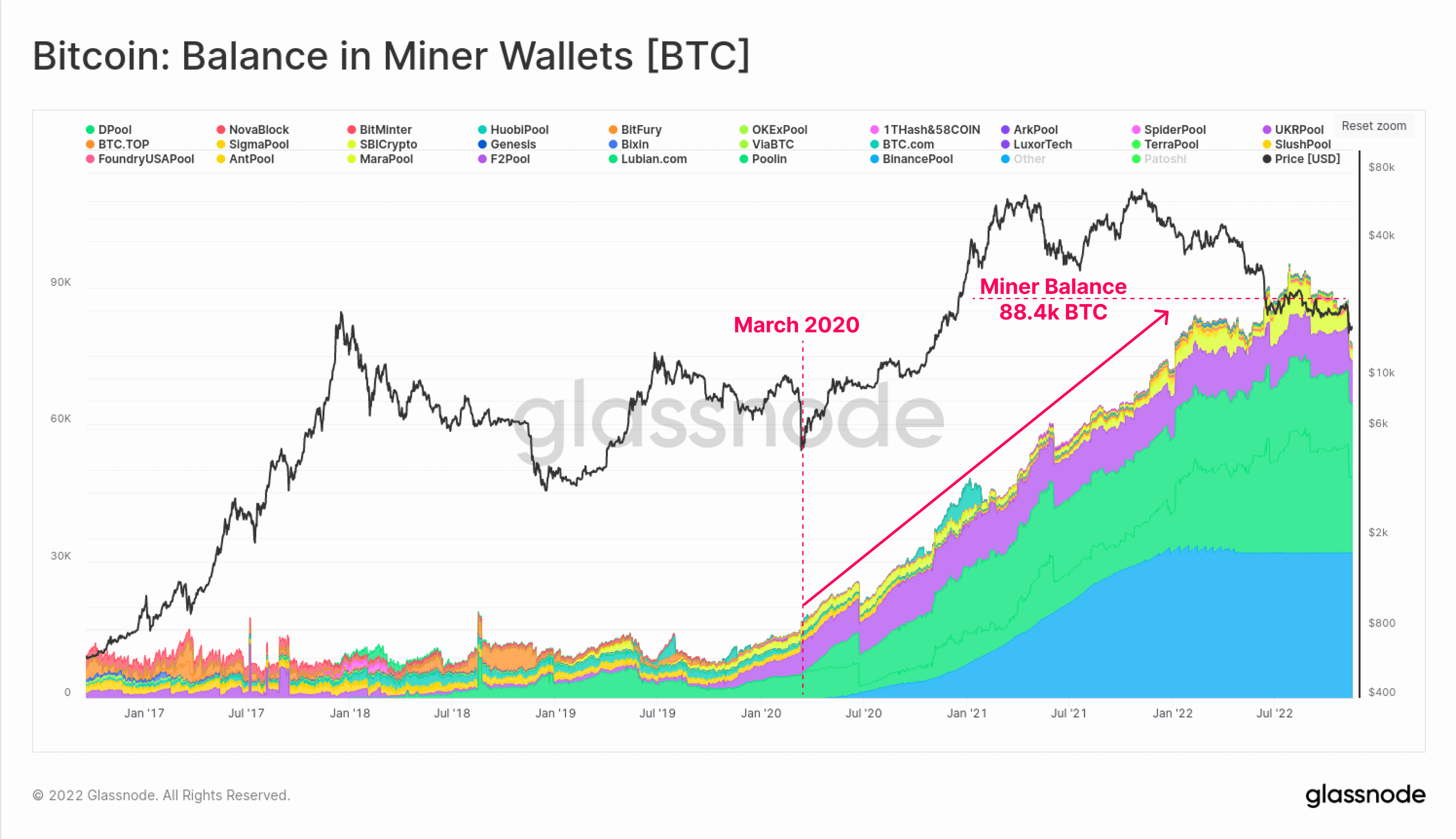

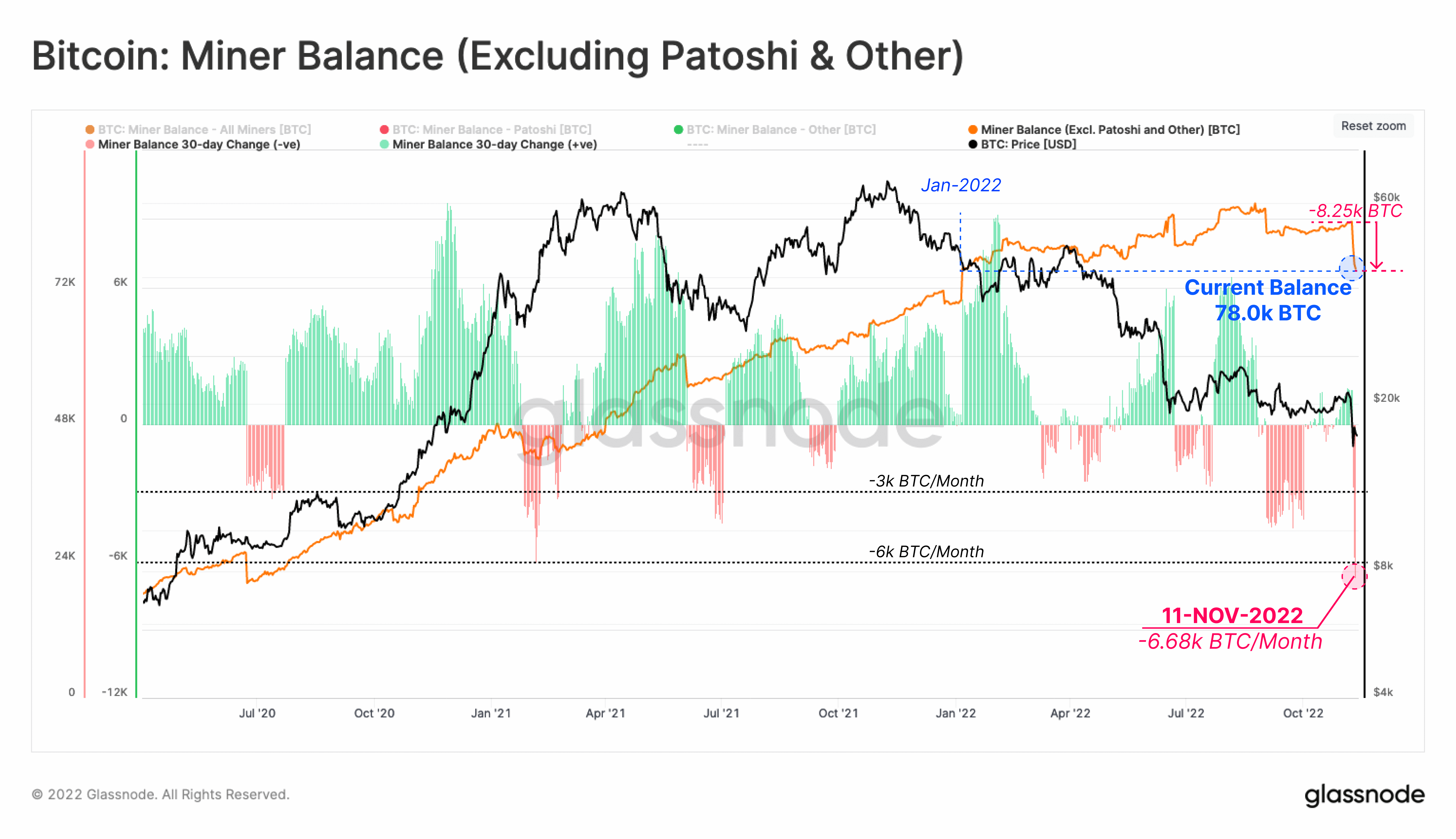

Since the March 2020 sell-off, miners have been significant accumulators of BTC, amassing over 88.4k BTC in their treasuries as of the start of November. Notice however that their balance started to plateau at the start of 2022. This suggests early miner stress may have started at BTC prices as high as $40k.

