Singapore-based crypto investment platform Pillow raised $18 million in Series-A funding on Oct. 13.

The funding round was co-led by Accel, Quona capital, Elevation Capital, and Jump Capital. Accel is the top venture capital firm with the most Unicorn ownership, and Elevation Capital was a significant investor in Pillow during its seed round.

Pillow allows users to invest and save in USD-backed stablecoins and various popular crypto assets like Bitcoin (BTC) and Ethereum (ETH).

The platform was launched in 2021 and already has over 75,000 users residing in 60 different countries. Since the beginning of the year, Pillow’s user base has grown by 300%, while its supported assets have grown 5x.

Focusing on emerging markets

Pillow aims at empowering individuals residing in emerging economies who may not have access to financial services. Pillow’s CEO, Arinda Roy, said:

“At Pillow, we aspire to create and reward a culture of disciplined personal finance…that enable young, hardworking, ambitious people to take control of their finances, achieve life goals and work towards financial freedom.”

He further added:

“We’re creating a suite of high-quality, secure, and transparent financial products that will grant our users access to global economic opportunities and let them take control of their financial future.”

The platform is also keen on removing friction and offering a smooth user experience, which serves its ultimate purpose of increasing financial inclusion. By removing frictions of formal economic systems, Pillow believes it can engage better with users and encourage them to take control of their finances by offering savings and investment opportunities.

Pillow expanded into various emerging markets in the past year, including Nigeria, Ghana, and Vietnam.

Emerging markets and crypto

Emerging economies have been the drivers of crypto adoption over the past years.

In 2021, Chainalysis reports showed an 880% surge in global crypto adoption. Emerging economies like Kenya, Nigeria, Vietnam, and Venezuela ranked high in the adoption index, while countries like China and the U.S. were 13th and 8th, respectively.

The 2022 update of the same report revealed that the countries with the highest adoption rates didn’t change much over the past year. Vietnam, the Philippines, and Ukraine came as the top-three nations with the most increased adoption, followed by India, Pakistan, and Thailand, ranking within the top ten.

Another study from May 2022 also revealed that emerging economies’ attitudes towards the metaverse were also bullish and adaptive.

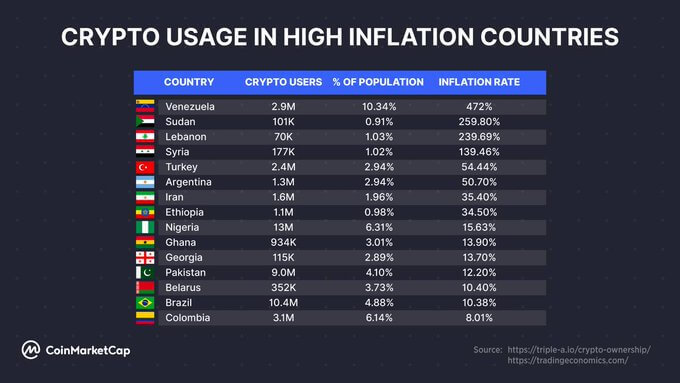

The link between emerging markets and high crypto adoption is high inflation. Since crypto is a direct alternative to fiat money, it is also seen as a hedge against inflation, which drives its popularity amongst high-inflation regions.

According to numbers from April 2022, emerging economies like Venezuela, Brazil, Nigeria, Pakistan, and Colombia, which have high inflation, also recorded high crypto adoption rates.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Shiba Inu

Shiba Inu  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Chainlink

Chainlink  Polkadot

Polkadot  Pepe

Pepe  Stellar

Stellar  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Cronos

Cronos  USDS

USDS  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Render

Render  Bittensor

Bittensor  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  MANTRA

MANTRA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  dogwifhat

dogwifhat  Arbitrum

Arbitrum  Monero

Monero  Stacks

Stacks  Filecoin

Filecoin  OKB

OKB