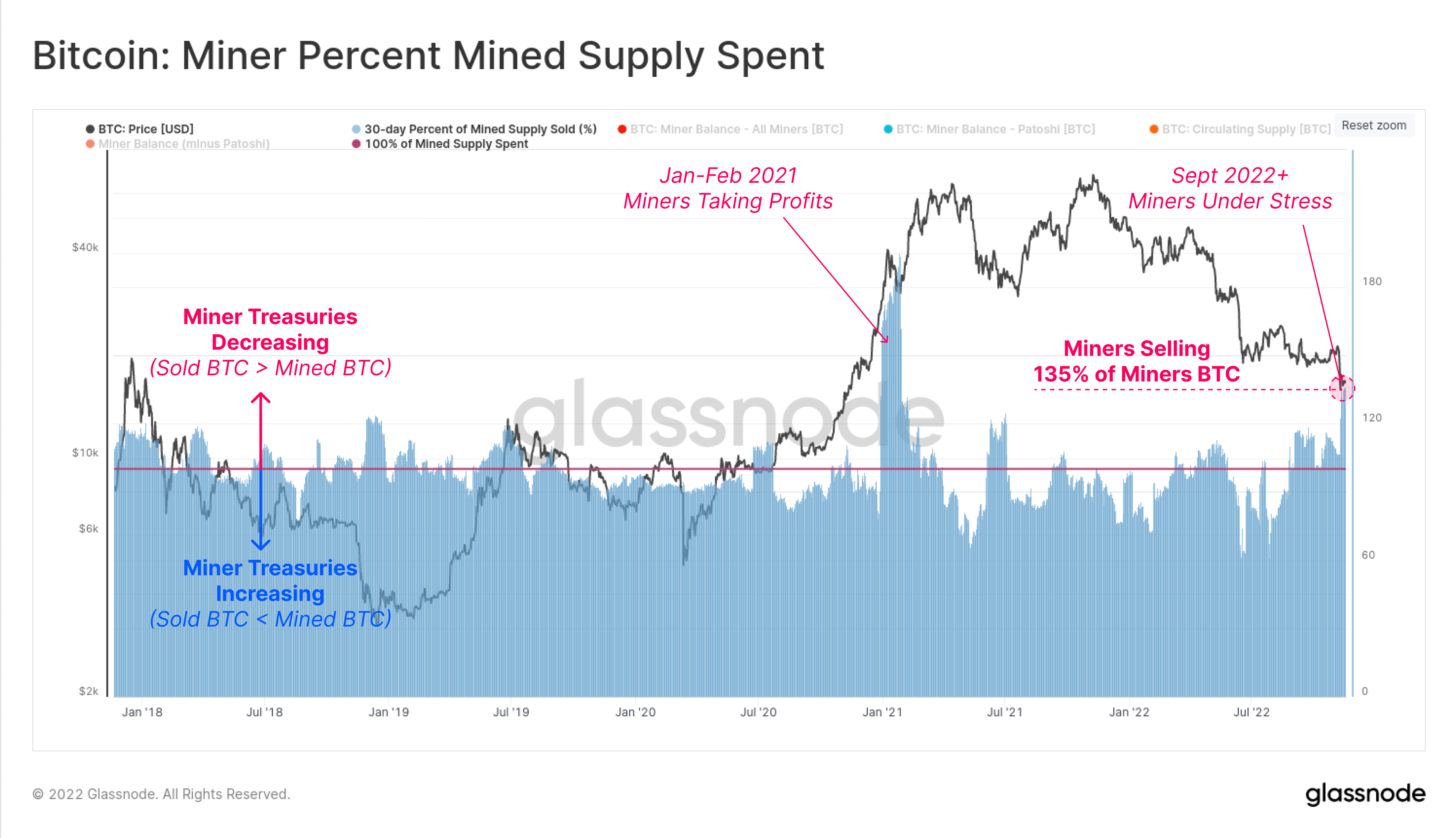

The chart below shows the percent of daily mined supply that miners are spending, which has recently hit 135%. Given the current block reward is ~900 BTC per day, this means that miners in aggregate are distributing all 900 newly minted coins, as well as depleting their treasuries at a rate of 315 BTC per day (total of 1,215 BTC/day).

As news of the FTX insolvency broke this week, miners responded by liquidating an additional 8.25k BTC over the last two weeks. This brings their current holdings down to 78.0k BTC, and erases all miner balance increases in 2022.

With BTC prices still languishing below the $17.0k average cost of production, this leaves a potential risk of a $1.287B supply overhang sourced from miner treasuries unless prices can recover.

Conclusion

Amidst the chaotic events unfolding around the FTX insolvency, the mining industry is rapidly becoming another area of concern in the market. Mining revenues have experienced a significant reduction in their revenue streams, with production costs up +68%, and coin prices down -76% over the last year.

Miner balances currently sit at around 78.0k BTC, equivalent to over $1.2B at current BTC prices of $16.5k. Whilst it is unlikely that the entirety of these reserves will be distributed, it provides a gauge on the potential risk. Until BTC prices have cleared some distance above the estimated cost of production level at $17.0k, it is likely that miners are going to be under acute financial stress, and net distributors of BTC.

This Market Report was brought to you by Glassnode

Glassnode brings data intelligence to the blockchain and cryptocurrency space.

Learn more

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Chainlink

Chainlink  Polkadot

Polkadot  Stellar

Stellar  Pepe

Pepe  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Render

Render  Bittensor

Bittensor  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  MANTRA

MANTRA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  dogwifhat

dogwifhat  Arbitrum

Arbitrum  Monero

Monero  Stacks

Stacks  Filecoin

Filecoin  OKB

OKB